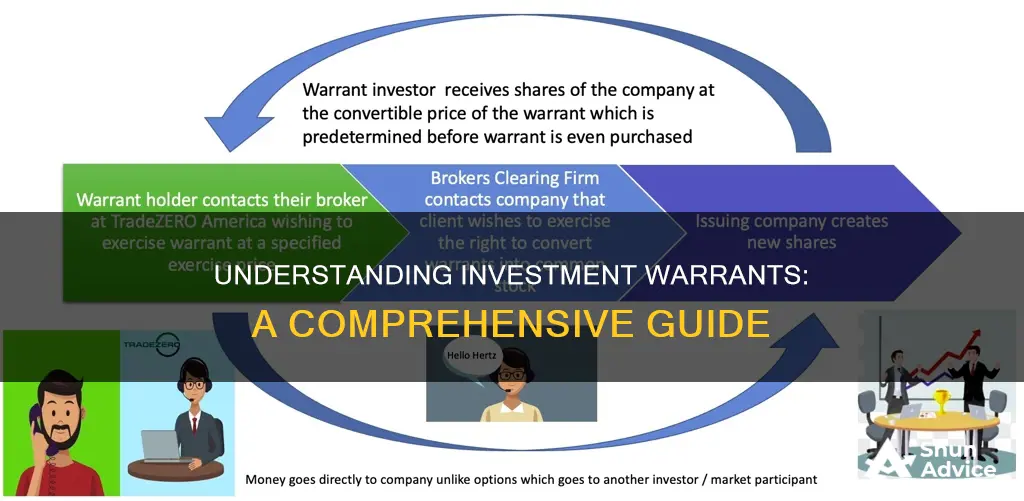

In the world of finance and investment, a warrant is a financial instrument that gives the holder the right, but not the obligation, to buy or sell a specific asset, such as a stock or bond, at a predetermined price within a specified period. This type of contract is often used by companies to raise capital by offering investors the opportunity to purchase a portion of their shares at a future date, typically at a premium to the current market price. Warrants can be an attractive investment strategy for those seeking to speculate on the future performance of a company or to gain exposure to a particular market without purchasing the underlying asset outright.

What You'll Learn

- Legal Authority: A warrant is a legal document granting the right to buy or sell securities at a specific price

- Investment Tool: Warrants provide leveraged exposure to an asset without direct ownership

- Expiration Date: They typically have an expiration date, after which they become worthless

- Strike Price: The strike price is the predetermined price at which the warrant can be exercised

- Risk and Reward: Warrants offer high-risk, high-reward potential, suitable for speculative investors

Legal Authority: A warrant is a legal document granting the right to buy or sell securities at a specific price

A warrant is a powerful financial instrument that serves as a legal contract, providing its holder with the right, but not the obligation, to buy or sell a specific security at a predetermined price. This price is often referred to as the "strike price." The term "warrant" is derived from the legal authority it bestows upon the holder, allowing them to exercise their right within a defined timeframe.

In the investment world, warrants are typically associated with companies, particularly those that are publicly traded. When a company issues a warrant, it is essentially offering an option to its investors or the public. This option gives the warrant holder the right to purchase a certain number of shares at the strike price, which is usually set at a premium to the current market price of the stock. This premium is a key feature, as it provides an incentive for investors to purchase the warrant, anticipating a potential profit if the stock price rises.

The legal authority of a warrant is crucial as it ensures that the holder has the right to execute the transaction at the agreed-upon terms. This right is time-sensitive, meaning the warrant can only be exercised within a specified period. After this period, the warrant becomes worthless unless the holder decides to extend it, which may require additional fees. This time-bound nature adds a layer of complexity and urgency for investors, as they must make timely decisions to maximize their potential gains.

Warrants are often issued as a form of compensation or as part of a larger financial package. For instance, a company might offer warrants to employees as a form of incentive, allowing them to purchase shares at a favorable price. This practice can boost employee morale and provide an opportunity for employees to benefit from the company's success. Additionally, warrants can be used in mergers and acquisitions, where a company may acquire another by offering its shares through warrants, providing a flexible and valuable consideration for the deal.

Understanding the legal authority and implications of warrants is essential for investors and financial professionals. It empowers them to make informed decisions, whether they are purchasing warrants for speculative purposes or using them as strategic financial instruments. The right to buy or sell securities at a specific price is a significant advantage, offering potential profits and a unique way to engage with the stock market.

Understanding CDs: A Guide to Certificate of Deposits

You may want to see also

Investment Tool: Warrants provide leveraged exposure to an asset without direct ownership

Warrants are a unique financial instrument that offers investors an alternative way to gain exposure to an underlying asset, such as a stock, commodity, or even a basket of securities, without actually purchasing the asset itself. This feature of warrants makes them a powerful tool for investors seeking leveraged exposure to a particular market or asset class.

In simple terms, a warrant is a type of derivative contract that gives the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price (the strike price) within a specified time frame. This strike price is a critical aspect of warrants, as it represents the threshold at which the warrant can be exercised, allowing the investor to profit from the underlying asset's movement. For instance, if an investor purchases a warrant with a strike price of $100 for a stock currently trading at $120, they have the right to buy the stock at $100, potentially making a profit if the stock price rises.

The key advantage of warrants is the leveraged nature of the investment. When an investor buys a warrant, they are essentially borrowing the right to buy the underlying asset at a lower price than the current market value. This leverage can amplify potential returns, especially in volatile markets. For example, if the stock price rises to $150, the investor can exercise the warrant and buy the stock at $100, realizing a profit of $50 per share. This is a more significant gain compared to buying the stock directly, where the profit would be $30 per share ($150 - $120).

Warrants are often used by investors to gain exposure to a specific market or asset without the need for large capital outlays. They are particularly attractive during periods of market volatility, as they can provide a hedge against potential losses. For instance, an investor might purchase warrants on a stock they believe will appreciate in value, using the warrants as a speculative tool. Simultaneously, they could also buy put warrants on the same stock to hedge against potential downturns, thus managing risk effectively.

In summary, warrants offer investors a flexible and leveraged way to participate in the financial markets. They provide an opportunity to gain exposure to assets without the immediate need for direct ownership, allowing investors to potentially benefit from market movements with a lower initial investment. However, as with any investment, warrants carry risks, and investors should carefully consider their strategies and the potential impact of market volatility.

Navigating Short-Term Reserves: Weighing Investment Options for Quick Returns

You may want to see also

Expiration Date: They typically have an expiration date, after which they become worthless

Warrants are financial instruments that give the holder the right, but not the obligation, to buy or sell a specific asset at a predetermined price before or at a specified time. This predetermined price is known as the "strike price," and it is a critical aspect of the warrant's value. One of the key features of warrants is their time-sensitive nature, which is closely tied to their expiration date.

The expiration date is a critical component of a warrant's life cycle. Warrants are typically issued with a limited validity, and this expiration date serves as a deadline for the warrant holder to exercise their right. After this date, the warrant becomes worthless, and the holder loses any potential benefit from the investment. This time constraint adds a layer of complexity to warrant investments, as it requires investors to make timely decisions to maximize their returns.

When an investor purchases a warrant, they are essentially buying the right to buy or sell an asset at a favorable price. This right is valid only up to the expiration date. For instance, if an investor buys a warrant for a tech company and the strike price is set at $100 per share, they can exercise the warrant to purchase the shares at $100 before the expiration date. However, if the investor decides not to exercise the warrant or if the market price of the shares exceeds the strike price, the warrant's value diminishes as the expiration date approaches.

The expiration date also influences the warrant's price dynamics. As the expiration date gets closer, the time value of the warrant decreases. This is because the longer the time until expiration, the more potential there is for the warrant to be exercised, thus increasing its value. As the expiration date nears, the time value diminishes, and the warrant's price may fluctuate based on market conditions and the underlying asset's performance.

In summary, the expiration date is a critical factor in warrant investments, dictating the lifespan and value of these financial instruments. Investors must be mindful of this time constraint to make informed decisions, ensuring they maximize their returns before the warrant becomes worthless. Understanding the expiration date's impact on warrant pricing and exercise rights is essential for anyone looking to invest in warrants or assess their potential value in the market.

Dividends: A Long-Term Investment Strategy?

You may want to see also

Strike Price: The strike price is the predetermined price at which the warrant can be exercised

The strike price is a critical component of a warrant, a financial instrument that gives the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price before a certain date. This predetermined price is a key factor in determining the value and potential profitability of a warrant. When an investor purchases a warrant, they are essentially agreeing to buy or sell the underlying asset at a specific price, which is the strike price. This price acts as a threshold, and if the market price of the underlying asset reaches or exceeds this strike price, the warrant holder can exercise their right to buy or sell at the favorable price.

In the context of call warrants, the strike price represents the price at which the warrant holder can purchase the underlying asset. For example, if a company issues a call warrant with a strike price of $50 for its stock, the holder has the right to buy the stock at $50 per share. If the stock price rises to $60, the warrant holder can exercise their right and buy the stock at the lower strike price, potentially making a profit. The higher the strike price relative to the current market price, the more valuable the warrant becomes, as it provides a guaranteed entry point at a lower price.

On the other hand, put warrants give the holder the right to sell the underlying asset at the strike price. For instance, a put warrant with a strike price of $40 for a particular stock would allow the holder to sell the stock at $40 per share. If the stock price falls to $30, the warrant holder can exercise their right and sell at the higher strike price, benefiting from the price difference. The strike price in this case acts as a safety net, allowing the investor to lock in a selling price that is potentially higher than the current market price.

Understanding the strike price is essential for investors as it directly impacts the profitability of a warrant. When evaluating warrants, investors should consider the relationship between the strike price and the current market price of the underlying asset. A favorable strike price is one that is significantly lower than the current market price, providing an opportunity to buy or sell at a discount. Conversely, if the strike price is much higher than the market price, the warrant may not be as attractive, as the potential upside is limited.

In summary, the strike price is the predetermined price that defines the terms of a warrant's exercise. It is a critical factor in warrant valuation and investment decisions. Investors should carefully analyze the strike price in relation to the market price to determine the potential benefits and risks associated with a warrant. By understanding this concept, investors can make more informed choices when dealing with warrants in the investment market.

Rights as Long-Term Assets: A Wise Investment Strategy

You may want to see also

Risk and Reward: Warrants offer high-risk, high-reward potential, suitable for speculative investors

Warrants are a type of derivative contract that gives the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price before or at a certain date. This underlying asset can be a stock, bond, commodity, or even another derivative. Warrants are often used as a speculative investment tool, offering investors the potential for significant gains or losses.

The key characteristic that sets warrants apart from other investment instruments is the inherent risk and reward they carry. When you purchase a warrant, you are essentially betting on the future performance of the underlying asset. This speculative nature makes warrants a high-risk investment, as the value of the warrant can fluctuate dramatically based on market conditions and the performance of the underlying asset.

The high-risk aspect is further emphasized by the fact that warrants typically have a limited lifespan. They are often issued with an expiration date, after which they become worthless if not exercised. This time constraint adds pressure to investors, as they must make a decision to exercise the warrant or let it lapse before the expiration date. The potential for significant gains is what attracts many investors, as the reward can be substantial if the underlying asset's value increases during the warrant's lifespan.

For speculative investors, warrants can be an attractive strategy to maximize returns. These investors are willing to take on the high risk because they believe in the potential upside. They carefully analyze market trends, company performance, and economic factors to make informed decisions about when to buy and exercise warrants. Successful speculation can lead to substantial profits, but it also requires a deep understanding of the market and a willingness to accept potential losses.

In summary, warrants are a complex investment instrument that offers a high-risk, high-reward opportunity. They are particularly suited to speculative investors who are comfortable with the volatility and are prepared to make quick decisions. Understanding the mechanics of warrants and the underlying asset is crucial for investors to navigate this risky yet potentially lucrative investment avenue.

Rivian's Potential: A Long-Term Investment Analysis

You may want to see also

Frequently asked questions

A warrant is a financial instrument that gives the holder the right, but not the obligation, to buy or sell a specific security, such as a stock or bond, at a predetermined price (the "strike price") within a specified period. It is essentially a contract between the issuer (the company) and the investor, allowing the investor to benefit from potential price movements in the underlying asset.

While both warrants and options provide the right to buy or sell an asset, they have distinct characteristics. Options typically have an expiration date, after which they become worthless if not exercised. In contrast, warrants often have a longer validity period, sometimes even indefinitely, unless the holder exercises the right or the warrant expires. Additionally, options are more commonly traded on exchanges, whereas warrants are usually issued directly by the company and may have less liquidity.

Investing in warrants can offer several benefits. Firstly, they can provide leverage, allowing investors to gain exposure to an asset's price movement with a smaller initial investment. Secondly, warrants can be used to hedge against potential losses in the underlying stock, as the warrant holder can sell the warrant at the strike price, limiting the downside risk. Lastly, warrants can be an attractive investment for those seeking higher returns, especially if the underlying asset's price is expected to rise significantly.

While warrants can be profitable, they also carry certain risks. One significant risk is that the underlying asset's price may not move as expected, leading to a potential loss if the warrant is exercised. Additionally, warrants may have a limited lifespan, and if not exercised before expiration, they become worthless. Another risk is the potential for dilution if the company issues additional shares or securities that reduce the value of the existing warrants.