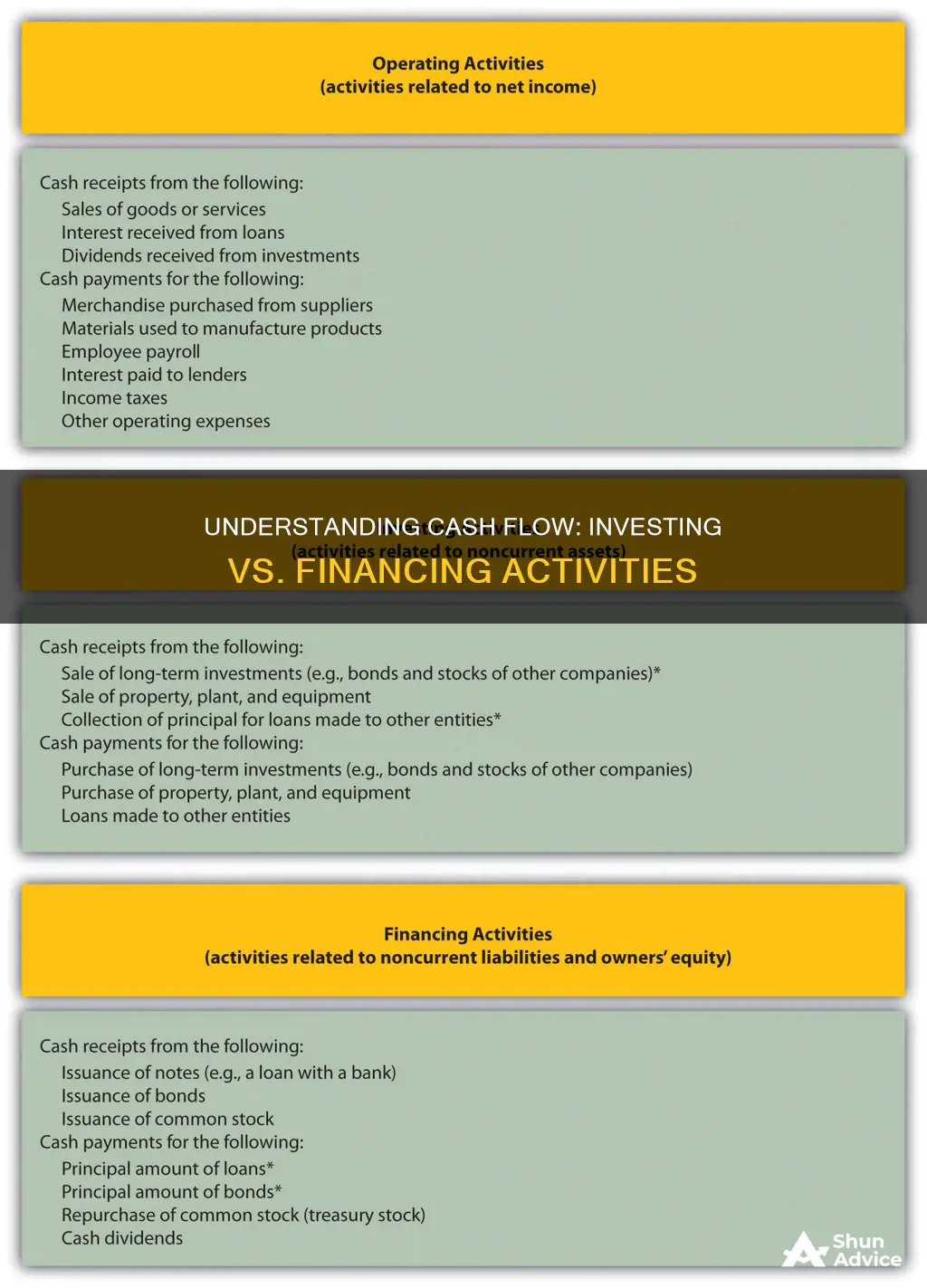

Cash flow is a critical financial metric that tracks the movement of money into and out of a business over a specific period. It is an important indicator of a company's financial health and operational efficiency. There are three main types of cash flow: operating cash flow, investing cash flow, and financing cash flow. Operating cash flow refers to the cash transactions from a company's daily operations, such as buying and selling goods. Investing cash flow refers to the cash transactions related to the purchase or sale of long-term assets, such as property, equipment, or investments. Financing cash flow involves transactions related to raising and repaying capital, such as issuing equity or debt, dividend payments, and receiving or repaying loans. These three types of cash flow are reported in a company's cash flow statement, which provides valuable insights into the company's financial health, liquidity, and solvency.

| Characteristics | Values |

|---|---|

| Definition | Cash Flow from Financing Activities (CFF) |

| Description | Provides an overview of the cash exchanges between a company and its stakeholders, such as investors and creditors. |

| Formula | CFF = CED – (CD + RP) |

| CED = Cash inflows from issuing equity or debt | |

| CD = Cash paid as dividends | |

| RP = Repurchase of debt and equity | |

| Positive CFF | Indicates a net increase in cash from financing activities, such as raising capital or obtaining loans |

| Negative CFF | Indicates a net decrease in cash from financing activities, such as repaying debt or buying back shares |

| Definition | Cash Flow from Investing Activities (CFI) |

| Description | Reports the cash inflows and outflows resulting from investment activities, including the acquisition and disposal of long-term assets and investments in marketable securities |

| Formula | Cash flow from investing activities = CapEx/purchase of non-current assets + marketable securities + business acquisitions – divestitures (sale of investments) |

| Positive CFI | Indicates cash generated by sales of investment securities or assets |

| Negative CFI | Indicates cash spent on long-term assets, lending, or marketable securities |

What You'll Learn

- Investing activities include the purchase and sale of physical assets, securities, and investments

- Negative cash flow from investing activities can indicate long-term investments in the company's health and performance

- Financing activities include debt, equity, and dividend transactions

- Positive cash flow from financing activities indicates more money flowing into the company, increasing assets

- Cash flow statements help investors understand how a company generates and uses cash

Investing activities include the purchase and sale of physical assets, securities, and investments

For example, if a business owner invests in a new factory building to expand their operations, that purchase would be considered a cash outflow from investing activities. Similarly, if they sell some old machinery the company no longer needs, the cash received from the sale would be a cash inflow from investing activities.

Other investing activities include:

- Capital expenditures involving the acquisition of fixed assets, plant and machinery

- Proceeds from sales of fixed assets

- Purchase of investment securities, bonds, debentures, and stock

- Proceeds from sales of investment securities, bonds, debentures, and stock

- Acquisition of another company

- Proceeds from sales of other business units

- Loans made to third parties

- Collection of loans made by the entity

It is important to note that cash flow from investing activities does not include short-term investments or cash equivalents, which are classified under operating activities.

Unlocking Investment Strategies: Determining Cash Availability

You may want to see also

Negative cash flow from investing activities can indicate long-term investments in the company's health and performance

Negative cash flow from investing activities is not necessarily a bad sign for a company. It can indicate that management is making long-term investments in the company's health and performance. These investments may include purchases of physical assets, investments in securities, or research and development. While this may lead to short-term losses, it could result in significant growth and gains in the long term if these investments are managed well.

For example, a company with negative cash flow from investing activities may be investing in long-term fixed assets, such as property, plant, and equipment. This would be considered a capital expenditure, which is an important aspect of growth and capital. It is common for growing companies to have negative cash flow in this area as they invest in their future operations.

Negative cash flow from investing activities can also be a result of a company acquiring other businesses or companies, lending money, or collecting loans. These activities are considered investments that may have a positive impact on the company's future performance.

It is important to review the entire cash flow statement and analyse the specific investing activities to determine if the negative cash flow is a positive or negative indicator of the company's financial health. Consistent negative cash flow could be a sign of a healthy, growing company that may provide positive returns in the future.

Overall, negative cash flow from investing activities can indicate that a company is making strategic, long-term investments to improve its performance and health, rather than indicating poor financial management.

Buyers' Strategies to Minimize Cash Outlay During Acquisitions

You may want to see also

Financing activities include debt, equity, and dividend transactions

Financing activities are a critical component of a company's cash flow statement, providing insights into its financial health and capital allocation. This section encompasses transactions related to debt, equity, and dividends, offering a glimpse into the company's funding strategies and capital structure management.

Debt financing plays a significant role in this context, as companies often issue bonds or take out loans to secure funding for their operations. These decisions are reflected in the cash flow statement, and companies are obliged to make interest payments to their bondholders and creditors. Equity financing, on the other hand, involves issuing stock to investors who purchase shares in the company. Dividend payments to shareholders are also included in this category and represent a cost of equity for the company.

The calculation of Cash Flow from Financing Activities (CFF) is essential for investors and analysts to assess a company's financial footing. The formula is as follows:

> CFF = CED – (CD + RP)

Where:

- CED = Cash inflows from issuing equity or debt

- CD = Cash paid as dividends

- RP = Repurchase of debt and equity

By substituting the respective values, investors can determine the net cash flow from financing activities. This information is crucial for understanding the company's ability to fund its operations and manage its capital structure.

Dividend transactions are also a key aspect of financing activities. Dividends are typically paid out to shareholders, and this outflow of cash is reflected in the CFF calculation. Dividend payments can impact a company's cash position and are considered when evaluating its financial health.

In summary, financing activities, including debt, equity, and dividend transactions, are vital components of a company's cash flow statement. They provide valuable insights into the company's funding sources, capital structure, and financial stability. By analysing these activities, investors and analysts can make informed decisions about the company's financial soundness and future prospects.

Investing: How Cash Flow Affects Your Bottom Line

You may want to see also

Positive cash flow from financing activities indicates more money flowing into the company, increasing assets

Positive cash flow from financing activities is a good sign for a company's financial health. It indicates that more money is flowing into the company than flowing out, leading to an increase in assets. This can be achieved through various transactions, such as issuing equity or stock, borrowing debt from creditors or banks, or issuing bonds.

Financing activities are an essential aspect of a company's cash flow statement, providing insights into the company's capital structure and financial management. It reflects the net amount of funding generated by the company in a given time period. Positive cash flow from financing activities suggests that the company is effectively raising capital to fund its operations and investments.

A positive cash flow from financing activities can be a result of the company issuing equity or debt to investors or borrowing funds from creditors or financial institutions. This indicates that the company is successfully accessing the necessary capital to support its business activities.

However, it is important to note that a positive cash flow from financing activities should be analysed in conjunction with other financial metrics. For example, if a company is heavily reliant on debt financing, it may face challenges in the future due to increasing debt servicing costs, especially in a rising interest rate environment.

Additionally, positive cash flow from financing activities does not always indicate strong financial performance. In some cases, it might be a sign that the company is not generating sufficient earnings from its operations and is relying heavily on external capital. Therefore, investors should carefully examine the company's overall financial health and consider other sections of the cash flow statement, such as operating and investing activities.

In summary, positive cash flow from financing activities indicates increased assets and can be a sign of a company's ability to raise capital. However, it should be analysed critically and in conjunction with other financial information to make informed assessments of the company's financial health and sustainability.

Converting Folio Investments: Strategies for Liquidating Your Portfolio

You may want to see also

Cash flow statements help investors understand how a company generates and uses cash

A cash flow statement is a crucial financial statement that provides an overview of a company's financial health and operations. It is one of the three main financial statements that a business uses, alongside the balance sheet and the income statement. The cash flow statement details the sources and uses of cash, and is divided into three sections: cash flow from operating activities, cash flow from investing activities, and cash flow from financing activities.

Cash flow from investing activities (CFI) is a section of the cash flow statement that details the cash inflows and outflows from investment-related activities. This includes the acquisition and disposal of long-term assets, such as property, equipment, and investments in securities. It also includes any long-term investments made or redeemed by the company. Positive cash flow from investing activities indicates that the company is generating more cash from these activities than it is spending, which can be a sign of effective investment management and future growth.

On the other hand, cash flow from financing activities (CFF) is another section of the cash flow statement that shows the net flow of cash used to fund the company's operations. This includes transactions related to debt, equity, and dividends. A positive cash flow from financing activities means more money is flowing into the company, increasing its assets. However, investors should be cautious if a company frequently relies on new debt or equity for cash, as it may indicate that the company is not generating sufficient earnings.

Overall, the cash flow statement is a valuable tool for investors and analysts to assess a company's financial health, strategic decisions, and ability to generate profits.

How Cash App Investing Works for Beginners

You may want to see also

Frequently asked questions

Cash flow from investing activities refers to the cash transactions related to the purchase or sale of long-term assets, such as property, equipment, or investments in securities.

This includes various cash transactions such as the acquisition and disposal of long-term assets, loans made to third parties, and the collection of loans.

Cash flow from financing activities is a section of a company's cash flow statement that shows the net flow of cash used to fund the company. This includes transactions involving debt, equity, and dividends.

Financing activities include the issuance and repayment of equity, payment of dividends, issuance and repayment of debt, and capital lease obligations.