Cash flow from investing activities (CFI) is a section of a company's cash flow statement that shows the cash generated by or spent on investment activities. It includes the purchase of physical assets, investments in securities, or the sale of securities or assets. CFI covers transactions like acquiring and disposing of assets, investing in securities, and acquiring other companies. It is calculated by subtracting total cash outflows from total inflows related to investing activities to find the net cash flow.

| Characteristics | Values |

|---|---|

| Definition | Cash flow from investing activities (CFI) |

| Type of Statement | Cash flow statement |

| Reported Information | Cash inflows and outflows from investment activities |

| Investment Activities | Acquisition and disposal of long-term assets, investing in securities, acquiring other companies |

| Long-Term Assets | Property, plant, equipment, marketable securities |

| Calculation | Net cash flow = total cash inflow – total cash outflow |

| Positive Cash Flow | Indicates effective management of investments and potential future growth |

| Negative Cash Flow | Not always a warning sign; may indicate investment in long-term health of the company |

| Examples | Hershey's net annual cash flow, Amazon's 2017 financial statements |

| Exclusions | Short-term investments, cash equivalents, cash flow from financing activities |

What You'll Learn

Long-term purchases

When a company makes long-term purchases, such as investing in property or equipment, it results in negative cash flow in the short term. This is because money is being spent on these assets. However, it is important to note that negative cash flow from investing activities does not necessarily indicate poor financial health. Instead, it often signifies that the company is making strategic investments in its long-term health and growth.

For example, a company might invest heavily in plant and equipment to expand its production capacity and meet future demand. While this will result in a negative cash flow from investing activities in the short term, it has the potential to generate significant returns in the long term. This type of investment is crucial for the company's future operations and competitiveness in the market.

The purchase of long-term assets, such as property or equipment, is typically accounted for as a capital expenditure in the investing activities section of the cash flow statement. This section provides valuable insights into the company's allocation of resources for long-term strategies. It is separate from the day-to-day business operations reflected in the operating activities section of the cash flow statement.

In summary, long-term purchases are a fundamental aspect of a company's cash flow from investing activities. These purchases, while resulting in short-term negative cash flow, are essential for the company's growth, competitiveness, and long-term financial health. By investing in physical assets and equipment, companies position themselves for future success and enhance their ability to generate returns.

Securities Sales: Investment Activity or Cash Flow?

You may want to see also

Sales of securities or assets

When a company sells a long-term asset, such as property, plant, or equipment, it results in cash inflow, which is recorded as a positive amount in the investing activities section of the cash flow statement. This indicates that the company is disposing of or liquidating its long-term assets, which can have implications for its operations and financial health.

The proceeds from the sale of a long-term asset refer to the money received by the company. If the proceeds exceed the book value or carrying value of the asset, the difference is recognised as a gain on the sale. On the other hand, if the proceeds are less than the book value, the difference is considered a loss.

For example, if a company sells a car with a book value of $6,000 (cost of $28,000 minus accumulated depreciation of $22,000) for $10,000, the proceeds would be $10,000, and the gain on the sale would be $4,000. This gain is reflected in the net income reported in the operating activities section of the cash flow statement.

It's important to note that the sale of securities or assets can impact a company's cash position and financial performance, and it is just one aspect of investing activities that analysts and investors consider when evaluating a company's financial health and growth prospects.

Cash Investments: What Are They?

You may want to see also

Capital expenditures

CapEx is recorded on a company's balance sheet rather than being expensed on the income statement. It is included in the cash flow from investing activities (CFI) section of a company's cash flow statement. This section shows the cash generated by or spent on investment activities, including the purchase of physical assets, investments in securities, or the sale of securities or assets.

CapEx can be calculated using data from a company's income statement and balance sheet. The formula for calculating CapEx is:

> CapEx = Change in property, plant, and equipment + Current Depreciation

For example, if a company's current depreciation is $43.7 billion and its change in property, plant, and equipment is $70.9 billion, then its CapEx would be $114.6 billion.

CapEx is an important metric for analysing a company's investment in its fixed assets and its ability to acquire long-term assets. It is also used in calculating free cash flow to equity (FCFE), which represents the amount of cash available to equity shareholders.

Warren Buffet's Berkshire Cash Reserves: Where Does it Go?

You may want to see also

Cash flow from operating activities

Operating activities include generating revenue, paying expenses, and funding working capital. It is calculated by taking a company's net income, adjusting for non-cash items, and accounting for changes in working capital. The formula for calculating CFO is:

> Cash Flow from Operations = Net Income + Non-Cash Items + Changes in Working Capital

The cash flow statement is one of the three main financial statements required in standard financial reporting, along with the income statement and balance sheet. The cash flow statement is divided into three sections: cash flow from operating activities, cash flow from investing activities, and cash flow from financing activities.

The cash flow from operating activities section can be presented in two ways: the indirect method and the direct method. The indirect method is more commonly used, as it is simpler and most companies use the accrual method of accounting. This method begins with net income from the income statement and adjusts it for non-cash items and changes in working capital to arrive at a cash basis figure for the period.

The direct method, recommended by the Financial Accounting Standards Board (FASB), tracks all transactions in a period on a cash basis and uses actual cash inflows and outflows on the cash flow statement. However, the FASB also requires companies using the direct method to provide a reconciliation report, which makes it less popular among companies.

Positive cash flow from operating activities indicates that a company's core business activities are thriving and profitable. It is an additional indicator of a company's potential profitability, alongside traditional measures such as net income or EBITDA.

Converting Folio Investments: Strategies for Liquidating Your Portfolio

You may want to see also

Cash flow from financing activities

Financing activities include transactions involving debt, equity, and dividends. This covers stock repurchases, dividend payments, debt issuance, and debt repayment.

The formula for calculating CFF is:

> CFF = Cash Inflow from Issuing Equity or Debt – (Cash Outflow from Dividends + Cash Outflow from Repurchase of Debt and Equity)

CFF can be positive or negative. A positive number indicates that more money is flowing into the company than out, increasing its assets. A negative number could mean the company is servicing debt, but it could also indicate the company is retiring debt or making dividend payments and stock repurchases, which investors may view as positive.

Overall, CFF is an important metric for investors and analysts to assess a company's financial health and stability.

Investing Cash: Strategies for Smart Money Allocation

You may want to see also

Frequently asked questions

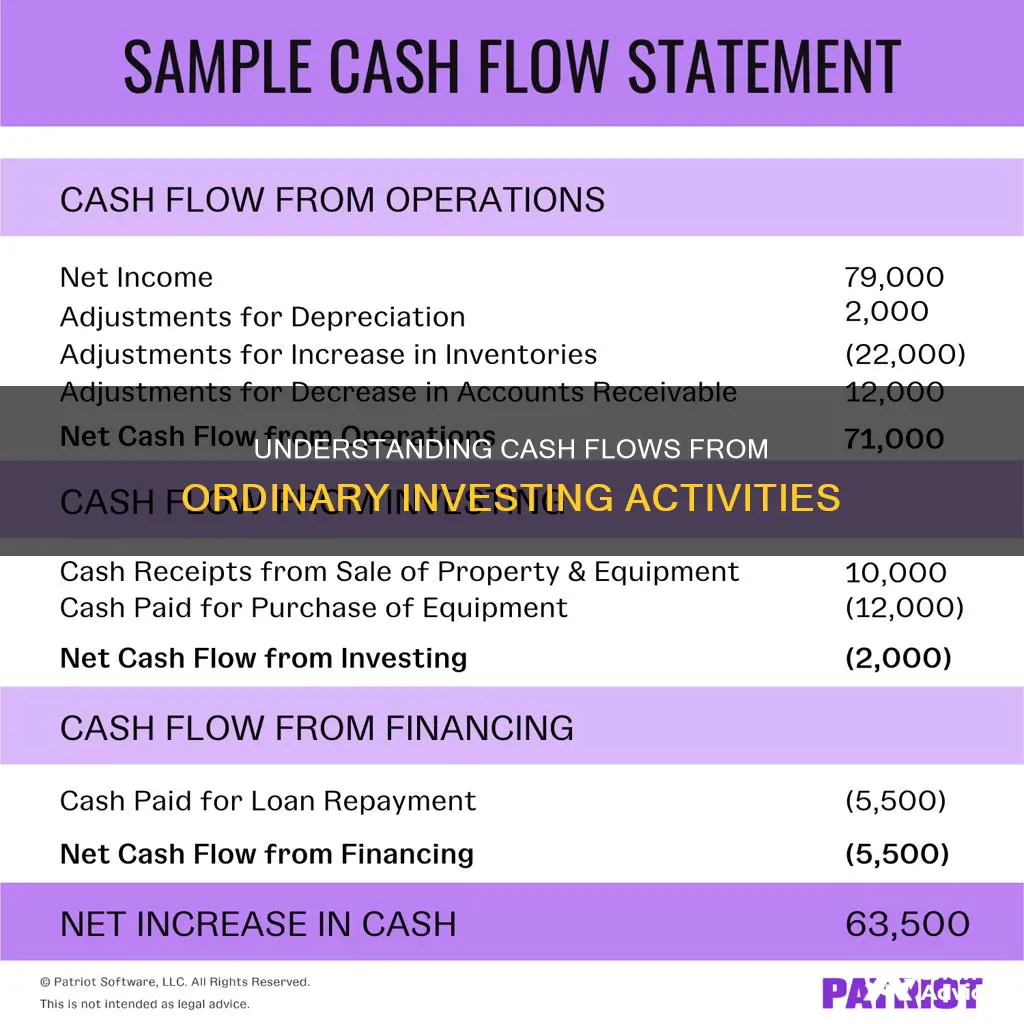

Cash from ordinary investing activities is the section of a company's cash flow statement that details the cash inflows and outflows resulting from investment activities. These activities include the acquisition and disposal of long-term assets such as property, plant, and equipment, as well as investments in marketable securities.

Examples of cash from ordinary investing activities include the purchase or sale of fixed assets, such as property, plant, and equipment. Proceeds from the sale of a division or cash outflow from a merger or acquisition would also be considered investing activities.

To calculate cash from ordinary investing activities, you need to add up all the cash inflows and outflows related to investing activities. Cash inflows typically include proceeds from asset sales, while outflows include purchases of investments. You then subtract the total outflows from the total inflows to get the net cash flow.

Cash from ordinary investing activities is important because it provides insights into a company's capital expenditure and investment strategies. It helps stakeholders understand how the company is allocating cash for the long term and its ability to invest in growth opportunities, acquire assets, and manage its financial health.