Compound interest is a key concept in the mathematics of investment. It is the interest calculated on the principal and the interest accumulated over the previous period. In other words, it is the total compounded amount minus the initial amount. Compound interest is different from simple interest, where interest is not added to the principal while calculating the interest during the next period.

| Characteristics | Values |

|---|---|

| Definition | Interest calculated on the principal and the interest accumulated over the previous period |

| Formula | CI = P [(1 + R)nt – 1] |

| Where | CI = compound interest, P = initial amount, R = annual rate of interest as a percentage, n = number of compounding periods in a given time |

| Difference from simple interest | In simple interest, interest is not added to the principal while calculating the interest during the next period |

| Applications | Increase or decrease in population, growth of bacteria, rise or depreciation in the value of an item, banking and finance transactions |

What You'll Learn

- How to calculate compound interest?

- The difference between compound interest and simple interest

- How compound interest is used in banking and finance?

- How compound interest can be used to calculate the growth of bacteria?

- How compound interest can be used to calculate the rise or depreciation in the value of an item?

How to calculate compound interest

Compound interest is the interest calculated on the principal amount and the interest accumulated over the previous period. It is different from simple interest, where interest is not added to the principal while calculating the interest during the next period.

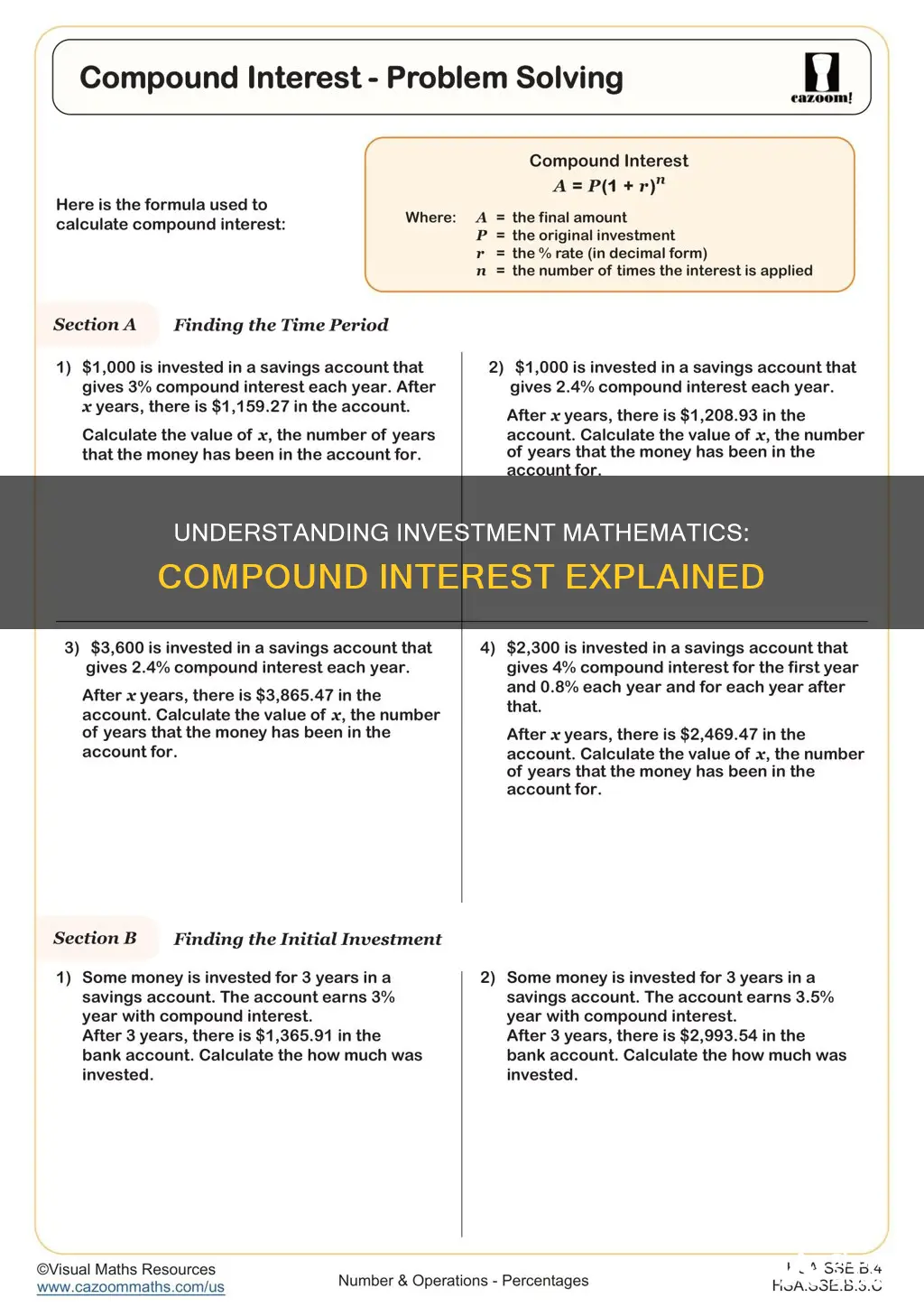

To calculate compound interest, you need to identify the principal amount (P), i.e. the amount that is invested. You also need to identify the rate of interest (r%) and divide it by 100 while substituting it into the formula for the variable r. The formula for calculating compound interest is: CI = P[(1 + R)nt – 1]. Here, P = Initial amount, R = Annual rate of interest as a percentage, and n = Number of compounding periods in a given time.

For example, let's say you invest $1000 at an annual interest rate of 5%. The compound interest for the first year would be calculated as follows: CI = $1000 x [(1 + 0.05)1 – 1] = $1000 x [1.05 – 1] = $1000 x 0.05 = $50. So, the compound interest for the first year would be $50.

It's important to note that the compounding frequency can vary. It could be yearly, half-yearly, quarterly, monthly, weekly, daily, continuously, or not at all until maturity. The compounding frequency will affect the final amount of compound interest accumulated.

Student Loan Interest: Pay or Invest?

You may want to see also

The difference between compound interest and simple interest

Compound interest is the interest calculated on the principal and the interest accumulated over the previous period. It is the result of reinvesting or retaining interest that would otherwise be paid out, or of the accumulation of debts from a borrower.

Simple interest, on the other hand, is calculated only on the principal amount. In other words, the interest accumulated is not added to the principal amount when calculating the interest for the next period.

For example, if you invest £100 in a savings account with a 5% annual interest rate, at the end of the first year, you will have earned £5 in interest with simple interest. However, with compound interest, the £5 interest is added to the principal amount, so you will have £105 in total. In the second year, the 5% interest rate will be applied to the new principal amount of £105, resulting in £5.25 in interest.

Compound interest is used in most transactions in the banking and finance sectors. It can also be applied to various situations, such as the increase or decrease in population, the growth of bacteria, or the rise or depreciation in the value of an item. The compounding frequency can vary, from yearly, half-yearly, quarterly, monthly, weekly, daily, or even continuously.

Understanding Cash Investment Interest Rates: Maximizing Your Returns

You may want to see also

How compound interest is used in banking and finance

Compound interest is used in banking and finance to calculate the interest on a principal amount, which is the amount that is invested. It is calculated by multiplying the initial principal amount by one plus the annual interest rate raised to the number of compound periods minus one. This means that the interest is added to the principal amount, and this becomes the new principal amount for the next time period. The interest for the next time period is then calculated on the accumulated principal value. This process is repeated for each time period, with the interest compounding on itself. The frequency of compounding can vary, from yearly to continuously.

Compound interest is used in most transactions in the banking and finance sectors. For example, it is used when calculating the increase or decrease in population, the growth of bacteria, or the rise or depreciation in the value of an item. It can also be used to calculate the accumulation of debts from a borrower.

The power of compound interest is that it always results in a higher final amount than simple interest, where the interest is not added to the principal. This makes it an attractive option for investors, as it can lead to greater returns on their investments.

To calculate compound interest, one must first identify the principal amount and the rate of interest. The rate of interest is then divided by 100 and substituted into the formula for the variable r. This formula is: CI = P [(1 + R)nt – 1], where P = Initial amount, R = Annual rate of interest as a percentage, and n = Number of compounding periods in a given time.

Maximizing Your Investment Returns with Compound Interest

You may want to see also

How compound interest can be used to calculate the growth of bacteria

Compound interest is the interest calculated on the principal and the interest accumulated over the previous period. It is different from simple interest, where interest is not added to the principal while calculating the interest during the next period.

Compound interest can be used to calculate the growth of bacteria. Bacteria growth can be calculated by identifying the principal amount (P), i.e. the amount that is invested. This is the initial number of bacteria. The rate of interest (r%) is the growth rate of the bacteria. The number of compounding periods (n) is the amount of time the bacteria are left to grow.

For example, let's say we start with 100 bacteria and they double every hour. After one hour, we will have 200 bacteria. After two hours, we will have 400 bacteria. This is because the bacteria are growing exponentially.

The formula for compound interest is CI = P[(1 + R)nt – 1], where CI is the total amount of bacteria, P is the initial amount, R is the growth rate as a percentage, and n is the number of compounding periods. Using this formula, we can calculate the total amount of bacteria after a certain number of hours.

Compounding Interest: Annual vs. Quarterly, Which is Better?

You may want to see also

How compound interest can be used to calculate the rise or depreciation in the value of an item

Compound interest is the interest calculated on the principal and the interest accumulated over the previous period. It is different from simple interest, where interest is not added to the principal while calculating the interest during the next period.

Compound interest can be used to calculate the rise or depreciation in the value of an item. The interest accumulated on a principal over a period of time is also added to the principal and becomes the new principal amount for the next time period. The interest for the next time period is then calculated on the accumulated principal value.

To calculate compound interest, you need to identify the principal amount (P), i.e. the amount that is invested, and the rate of interest (r%). The formula for compound interest is: CI = P[(1 + R)nt – 1], where P = Initial amount, R = Annual rate of interest as a percentage, and n = Number of compounding periods in a given time.

For example, let's say you invest £1000 at an annual interest rate of 5% compounded yearly. After the first year, you would have £1050. After the second year, the interest would be calculated on the new principal amount of £1050, so you would have £1102.50. This process continues, with the interest compounding on the accumulated principal value, leading to exponential growth over time.

Investments with 10% Compound Interest: Where to Start?

You may want to see also

Frequently asked questions

Compound interest is the interest calculated on the principal and the interest accumulated over the previous period.

Simple interest is calculated without adding interest to the principal while calculating the interest during the next period.

Compound interest is calculated by multiplying the initial principal amount (P) by one plus the annual interest rate (R) raised to the number of compound periods (nt) minus one.

The formula for compound interest is CI = P[(1 + R)nt – 1], where P = Initial amount, R = Annual rate of interest as a percentage, and n = Number of compounding periods in a given time.

An example of compound interest is the increase or decrease in population over time.