Net investment is the total amount of money a company spends on capital assets, minus the cost of depreciation of those assets. This figure gives an indication of the real expenditure on durable goods such as plants, equipment, and software used in the company's operations. It is calculated by subtracting depreciation expenses from gross capital expenditures (CAPEX) over a period of time. Net investment can be used as a metric to measure a company's performance or to compare it against competitors. If net investment is positive, the company is expanding its capacity, whereas if it is negative, its capacity is shrinking.

| Characteristics | Values |

|---|---|

| Definition | The total amount of money that a company spends on capital assets, minus the cost of the depreciation of those assets. |

| Calculation | Net Investment = Capital Expenditures – Depreciation (non-cash) |

| Calculation Example | A company spends $100,000 in capital expenditure and has a depreciation expense of $50,000 on the income statement. Its net investment is $50,000 ($100,000 – $50,000). |

| Real-World Example | Netflix invests in video content by creating shows and movie content of its own and buying streaming rights from other organisations. |

| Importance | Net investment is a good indication of how much is being invested in the productive capacity of a company. |

| Positive vs Negative | If net investment is positive, the company is expanding its capacity. If net investment is negative, its capacity is shrinking. |

| Application | Net investment is a component of a nation's gross domestic product (GDP). |

What You'll Learn

Net investment calculation

Net investment is the total amount of money a company spends on capital assets, minus the cost of depreciation of those assets. This figure gives an indication of how much a company is spending on maintaining and improving its operations.

The formula for calculating net investment is:

> Net Investment = Capital Expenditures – Depreciation (non-cash)

The capital expenditure is the gross amount spent on maintaining existing assets and acquiring new ones. Depreciation is a non-cash expense that accounts for the loss in value of an asset over time due to wear and tear, and obsolescence.

Suppose a company spends $1 million on a new machine with an expected life of 30 years and a residual value of $100,000. Using the straight-line method of depreciation, the annual depreciation would be $30,000, calculated as ($1,000,000 - $100,000) / 30. Therefore, the net investment at the end of the first year, assuming no new capital expenditures, would be $970,000.

Net investment can be positive or negative. A positive net investment indicates that a company is expanding its capacity, while a negative net investment suggests a shrinking capacity.

Comparing net investment figures is most relevant when comparing companies within the same industry, as the net investment amount required varies across sectors.

Oakmark's Cash Strategy: Liquidated Investments and Holdings

You may want to see also

Net investment in economics

Net investment is a term used in economics to refer to the total spending on physical capital and inventories, minus the cost of replacing depreciated capital goods. In other words, it is the amount of money a company or country spends on capital assets, minus the depreciation of those assets. This provides an indication of the real expenditure on durable goods such as plants, equipment, and software, and it is an important metric for understanding a company's financial health and growth potential.

Net investment is calculated using the following formula:

Net Investment = Capital Expenditures – Depreciation (non-cash)

Capital expenditures include the calculated worth of all assets, such as property, software, and equipment, as well as any additional expenses invested in those assets, such as maintenance, repair, and installation. These capital assets lose value over time due to wear and tear, obsolescence, and breakdown, so depreciation needs to be taken into account to get an accurate representation of capital expenditures.

In economics, net investment is used as a component in calculating a region's gross domestic product (GDP) and is a primary indicator of overall economic growth. It indicates the domestic private investment being made by companies and governments.

By comparing the net investment of a company to its revenue, analysts can understand how much the company is investing in maintaining and improving its operations. If a company's net investment is positive, it indicates that the company is expanding its capacity and increasing its productive capacity. On the other hand, if the net investment is negative, it suggests that the company's capacity and productive capacity are shrinking, indicating limited growth potential.

Net investment is an important metric for investors to consider when evaluating a company's viability as a place to invest. It provides insight into how serious a company is about maintaining and improving its operations, as well as its potential for future growth.

Positive Cash Flows: A Smart Investment Strategy?

You may want to see also

Net cash flow to invested capital

Net income (after-tax) + Non-cash charges (e.g. depreciation, amortisation, deferred revenue, deferred taxes) – Capital expenditures necessary to support projected operations – Additions (deletions) to net working capital necessary to support projected operations + Interest expense net of the tax benefit = Net cash flow to invested capital (after-tax)

The net cash flow to invested capital is also referred to as Invested Capital Net Cash Flow. This metric is reviewed during business valuation analytical work to ensure that the cash and cash balances reflected in the statement of financial position are appropriate and not overstated or understated.

The net cash flow to invested capital is an important metric as it provides insight into a company's ability to generate sustainable, positive cash flows, which in turn determines its future growth prospects, its ability to reinvest in maintaining past growth or excess growth, expand its profit margins, and operate as a "going concern" over the long run.

Restricted Cash: A Viable Investment Option?

You may want to see also

Net cash flow vs net income

Net investment is the total amount of money a company spends on capital assets, minus the cost of depreciation of those assets. This figure gives an indication of the real expenditure on durable goods such as plants, equipment, and software used in a company's operations. Net investment is a good way to understand how much a company is spending to maintain and improve its operations.

Net income is a key metric of profitability and is a major driver of stock prices and bond valuations. It is the profit a company has earned over a period, and is calculated by subtracting the cost of sales, operational expenses, depreciation, interest, amortization, and taxes from total revenue. Net income is also referred to as the bottom-line profit as it appears at the bottom line of the income statement.

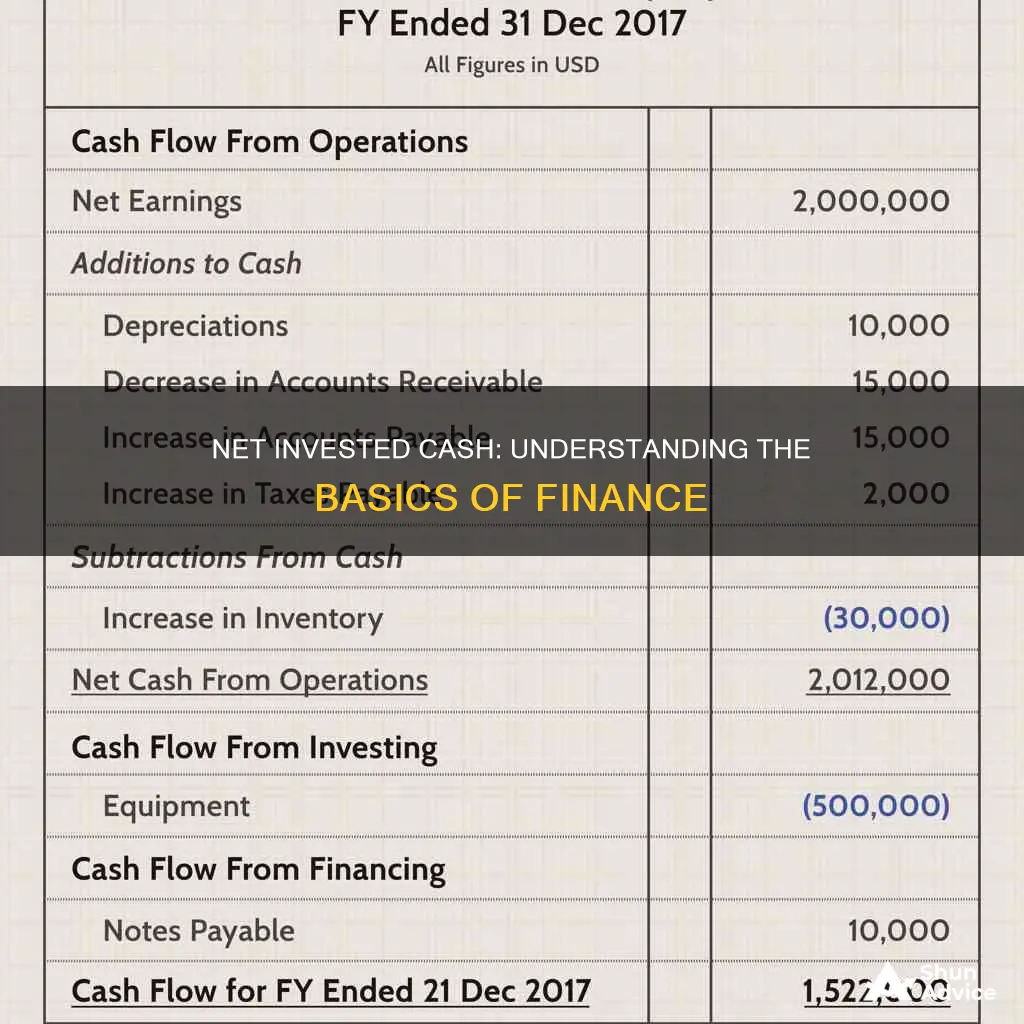

Net cash flow is a measure of the cash that a business generates or uses during a given period. This metric indicates whether a business has ended a period with more or less cash than it started with. Net cash flow is calculated by netting the cash inflows and outflows from operating activities, which include cash receipts from the sale of goods and cash outflows such as payments to suppliers, employees, and utilities.

Net income is the starting point for calculating net cash flow. However, the two metrics are distinct and provide different insights. Net income is a key figure for investors and stakeholders, whereas net cash flow is seen as a more objective measure of a business's financial state. Net income can be impacted by how revenue and expenses are recognised and how depreciation and amortisation are treated from an accounting standpoint, which could misrepresent the actual financial position of the business.

Both net income and net cash flow are important in determining the financial health of a company. They are widely monitored by stakeholders, investors, and internal management, and when analysed together, they can paint a comprehensive picture of a company's overall financial health.

Investing Activities: Statement of Cash Flows Impact

You may want to see also

Net cash flow calculation

Net cash flow is a profitability metric that represents the amount of money produced or lost by a business during a given period. It is the difference between the money coming in ("inflows") and the money going out of a company ("outflows") over a specified period.

The net cash flow formula is:

Net Cash Flow = Total Cash Inflows – Total Cash Outflows

This can also be calculated by adding the net cash flow from operating activities, net cash flow from investing activities, and net cash flow from financing activities.

Let's assume Company XYZ has been in the manufacturing business for several years. The company reported $34 million as the opening cash balance. It further reported that it earned $100 million from operating activities, lost $50 million from investing activities, and earned $30 million from financing activities.

The net cash flow calculation for this scenario is as follows:

Net Cash Flow = $100 million – $50 million + $30 million

Net Cash Flow = $80 million

The net cash flow for the company is $80 million.

Now, if we add the net cash flow of $80 million to the opening cash balance of $34 million, we get a closing balance of $114 million.

This calculation provides insight into the financial health of a business and can help determine if it has positive or negative cash flows, indicating its short-term financial viability.

Cash Repayments: A Smart Investment Strategy?

You may want to see also

Frequently asked questions

Net invested cash is the total amount of money that a company spends on capital assets, minus the cost of the depreciation of those assets.

Net invested cash indicates how much a company is spending to maintain and improve its operations.

If net investment is positive, the company is expanding its capacity.

If net investment is negative, the company's capacity is shrinking.

The formula for calculating net investment is: Net Investment = Capital Expenditures – Depreciation (non-cash)