Simple interest is a straightforward crediting of cash flows associated with some investment or loan. It is calculated by multiplying the interest rate (in decimal form) by the time period (in years). For example, if you invest $10,000 at 5% simple interest, you'd receive $500 per year, every year, for as long as the investment remained in place. Simple interest is different from compound interest, which takes into account the power of compounding, or interest-on-interest.

| Characteristics | Values |

|---|---|

| Definition | Simple interest is a straightforward crediting of cash flows associated with some investment or deposit. |

| Calculation | Simple interest is calculated by multiplying the interest rate (in decimal form) and the time period (in years). |

| Comparison to compound interest | Simple interest is paid on the principal amount only, whereas compound interest is paid on the principal as well as on any interest that has already accumulated. |

| Example | 1% annual simple interest would credit $1 for every $100 invested, year after year. |

What You'll Learn

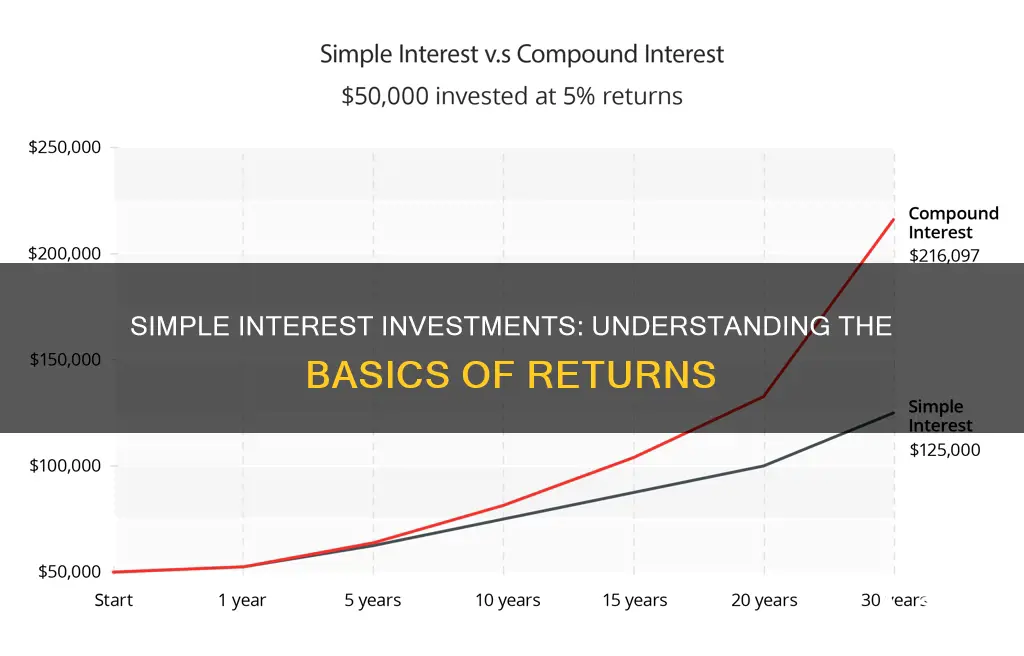

Simple interest vs compound interest

Simple interest is a straightforward crediting of cash flows associated with some investment or deposit. For example, 1% annual simple interest would credit $1 for every $100 invested, year after year. Simple interest is paid on the principal amount of an investment or loan. If you invest $10,000 at 5% simple interest, you'd receive $500 per year, every year, for as long as the investment remained in place. Simple interest does not take into account the power of compounding, or interest-on-interest, where after the first year the 1% would actually be earned on the $101 balance, adding up to $1.01. The next year, the 1% would be earned on $102.01, amounting to $1.02, and so on.

Compound interest will always pay more after the first payment period. For example, suppose you borrow $10,000 at a 10% annual interest rate with the principal and interest due as a lump sum in three years. In this case, the compound interest would be calculated on the total amount of $110,000, resulting in a higher interest payment.

Simple interest is a key part of personal finance and can help you make better decisions when borrowing or investing money. It is a simple calculation, making it easier for you to compare different investment or loan options. However, it is important to note that not all interest is the same, and it is common to mix up simple interest and compound interest.

To illustrate the difference, let's consider two investments. One is a bond that cost $5,000 and pays 6% simple interest. The other is a 24-month certificate of deposit (CD) that pays compound interest at the same annualized rate of 6%. After two years, the simple interest bond investment would be worth $5,600, while the compound interest investment would be worth more due to the interest-on-interest calculation.

Maximizing Investment Returns: Understanding Interest Rate Compounding

You may want to see also

How to calculate simple interest

Simple interest is a straightforward crediting of cash flows associated with some investment or deposit. It is calculated by multiplying the interest rate (in decimal form) by the time period (in years). For example, if you invest $10,000 at 5% simple interest, you'd receive $500 per year, every year, for as long as the investment remained in place.

Simple interest is different from compound interest, which refers to interest paid on the principal as well as on any interest that has already accumulated. For example, if you invest $100 at 1% annual simple interest, you would receive $1 every year. However, with compound interest, after the first year, the 1% would be earned on the $101 balance, adding up to $1.01. The next year, the 1% would be earned on $102.01, amounting to $1.02, and so on. Compound interest will always pay more after the first payment period.

Investing: Interest and Cash Flow Interdependence

You may want to see also

How simple interest impacts your financial journey

Simple interest is a straightforward calculation that shows how your money will grow over a set period. It is a key part of personal finance and can help you make better decisions when borrowing or investing money.

Simple interest refers to situations where interest is paid on the principal amount of an investment or loan. For example, if you invest $10,000 at 5% simple interest, you'd receive $500 per year, every year, for as long as the investment remained in place.

Simple interest does not take into account the power of compounding, or interest-on-interest. For example, 1% annual simple interest would credit $1 for every $100 invested, year after year. However, after the first year, the 1% would actually be earned on the $101 balance, adding up to $1.01. The next year, the 1% would be earned on $102.01, amounting to $1.02. And so on. Compound interest will always pay more after the first payment period.

For example, let's say that you have two investments. One is a bond that cost $5,000 and pays 6% simple interest. The other is a 24-month certificate of deposit (CD) that pays compound interest at the same annualized rate of 6%. After two years, the simple interest bond investment would be worth $5,600.

Ally Invest Interest Payments: What You Need to Know

You may want to see also

How simple interest can help you make better decisions when investing

Simple interest is a straightforward crediting of cash flows associated with an investment or deposit. For example, 1% annual simple interest would credit $1 for every $100 invested, year after year.

Simple interest is a key part of personal finance and can help you make better decisions when investing money. It can show you how your money will grow over a set period, allowing you to compare different investment or loan options.

For example, let's say you have two investments. One is a bond that costs $5,000 and pays 6% simple interest. The other is a 24-month certificate of deposit (CD) that pays compound interest at the same annualised rate of 6%. After two years, the simple interest bond investment would be worth $5,600.

Simple interest does not take into account the power of compounding, or interest-on-interest, where after the first year, the 1% would be earned on the $101 balance, adding up to $1.01. The next year, the 1% would be earned on $102.01, amounting to $1.02, and so on. Compound interest will always pay more after the first payment period.

Therefore, understanding simple interest can help you make better decisions when investing by allowing you to compare different investment options and choose the one that best suits your financial goals.

Exploring Surplus Impact on Interest Rates and Investments

You may want to see also

How simple interest is different to interest-on-interest

Simple interest is a straightforward crediting of cash flows associated with an investment or loan. It is calculated as a percentage of the principal amount. For example, if you invest $10,000 at 5% simple interest, you would receive $500 per year, every year, for as long as the investment remains in place.

Simple interest is different from interest-on-interest, or compound interest, in that it is only paid on the principal amount. Compound interest is paid on the principal amount as well as on any interest that has already accumulated. For example, if you invest $100 at 1% annual simple interest, you would receive $1 every year. However, with compound interest, after the first year, the 1% would be earned on the $101 balance, adding up to $1.01. The next year, the 1% would be earned on $102.01, amounting to $1.02, and so on.

Compound interest will always pay more after the first payment period. However, simple interest has the advantage of being a simpler calculation, making it easier to compare different investment or loan options. It is a key part of personal finance and can help individuals make better decisions when borrowing or investing money.

Investment Interest: Caps and Limits to Your Money

You may want to see also

Frequently asked questions

Simple interest investment refers to situations where interest is paid on the principal amount of an investment or loan. For example, if you invest $10,000 at 5% simple interest, you would receive $500 per year, every year, for as long as the investment remained in place.

Simple interest is calculated by multiplying the interest rate (in decimal form) by the time period (in years). For example, 1% annual simple interest would credit $1 for every $100 invested, year after year.

Simple interest does not take into account the power of compounding, or interest-on-interest. Compound interest will always pay more after the first payment period. For example, if you borrow $10,000 at a 10% annual interest rate with the principal and interest due as a lump sum in three years, the compound interest will be higher than the simple interest.