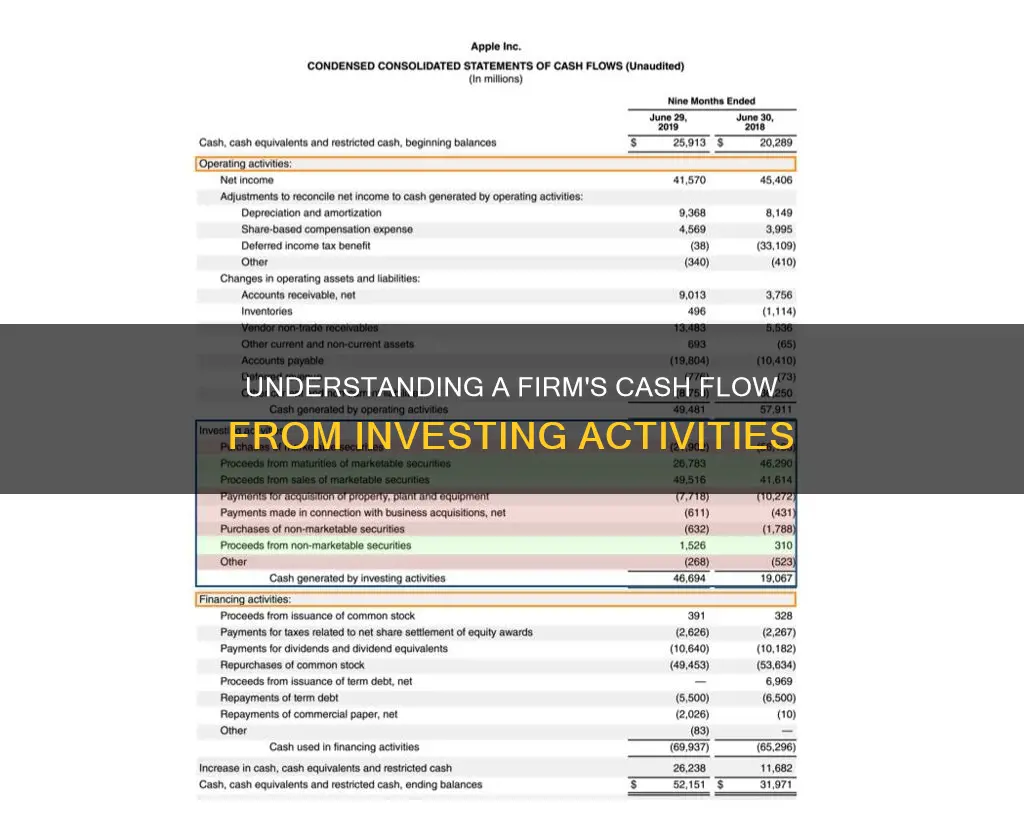

A company's cash flow statement is one of the three main financial statements that show its financial health. The cash flow statement bridges the gap between the income statement and the balance sheet by showing how much cash is generated or spent on operating, investing, and financing activities for a specific period. Cash flow from investing activities (CFI) is one of the sections of a company's cash flow statement. It reports how much cash has been generated or spent from various investment-related activities in a specific period.

| Characteristics | Values |

|---|---|

| Type of financial statement | Cash flow statement |

| Purpose | Reports how much cash has been generated or spent from various investment-related activities in a specific period |

| Calculation | Total cash inflow – Total cash outflow |

| Positive cash flow | Indicates that a company's liquid assets are increasing, enabling it to cover obligations, reinvest in its business, return money to shareholders, pay expenses, and provide a buffer against future financial challenges |

| Negative cash flow | May be due to significant amounts of cash being invested in the company, such as research and development (R&D), and is not always a warning sign |

| Examples of activities | Purchase of fixed assets, purchase of investments such as stocks or securities, sale of fixed assets, sale of investment securities, collection of loans and insurance proceeds |

What You'll Learn

- Cash flow from investing activities includes the purchase and sale of physical assets

- It also includes investments in securities, or the sale of securities

- A company's cash flow statement shows how much cash has been generated or spent from investment activities

- Cash flow from investing activities can be calculated by subtracting total cash outflows from total inflows

- A positive net cash flow from investing activities indicates a company is generating more cash than it spends

Cash flow from investing activities includes the purchase and sale of physical assets

Cash flow from investing activities (CFI) is a section of a company's cash flow statement that shows the cash generated by or spent on investment activities during a specific period. It is an important aspect of understanding a company's financial health and can indicate how effectively a company manages its cash.

Investing activities include the purchase and sale of physical assets, investments in securities, acquisitions of other businesses, and the sale of other businesses (divestitures). These activities can generate either negative or positive cash flow. Purchases require spending money and generate negative cash flow, while sales produce income and generate positive cash flow.

Physical assets, also known as long-term or fixed assets, include property, plant, and equipment (PP&E). PP&E is considered a capital expenditure, which is a popular measure of capital investment used in the valuation of stocks. An increase in capital expenditures indicates that a company is investing in future operations. However, it also represents a reduction in cash flow. Companies with significant capital expenditures are typically in a state of growth.

The purchase or sale of a fixed asset is considered an investing activity and is listed under investing activities in a company's cash flow statement. For example, proceeds from the sale of a division or cash out as a result of a merger or acquisition would fall under investing activities.

Overall, cash flow from investing activities provides insight into a company's long-term investments and how it is allocating cash for the future. It is important to note that negative cash flow from investing activities does not always indicate poor financial health. It often signifies that a company is investing in assets, research, or other long-term development activities that are crucial for the company's health and continued operations.

Understanding Cash Flow from Sales of Investments

You may want to see also

It also includes investments in securities, or the sale of securities

A company's cash flow statement is a crucial indicator of its financial health and efficiency. It is one of the three main financial statements that a business uses, alongside the balance sheet and the income statement. The cash flow statement is divided into three sections: cash flow from operating activities, cash flow from investing activities, and cash flow from financing activities.

Cash flow from investing activities (CFI) is a section of a company's cash flow statement that reports the cash inflows and outflows resulting from investment activities. These activities include purchases of physical assets, investments in securities, or the sale of securities or assets.

When a company makes investments in securities, it is allocating its cash towards the purchase of financial instruments such as stocks, bonds, or other types of investments. This can include buying shares of stock in another company, purchasing government or corporate bonds, or investing in other types of securities such as mutual funds or options. These investments can be made to generate income or as long-term investments to support the company's health and performance.

On the other hand, the sale of securities refers to the disposal or liquidation of these financial instruments. This can occur for various reasons, such as generating cash, rebalancing a portfolio, or realising profits or losses. For example, a company may choose to sell stocks, bonds, or other securities to free up cash for other strategic initiatives or to reinvest in different opportunities.

Both the purchase and sale of securities impact the cash flow from investing activities. When a company buys securities, it represents a cash outflow, as money is being spent on these investments. Conversely, when a company sells securities, it results in a cash inflow, as money is received from the sale of these investments.

By analysing the cash flow from investing activities, stakeholders can gain insights into the company's investment strategies and capital allocation decisions. It reflects the company's commitment to expanding its operations, enhancing its technological capabilities, or investing in research and development for long-term growth.

In summary, the cash flow statement's inclusion of investments in securities and the sale of securities provides valuable information about a company's financial health and investment performance. It offers transparency into how the company manages its cash, generates income, and allocates resources towards long-term growth initiatives.

Is Now the Time to Change Investments to Cash?

You may want to see also

A company's cash flow statement shows how much cash has been generated or spent from investment activities

A company's cash flow statement is one of the three main financial statements that show the state of a company's financial health. The other two are the balance sheet and the income statement. The cash flow statement provides an account of the cash used in operations, including working capital, financing, and investing.

The cash flow statement is divided into three sections: cash flow from operating activities, cash flow from investing activities, and cash flow from financing activities.

Cash flow from investing activities (CFI) is one of the sections of a company's cash flow statement. It reports how much cash has been generated or spent from various investment-related activities in a specific period. This includes purchases of physical assets, investments in securities, or the sale of securities or assets. These activities can generate either negative or positive cash flow. Purchases require spending money, which generates negative cash flow, while sales produce income, which generates positive cash flow.

Negative cash flow from investing activities is not always a bad sign. It can indicate that management is investing in the long-term health of the company, such as research and development. Positive cash flow from investing activities indicates that a company is generating more cash from its investing activities than it is spending, suggesting that the company is effectively managing its investments.

Overall, the cash flow statement provides valuable insights into a company's financial health and operational efficiency, helping investors make informed decisions.

Cash Reserves Investments: A Safe Haven for Your Money

You may want to see also

Cash flow from investing activities can be calculated by subtracting total cash outflows from total inflows

Cash flow from investing activities (CFI) is one of the sections of a company's cash flow statement. It reports the net amount of cash flow generated or spent from various investment-related activities in a specific period. These activities include the purchase and sale of investments, as well as earnings from investments.

CFI is calculated by adding up all the cash inflow from the sale of non-current assets and any money received from the sale of marketable securities. Then, the costs of purchasing non-current assets such as equipment or securities are subtracted. The total gives you the CFI.

Cash flow from investing activities = CapEx/purchase of non-current assets + marketable securities + business acquisitions - divestitures.

Divestitures refer to the sale of investments.

For example, consider a company that spent $30 billion on capital expenditures, $5 billion on investments, and $1 billion on acquisitions. The company also realised a positive inflow of $3 billion from the sale of investments. To calculate the CFI, these items are added together, resulting in an annual figure of -$33 billion.

Commercial Paper: Investing or Cash Flow?

You may want to see also

A positive net cash flow from investing activities indicates a company is generating more cash than it spends

A positive net cash flow from investing activities is generally a good sign for a company, indicating that it is generating more cash than it spends. This means that the company's liquid assets are increasing, which can be beneficial in several ways.

Firstly, a positive cash flow enables a company to cover its financial obligations, such as paying debts and expenses. This is a crucial indicator of a company's ability to manage its financial commitments effectively. Secondly, positive cash flow allows reinvestment in the business, which can include purchasing fixed assets, investing in securities, or funding research and development. Such investments are essential for the long-term health and growth of the company.

Additionally, a company with a positive cash flow can choose to return money to shareholders, providing them with dividends or profits. This can enhance shareholder confidence and satisfaction. Positive cash flow also serves as a buffer against future financial challenges and economic downturns, as the company has additional financial resources to draw upon during difficult periods.

It is worth noting that a positive net cash flow from investing activities specifically refers to the cash generated by or spent on investment activities in a specific period. This is distinct from other types of cash flow, such as cash flow from operations or cash flow from financing activities, which relate to different aspects of a company's financial activities.

While positive cash flow is generally favourable, it is important to consider the context and analyse other financial statements alongside the cash flow statement to fully understand a company's financial health and performance.

Supplies: Investing or Operating Cash?

You may want to see also

Frequently asked questions

Cash flow from investing is listed on a company's cash flow statement and includes any inflows or outflows of cash from a company's long-term investments.

A cash flow statement shows the sources and use of cash over a certain period of time. It is one of three main financial statements that show the state of a company's financial health. The other two are the balance sheet and the income statement.

To calculate cash flow from investing activities, add the purchases or sales of property and equipment, other businesses, and marketable securities.

Cash flow from investing activities = CapEx/purchase of non-current assets + marketable securities + business acquisitions – divestitures (sale of investments).