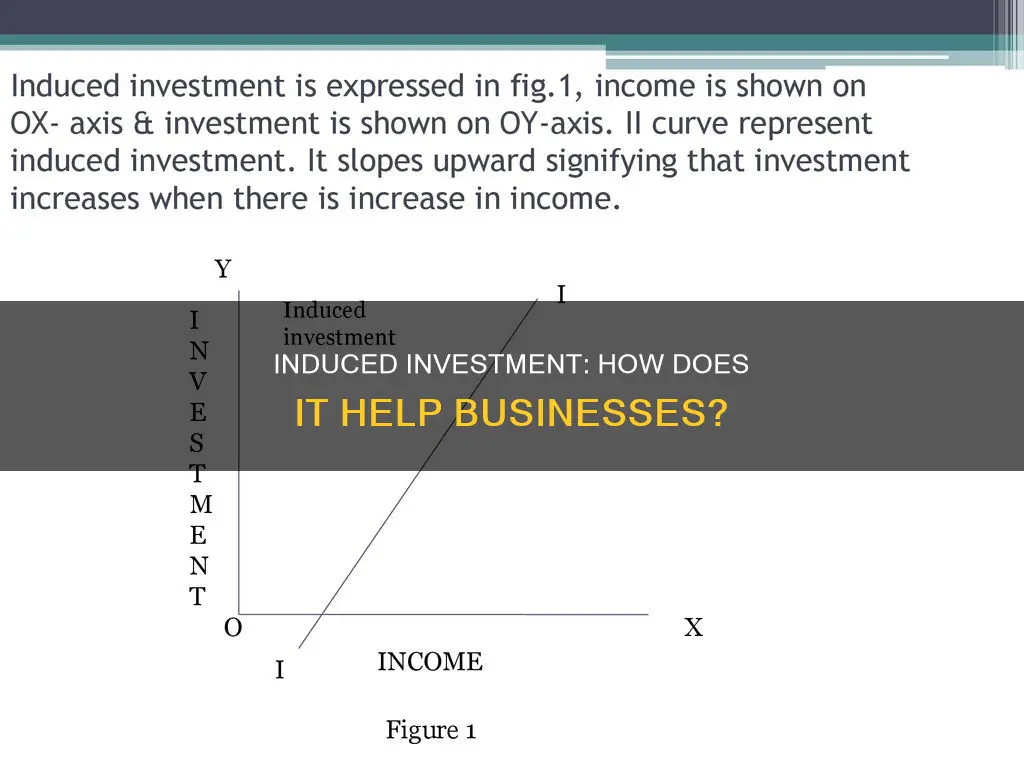

Induced investment is a type of investment that is influenced by changes in income levels and economic conditions. It is undertaken in response to consumer demand for a producer's goods and services, with the motive of profit. This is in contrast to autonomous investment, which is influenced by factors other than profit, such as social welfare. Induced investment increases when income increases and decreases when income decreases. It is positively related to national income and can accelerate economic growth by increasing the stock of capital and productive capacity.

| Characteristics | Values |

|---|---|

| Type of investment | Depends on the level of income in the economy |

| Influencing factors | Changes in consumer spending, business confidence, interest rates, economic growth |

| Investment behaviour | Financial gains, profit motive, business perspective, retail investment perspective |

| Relation to national income | Positively related to national income |

What You'll Learn

Induced investment is income elastic

Induced investment is a type of investment that is dependent on the level of income or the rate of interest. It is undertaken in response to consumers' demand for a producer's goods. In other words, induced investment is income elastic, meaning that the amount of investment is directly related to the level of income. When income levels are high, induced investment will also be high, and when income levels are low, induced investment will decrease.

The relationship between income and induced investment can be explained by the following: when income levels increase, the level of employment and the demand for consumer goods also increase. This, in turn, results in an increase in investment as businesses invest in more inventory and equipment to meet the higher demand.

Entrepreneurs and businesses will produce or purchase capital goods when they anticipate high levels of sales of final goods. This anticipation depends on the level of income and the effective demand of consumers. An increase in income leads to an increase in employment and consumer demand, which then results in an increase in investment.

Induced investment can also be influenced by other factors such as technological innovations, government policies, and population structure. It is important to note that induced investment is different from autonomous investment, which is independent of the level of income and remains constant regardless of income level.

The concept of induced investment is crucial in understanding how businesses respond to changes in income levels and consumer demand. By investing in inventory and equipment, businesses can meet the changing demands of their consumers and adapt their operations to match economic trends. This type of investment plays a significant role in the overall economic landscape and can impact the supply of goods and services available in the market.

Millionaires' Secrets: Where They Invest Their Money

You may want to see also

It is positively related to national income

Induced investment is positively related to national income. This means that induced investment increases when income increases, and decreases when income decreases. It is a type of investment that depends on the level of income in the economy and changes as income levels change.

Induced investment is undertaken in response to consumer demand for a producer's goods. It is income elastic, meaning that it is sensitive to changes in income levels. As income levels rise, induced investment increases, and vice versa. This is in contrast to autonomous investment, which remains unchanged regardless of income fluctuations and is driven by the profit motive and social welfare.

The relationship between induced investment and national income can be further understood through the investment multiplier. The investment multiplier expresses the magnitude of change in investment resulting from income changes. A positive relationship between induced investment and national income indicates that as income levels rise, businesses will invest more in response to increased consumer demand. This, in turn, can lead to an expansion of the capital stock, offering greater productive capacity.

The positive relationship between induced investment and national income also has implications for economic growth. As income levels rise, induced investment can accelerate economic growth as the interaction between the multiplier and the acceleration coefficient increases growth rates. This suggests that induced investment plays a crucial role in the overall economic growth of a country.

Furthermore, induced investment is typically carried out by the private sector. Therefore, the positive relationship between induced investment and national income indicates that the private sector's investment decisions are closely tied to income levels in the economy. This has implications for understanding the business cycle and the impact of income fluctuations on private sector investment behaviour.

Understanding Net Cash Flows from Investing Activities

You may want to see also

It is undertaken in response to consumer demand

Induced investment is a type of investment that is undertaken in response to consumer demand for a producer's goods and services. It is driven by the motive of profit and is positively related to national income. As income levels change, induced investment also changes. This means that when income increases, induced investment increases, and vice versa.

Induced investment is influenced by changes in consumer spending and demand. When consumer spending increases, businesses are more likely to invest in new projects or expand existing ones to meet the growing demand. For example, a company may decide to install AI-enabled machines that can increase productivity to meet the increased demand for their products. This would be considered an induced investment as it is undertaken in response to changes in consumer demand.

Business confidence also plays a role in induced investment. When businesses are more confident in the economy, they are more likely to invest in new projects or expand their operations. Interest rates are another factor that influences induced investment. Lower interest rates make borrowing cheaper, which can stimulate investment by making it more attractive for businesses to invest in new projects.

Overall, induced investment is an important concept in economics as it is driven by the motive of profit and is responsive to changes in consumer demand and income levels. It plays a crucial role in a company's decision-making process regarding investments and can have a significant impact on a country's economic growth.

Target's Overseas Strategy: Direct Investment Approach?

You may want to see also

It is influenced by changes in consumer spending and demand

Induced investment is influenced by changes in consumer spending and demand. As consumer spending increases, businesses are more likely to invest in new projects or expand existing ones to meet the growing demand. This is because induced investment is undertaken in response to consumers' demand for a producer's goods. It is driven by the desire to maximise returns, build a secure future, combat inflation, and provide a financial safety net for retirement.

When consumer spending increases, businesses often need to invest in new projects or expand their existing operations to keep up with the demand. This could involve investing in new equipment, technology, or infrastructure. For example, a company might invest in additional machinery to increase its production capacity or in research and development to create new products that meet the changing demands of consumers.

Changes in consumer spending can also impact the type of induced investment a business undertakes. For instance, if consumers are demanding more environmentally friendly products, a company might invest in sustainable practices and technologies. Similarly, if consumers are demanding more personalised products, a company might invest in customisation technologies or hire more staff to meet those demands.

Consumer spending can also influence the timing of induced investments. If consumer spending increases rapidly, businesses may need to accelerate their investment plans to keep up with the demand. On the other hand, if consumer spending decreases, businesses may postpone or cancel their investment plans.

It's worth noting that while induced investment is influenced by consumer spending and demand, it is also impacted by other factors, such as business confidence, interest rates, and overall economic growth. Businesses are more likely to invest when they are confident about the economy and when interest rates are low, making borrowing cheaper. Additionally, as the economy grows, businesses often have more financial resources to invest in new projects or expansion.

Warren Buffett's Investment Philosophy: Value Investing Strategy

You may want to see also

It is influenced by business confidence

Induced investment is influenced by changes in income and economic conditions. When income levels change, induced investment also changes. It is undertaken in response to consumer demand for a producer's goods.

Business confidence is a key factor that influences induced investment. Positive business sentiment and confidence in future economic prospects can encourage businesses to increase investment. When businesses are confident about the economy, they are more likely to invest in new projects or expand existing ones. This is because confident businesses anticipate higher sales and profits, which makes them more willing to take on new investments or expand their operations.

The level of business confidence can be influenced by various factors, such as market trends, economic indicators, and government policies. For example, businesses may feel more confident to invest when economic indicators, such as GDP growth or interest rates, are favourable. Additionally, government policies that support businesses, such as tax incentives or subsidies, can also boost business confidence and encourage investment.

It is important to note that induced investment is different from autonomous investment, which is independent of income levels and driven by factors such as technological advancements or government policies. Autonomous investment is more stable and less responsive to short-term fluctuations in income or economic conditions. On the other hand, induced investment is more sensitive to changes in income and economic conditions and reflects the cyclical nature of the economy.

Maximizing Returns: IRR for Multiple Investments

You may want to see also

Frequently asked questions

Induced investment is a type of investment expenditure that is influenced by shifts in the economy and depends on profit expectations. It is income elastic, meaning that induced investment increases when income increases and vice versa. Induced investment is undertaken in response to consumers' demand for a producer's goods.

Autonomous investment is a type of investment that is not influenced by changes in income levels and is induced solely by the profit motive. It is income inelastic, meaning that autonomous investment remains the same regardless of changes in income. Autonomous investments are generally made by governments in infrastructural activities and are motivated by social welfare.

Induced investment is positively related to national income. As income and profit increase, induced investment also increases, and this relationship is illustrated by an upward-sloping curve.

Induced investment is influenced by various factors, including changes in the cost of raw materials, shifts in consumer tastes and preferences, and fluctuations in lending or borrowing rates. Companies adjust their induced investments to remain viable in response to these shifts.

Induced investment can include investments in inventories and equipment, and it often occurs when private companies identify gaps between demand and supply, aiming to generate profits by meeting the market demand.