Deciding how much cash to keep on hand is a complex question that depends on a variety of factors, including your financial situation, budget, age, and risk tolerance. While some experts recommend keeping at least three months' worth of expenses in cash reserves, others suggest that investors keep between 5% and 20% of their portfolio in cash. This liquid asset serves as a safety net during emergencies and market downturns, but it's important to remember that cash offers low returns compared to other investments.

| Characteristics | Values |

|---|---|

| Minimum amount of cash to keep on hand | 3 months of expenses |

| Recommended amount of cash to keep on hand | 6 months of expenses |

| Maximum amount of cash to keep in a portfolio | 20% |

| Common amount of cash kept by professionals | 5% |

| Maximum amount of cash kept by professionals | 10% to 15% |

| Common amount of cash kept by retail investors | 28% |

| Minimum amount of cash in a portfolio | 2% |

| Common-sense strategy for cash allocation | 5% to 20% |

| Maximum risk/reward level for cash allocation | 30% |

Liquidity and emergency funds

Emergency Funds:

It is generally recommended to have an emergency fund that covers at least three months' worth of expenses, although ideally, you should aim for six months' worth. This fund ensures you have financial support during unexpected situations like job loss or medical emergencies, preventing the need to sell assets or investments at a loss. It is best to keep this fund in a safe and easily accessible account, such as a savings or checking account, to ensure you can quickly tap into it when needed.

Liquidity:

Liquidity refers to how quickly an investment can be converted into cash. It is essential to have liquid assets as part of your portfolio to take advantage of new investment opportunities or to weather market downturns without needing to sell other assets. Examples of liquid assets include savings and checking accounts, money market accounts, and short-term investments with maturities of less than 90 days, such as certificates of deposit (CDs), bonds, and Treasuries.

Determining the Right Cash Percentage:

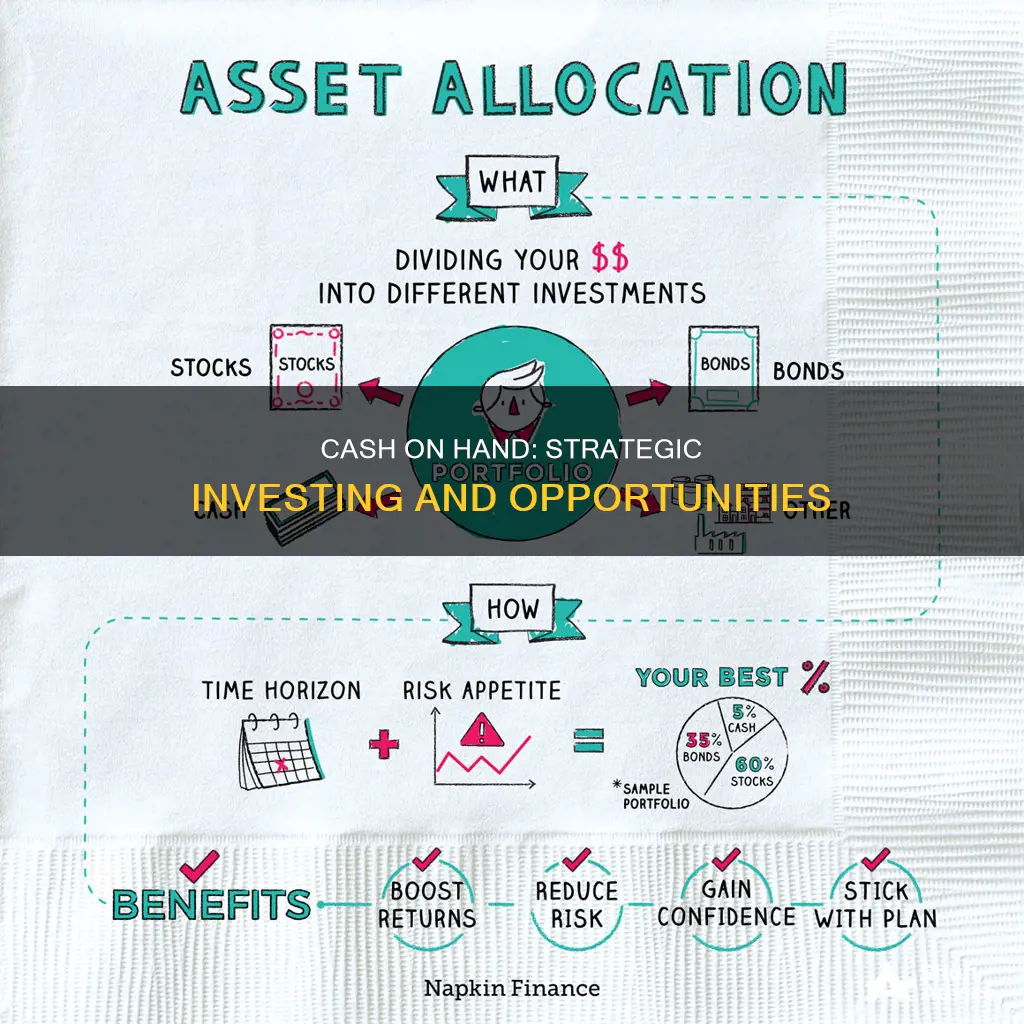

The percentage of your portfolio that should be in cash or cash equivalents depends on various factors, including your financial goals, risk tolerance, and current market conditions. A common rule of thumb is to maintain between 2% and 10% of your portfolio in cash or cash equivalents. However, this may vary depending on your unique circumstances, with some investors opting for as much as 20% to 30% during certain market conditions.

Advantages of Cash and Cash Equivalents:

Cash and cash equivalents provide liquidity, portfolio stability, and emergency funds. They are among the safest and most liquid investments, especially with FDIC-insured savings and checking accounts, CDs, and money market deposit accounts. Additionally, cash can provide peace of mind, especially for retirees, as it ensures liquid reserves during periods of economic uncertainty or downturns.

Disadvantages of High Cash Allocation:

While cash offers stability, it is important to remember that it may not provide returns that exceed inflation over the long term. Holding too much cash in your portfolio can potentially slow your progress toward financial goals, as you may miss out on the higher returns associated with stocks and bonds. Therefore, it is crucial to strike a balance and ensure that your cash allocation aligns with your financial plan and goals.

In conclusion, while determining the exact percentage of cash to keep in your portfolio depends on your unique circumstances, it is clear that liquidity and emergency funds are essential components of a robust financial strategy. By maintaining adequate cash reserves, you can take advantage of new opportunities, weather market downturns, and have peace of mind during uncertain times.

Cash Outflow for Land Purchase: Investing Activity?

You may want to see also

Peace of mind

Emergency Fund

One of the primary reasons to keep cash is to have an emergency fund. Life is unpredictable, and unexpected expenses can arise at any time. Having a cash buffer ensures you are prepared for unforeseen events such as job loss, medical emergencies, or significant home repairs. This fund can help you maintain financial stability and avoid the need to sell assets or incur high-interest debt during challenging times. Most experts recommend having at least three to six months' worth of living expenses set aside as an emergency fund.

Market Volatility Protection

Cash reserves can also provide a safety net during volatile market conditions. In a bear market or during market downturns, having cash on hand can prevent you from being forced to sell your stocks or other assets at a loss. It gives you the flexibility to hold onto your investments until the market recovers, protecting your long-term gains. Additionally, cash allows you to take advantage of buying opportunities when asset prices fall, enabling you to acquire investments at a discount.

Liquidity and Stability

Cash is highly liquid, providing immediate access to funds when needed. This liquidity is essential not only for emergencies but also for pursuing new work opportunities or making significant purchases. Additionally, cash helps stabilize your portfolio. It is one of the safest places to keep your money, especially for risk-averse individuals. While the returns may be lower compared to other investments, cash offers stability and peace of mind, knowing your principal is secure.

Age and Risk Considerations

Your age and risk tolerance should also factor into your cash reserve strategy. Younger investors with a longer investment horizon may be advised to hold less cash, as they have more time to recover from market corrections. On the other hand, investors approaching retirement may want to increase their cash holdings to reduce exposure to potential market downturns. Additionally, consider your risk profile, as more cautious individuals may opt for a higher cash percentage in their portfolio.

Interest Rate and Inflation Impact

The interest rate environment can influence your cash reserve decision-making. In a low-interest-rate environment, you may be tempted to invest more to seek higher returns. However, when interest rates rise, the yield on cash increases, making it more attractive to hold a larger cash balance. Keep in mind that inflation can erode the purchasing power of your cash over time, so ensure your cash holdings are considered within the broader context of your financial goals and market conditions.

In conclusion, maintaining a prudent level of cash reserves is essential for peace of mind. It provides financial security during unexpected events, market volatility, and changing economic conditions. By balancing your cash holdings with your investments, you can achieve both stability and the potential for higher returns. Remember to regularly review and adjust your portfolio based on your life stage, risk tolerance, and financial goals.

Cash from Investments: Where Does the Money Go?

You may want to see also

Risk tolerance

When it comes to cash reserves, those with a higher risk tolerance may be comfortable with a smaller percentage of their portfolio in cash, as they are willing to take on the higher risk of investing in the market. They understand that keeping too much cash in their portfolio could slow their progress toward their financial goals. Additionally, they may view cash as a less attractive investment option due to its low returns compared to stocks and bonds.

On the other hand, individuals with a lower risk tolerance may prefer to hold a larger percentage of their portfolio in cash. This provides them with a sense of security and stability, especially during market downturns or volatile periods. They are willing to sacrifice potential higher returns in the market for the peace of mind that comes with having a substantial cash buffer.

It's important to note that risk tolerance can change over time. For example, younger investors may have a higher risk tolerance and be comfortable with a lower cash position, while those approaching retirement may become more risk-averse and increase their cash reserves.

Determining one's risk tolerance is a crucial step in deciding the percentage of cash to keep in an investment portfolio. It involves assessing an individual's financial goals, investment horizon, and comfort level with market risk. While those with a higher risk tolerance may hold a smaller cash position, those with a lower risk tolerance may prefer the security of having a larger cash buffer.

Cash Investment Strategies: Your Guide to Profitable Opportunities

You may want to see also

Interest rates

When interest rates are low, investors may opt to invest a larger portion of their portfolio in stocks, bonds, or other assets. This is because the potential returns from these investments are typically higher than the interest earned on cash. Additionally, low-interest rates may encourage investors to take on more risk, as they can borrow money at a lower cost. However, it is important to remember that higher-risk investments can also result in higher losses.

On the other hand, when interest rates are high, as they are currently, cash becomes a more attractive investment option. High-interest rates mean that investors can earn a higher return on their cash holdings, making it more appealing to keep a larger percentage of their portfolio in cash. Additionally, high-interest rates can make borrowing money more expensive, which may cause investors to be more cautious and favour cash holdings over riskier investments.

It is worth noting that interest rates are not the only factor influencing investment decisions. Other considerations include an investor's risk tolerance, time horizon, financial goals, and current market conditions. A well-diversified portfolio typically includes a mix of stocks, bonds, and cash, with the specific allocation varying depending on an investor's unique circumstances.

While there is no one-size-fits-all answer to the question of how much cash to keep in an investment portfolio, a general rule of thumb is to maintain between 2% and 10% of your portfolio in cash and cash equivalents. However, this percentage can vary depending on individual circumstances, with some investors opting for as much as 20% to 30% in cash reserves. Ultimately, the decision of how much cash to keep in an investment portfolio depends on a combination of factors, including interest rates, risk appetite, and financial goals.

Outside Investment: Blessing or Cash Flow Curse?

You may want to see also

Inflation

Treasury Inflation-Protected Securities (TIPS)

TIPS are government bonds that are indexed to inflation. They mirror the rise and fall of inflation, so when inflation goes up, the interest rate paid on these bonds also increases. TIPS are considered one of the safest investments during inflationary periods and are an effective way to diversify your portfolio while supplementing future retirement income. The interest on TIPS is paid out twice a year at a fixed rate, and they are issued in 5-, 10-, and 30-year maturities.

Cash and Short-Term Investments

Cash, particularly in a high-yield savings account, money market account, or CD, can be a good inflation hedge, especially during unpredictable economic times. Keeping some cash on hand ensures liquidity and can help you avoid selling off other investments to cover unexpected expenses. Short-term bonds are also a good option during inflationary periods, as they are less affected by rising interest rates compared to long-term bonds.

Real Estate

Real estate values and rental income tend to rise with inflation, making it a good inflation hedge. You can invest in real estate directly or through Real Estate Investment Trusts (REITs) or specialised funds. However, real estate is also sensitive to rising interest rates and financial crises, so it carries some risk.

Commodities

Commodities such as raw materials (oil, metals, agricultural products) and precious metals (gold) tend to increase in price during inflationary periods. You can invest in commodities directly or through exchange-traded funds (ETFs) or mutual funds. However, commodities are highly volatile and dependent on supply and demand factors, so they carry a high level of risk.

Stocks

While stocks can be risky during inflationary periods, companies in certain sectors, such as consumer staples, may be able to pass their rising input costs on to customers and thus keep pace with inflation. Additionally, market-tracking index funds have historically performed well over the long term and may be a good option for investors willing to take on more risk.

It's important to remember that the impact of inflation on your investments will depend on your specific financial situation and goals. Consult a financial professional for advice tailored to your needs.

Cash or Invest: Where Should Your Money Go?

You may want to see also

Frequently asked questions

A general rule of thumb is that cash and cash equivalents should comprise between 2% and 10% of your portfolio. However, this will vary depending on your unique circumstances and current market conditions. For example, if you are a retiree, you may want to allocate more cash to your portfolio to provide peace of mind and ensure you have sufficient liquid reserves.

Cash and cash equivalents provide liquidity, portfolio stability, and emergency funds. They can also help you take advantage of buying opportunities when the market dips. Additionally, having a cash buffer can prevent you from panic-selling stocks at a loss during a bear market.

While keeping a significant cash allocation in your portfolio offers immediate liquidity and can help you weather a market downturn, there is a risk of missing out on market gains if you have too much parked in cash when the market turns higher. Additionally, inflation can diminish the real value of cash over time.