Financial ratios are a key tool for investors to gain insight into a company's financial health and potential for success. They are used to analyse a company's balance sheet and income statement, tracking its performance, liquidity, operational efficiency, and profitability. While they do not give a complete picture of a company's investment potential, they are a good starting point for analysis. Investors use a variety of ratios, including profitability, liquidity, solvency, and valuation ratios, to make informed decisions about potential investments.

| Characteristics | Values |

|---|---|

| Earnings Per Share (EPS) | Calculated by dividing net income by the weighted average number of common shares outstanding during the year |

| Price-to-Earnings (P/E) Ratio | Compares a company's stock price to its earnings on a per-share basis |

| Debt-to-Equity (D/E) Ratio | Measures how much a company is funding its operations using borrowed money |

| Return on Equity (ROE) | Measures profitability and how effectively a company uses shareholder money to make a profit |

| Debt-to-Capital Ratio | Indicates how indebted a company is |

| Interest Coverage Ratio (ICR) | Measures whether a company can support the amount of debt it has |

| Enterprise Value to EBIT | A more advanced version of the P/E ratio |

| Operating Margin | Measures the profitability of a business's core operations |

| Quick Ratio | Also called the acid test, measures whether a company can meet its short-term obligations |

What You'll Learn

Earnings per share

EPS is one of the most fundamental financial metrics and is often used in conjunction with the price-to-earnings (P/E) ratio, allowing investors to gauge the stock price relative to a company's profits. A higher EPS indicates greater value and profitability, suggesting that the company is performing well and may increase its stock price and dividend payouts over time.

However, it is important to consider that EPS has its limitations. Cash flow, for example, is not considered in the EPS calculation, which means a high EPS may not accurately reflect a company's financial health or ability to repay its debts. Additionally, companies can manipulate their EPS in the short term by altering the number of outstanding shares through actions like stock buybacks or issuances, which may impact the metric's reliability.

Despite these limitations, EPS remains a critical tool for investors when used in conjunction with other financial metrics and parameters. It provides a common base for comparing companies with different numbers of outstanding shares, stock prices, and profits, helping investors make informed decisions about a company's potential for success.

Understanding Present Value Tables: A Guide to Smart Investing

You may want to see also

Price-to-earnings ratio

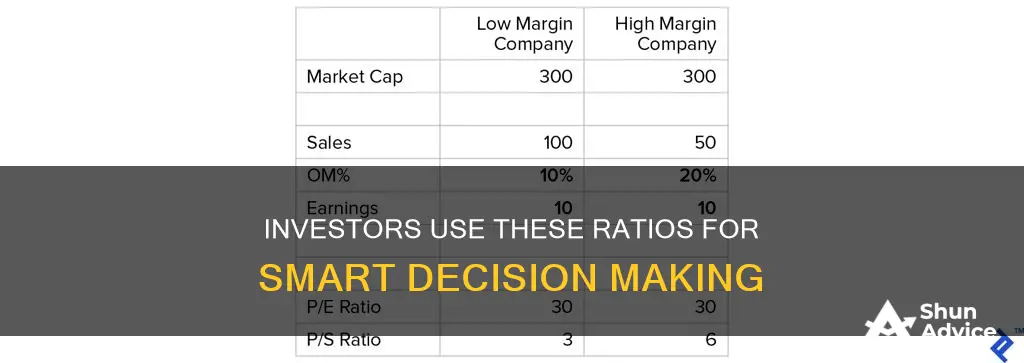

The price-to-earnings ratio (P/E) is one of the most widely used metrics for investors and analysts to determine stock valuation. It is a valuation ratio that helps investors determine how much value they are getting relative to what they are paying for a share of stock.

The P/E ratio is calculated by dividing a company's current stock price by its earnings per share. This helps to determine the relative value of a company's stock. It is handy for comparing a company's valuation against its historical performance, against other firms within its industry, or the overall market.

A high P/E ratio could mean that a company's stock is overvalued or that investors expect high growth rates. Conversely, a low P/E ratio could indicate that a stock is undervalued and perhaps worth buying. However, a low P/E ratio could also mean that the company is not financially healthy.

The P/E ratio can be calculated using trailing earnings, which are earnings that have already been earned, or forward earnings, which are projections for what the company may earn in the future. For fast-growing companies, looking at the forward P/E ratio may be more useful than using historical earnings. However, it is important to remember that projections are not guaranteed.

The P/E ratio can also be inverted to calculate an earnings yield. By taking earnings per share and dividing it by the stock price, investors can easily compare the yield to other investment opportunities.

The P/E ratio is most valuable when comparing similar companies in the same industry or for a single company over time. It is a good tool for investors to use to gain an understanding of a company's potential for success and to make more confident investment decisions.

YNAB for Investments: Tracking Your Money the Right Way

You may want to see also

Debt-to-capital ratio

The debt-to-capital ratio is a measurement of a company's financial leverage. It is calculated by taking a company's interest-bearing debt, including both short- and long-term liabilities, and dividing it by the total capital. The total capital is the sum of all interest-bearing debt and shareholders' equity. This equity may include items such as common stock, preferred stock, and minority interest.

The debt-to-capital ratio provides analysts and investors with a better idea of a company's financial structure and whether it is a suitable investment. Generally, the higher the debt-to-capital ratio, the riskier the company. This is because a higher ratio indicates that the company is funded more by debt than by equity, leading to a higher liability to repay the debt. Consequently, this increases the risk of forfeiture on the loan if the debt cannot be paid on time.

For instance, assume a firm has $100 million in liabilities, including notes payable, bonds payable, accounts payable, accrued expenses, deferred income, long-term liabilities, and other long-term liabilities. Of these, only notes payable, bonds payable, and long-term liabilities are interest-bearing securities, totalling $80 million. As for equity, the company has $20 million worth of preferred stock and $3 million of minority interest. The company also has 10 million shares of common stock outstanding, which are currently trading at $20 per share. Thus, total equity is $223 million. Using these numbers, the calculation for the company's debt-to-capital ratio is:

> Debt-to-capital = $80 million / ($80 million + $223 million) = $80 million / $303 million = 26.4%.

As a general rule, debt-to-capital ratios above 40% warrant a closer look to ensure that the company can manage its debt load. However, it is important to note that the specific impact of debt depends on the company's circumstances. While a certain amount of debt may be detrimental to one company, the same amount may have a negligible effect on another.

The debt-to-capital ratio is often preferred by analysts compared to other leverage ratios, such as the debt-to-asset ratio, as it provides a more accurate picture of the company's health. By expressing debt as a percentage of capital rather than a dollar amount, it becomes easier to compare companies within an industry or across different industries.

CDs: A Smart Investment Strategy?

You may want to see also

Interest coverage ratio

The interest coverage ratio (ICR) is a financial ratio used to determine how well a company can pay the interest on its outstanding debts. It is commonly used by lenders, creditors, and investors to determine the riskiness of lending capital to a company. The higher the ratio, the more coverage the company has for its debt payments.

The interest coverage ratio is calculated by dividing a company's earnings before interest and taxes (EBIT) by its interest expense during a given period. This can be represented by the following formula:

ICR = EBIT / Interest Expense

Alternatively, the interest coverage ratio can also be calculated using earnings before interest, taxes, depreciation, and amortization (EBITDA) as the numerator:

ICR = EBITDA / Interest Expense

A higher interest coverage ratio indicates stronger financial health and the company's ability to meet interest obligations. Generally, an ICR above 2 is considered barely acceptable, while analysts often look for an ICR above 3. A low-interest coverage ratio, such as below 1, indicates that the company may not be able to meet its short-term interest obligations and is at risk of default.

The interest coverage ratio is an important metric for investors as it helps determine a company's riskiness for future borrowing. It provides insight into the company's ability to service its debt and meet its financial obligations.

Using Correlation to Make Currency Investment Decisions

You may want to see also

Return on equity

ROE is considered a gauge of a corporation's profitability and how efficiently it generates those profits. The higher the ROE, the more efficient a company's management is at generating income and growth from its equity financing.

ROE is expressed as a percentage and can be calculated for any company if net income and equity are both positive numbers. Net income is calculated before dividends paid to common shareholders and after dividends to preferred shareholders and interest to lenders.

ROE is best used to compare companies within the same industry, as it varies across sectors. For example, utilities have many assets and debt on the balance sheet compared to a relatively small amount of net income. A normal ROE in the utility sector could be 10% or less. A technology or retail firm with smaller balance sheet accounts relative to net income may have normal ROE levels of 18% or more.

ROE is a useful metric for investors to determine if they are getting a good return on their money. It can also provide insight into how company management is using financing from equity to grow the business.

A sustainable and increasing ROE over time can mean a company is good at generating shareholder value because it knows how to reinvest its earnings wisely, thus increasing productivity and profits. Conversely, a declining ROE can mean that management is making poor decisions on reinvesting capital in unproductive assets.

ROE is just one of many metrics for evaluating a firm's overall financials. Investors should utilize a combination of metrics to get a full understanding of a company's financial health before investing.

Investment Strategies: Navigating Change for Success

You may want to see also

Frequently asked questions

A good ROE is generally considered to be one that increases steadily over time, indicating that a company is effectively using shareholder funds to increase profits and, in turn, shareholder value.

A good P/E ratio depends on the industry and investing climate. It is a comparative measure, so context is needed to determine if a P/E ratio is good or bad. Generally, a lower P/E ratio indicates that a stock is undervalued and may be worth buying.

A lower D/E ratio is generally preferable, as it indicates that a company has less debt and is, therefore, a lower-risk investment. However, it's important to analyse this ratio in the context of industry norms and company-specific requirements.