Cash allocation is a crucial aspect of investing, referring to the percentage of an investment portfolio that is comprised of cash or cash equivalents. While cash may not be commonly thought of as an investment vehicle, it plays a significant role in an investor's portfolio, offering stability and liquidity. The recommended percentage of cash in a portfolio varies based on factors such as age, risk tolerance, and investment goals. Tactical investors and financial advisors adjust cash allocations based on market opportunities, while traditional asset allocation models use factors like age and risk tolerance to determine the cash percentage. Ultimately, the decision on cash allocation depends on the individual investor's circumstances and preferences.

| Characteristics | Values |

|---|---|

| Purpose | To balance risk and potential returns over time |

| Investment types | Stocks, bonds, cash and money market securities |

| Investor suitability | Depends on financial goals, risk tolerance, and time horizon |

| Cash percentage | Commonly 10-15% but can vary from 5-40%+ based on opportunities and investor preferences |

| Cash types | Savings accounts, money market accounts, certificates of deposit, cash management accounts, treasury bills, money market mutual funds |

| Cash advantages | Low risk, stable, liquid |

| Cash disadvantages | Low return, potential negative real return after inflation and taxes |

What You'll Learn

Cash vs stocks and bonds

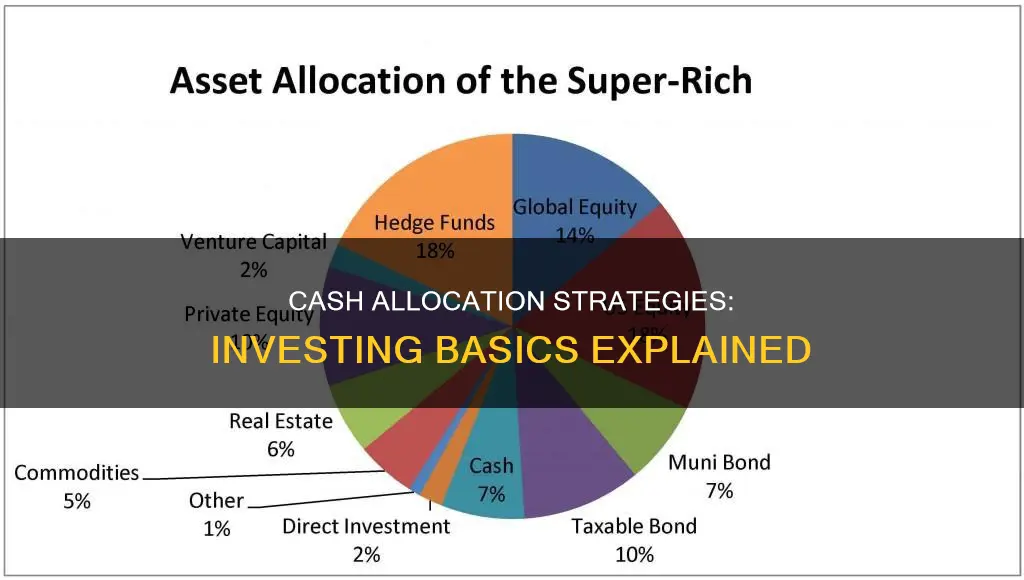

Cash allocation is part of a broader investment strategy known as asset allocation. Asset allocation is how investors divide their portfolios among different assets, including stocks, bonds, and cash or cash equivalents.

Stocks, bonds, and cash are the most common tools of the trade and the basic building blocks of your portfolio. They are also referred to as asset classes.

Stocks

Stocks, or shares, represent partial ownership or equity in a company. When you buy stock, you're purchasing one or more shares, and the more shares you buy, the more of the company you own. Stocks are considered riskier or more aggressive assets. Historically, stocks have offered the highest rates of return, but the share value can decrease, and stock prices fluctuate.

Bonds

Bonds are loans from you to a company or government. There's no equity involved, and the company or government pays you interest on the loan for a set period. Bonds are typically considered safer or more conservative assets. They have lower rates of return than stocks but provide interest income that often meets or exceeds the rate of inflation.

Cash

Cash is readily available and typically insured. It is a low-risk option that offers lower returns. Cash is vulnerable to rising interest rates, which can erode its buying power over time. Cash is suitable for short-term goals and provides flexibility in times of stress.

Each asset class has different risks and return potential, and there is no one-size-fits-all approach to asset allocation. It depends on various factors, including your financial goals, risk tolerance, time horizon, and age. Stocks, bonds, and cash can all play a role in a well-diversified portfolio, with the mix tailored to your specific needs and goals.

Depreciation's Impact on Cash Flow: Investing Activities

You may want to see also

Cash as a risk management tool

Cash is an important tool for risk management in investing. Cash management involves managing cash flows, including cash receipts, disbursements, and balances, to ensure that a business or an individual has enough cash to meet its financial obligations and achieve its financial goals.

Effective cash management can help mitigate liquidity risks, credit risks, and market risks, and improve financial flexibility and resilience. It can also help individuals and businesses weather unexpected events, such as job loss, medical emergencies, and economic downturns, without resorting to high-cost borrowing or fire sales of assets.

- Building an emergency fund: Setting aside enough cash to cover three to six months of living expenses in case of job loss, illness, or other emergencies. This should be kept in a separate account or a cash-equivalent asset, such as a money market fund or a high-yield savings account, that is easily accessible and earns interest.

- Managing cash flow: Monitoring and controlling cash inflows and outflows to ensure that cash is available when needed. This may involve budgeting, forecasting, invoicing, payment terms negotiation, and collection policies.

- Investing surplus cash: Putting excess cash to work in safe and liquid assets that offer a reasonable return and a low risk of loss. Surplus cash may be invested in short-term bonds, certificates of deposit, treasury bills, or money market funds, depending on the investor's risk tolerance, liquidity needs, and investment horizon.

- Maintaining a cash reserve: Having a cash reserve is essential for businesses to manage unexpected expenses or revenue shortfalls. This can be in the form of cash savings, a line of credit, or a business credit card. Ideally, the cash reserve should be enough to cover at least three to six months of operating expenses.

In addition to these strategies, it is important to remember that cash is one of the three main asset classes, along with stocks and bonds. As part of asset allocation, investors can choose to hold a certain percentage of their portfolio in cash and cash equivalents to balance risks and rewards based on their financial goals, risk tolerance, and investment horizon.

Creating Cash Flow: Investment Strategies for Success

You may want to see also

Cash allocation in retirement

Cash allocation is a crucial component of retirement planning, and it can make or break your retirement dreams. Here are some detailed guidelines on cash allocation in retirement:

Understanding Cash Allocation

Cash allocation is part of asset allocation, which is how investors divide their portfolios across different investment vehicles, such as stocks, bonds, real estate, and cash. The ratio of allocation depends on individual needs, risk tolerance, and financial goals.

Determining Cash Allocation for Retirement

When planning for retirement, it's essential to consider your monthly expenses and how much you've already saved. As a rule of thumb, your monthly expenses during retirement will likely be around 70-80% of your pre-retirement income. It's also worth noting that you may have additional income sources, such as social security or a pension, to supplement your retirement savings.

Recommended Cash Allocation Strategies

Financial advisors often recommend the "bucket strategy" for retirement planning. This strategy involves structuring your assets into three buckets based on longevity and cash needs:

- Short-term bucket (cash bucket): This bucket holds cash, cash equivalents, and liquid assets designed to cover expenses during the first years of retirement. A good rule of thumb is to set aside 5-30% of your portfolio in this bucket, equivalent to 1-2 years' worth of living expenses.

- Medium-term bucket (bond bucket): This bucket primarily focuses on bonds and other fixed-income investments. These investments mature and provide returns during years 3-10 of retirement. The recommended allocation for this bucket is 35-50% of your portfolio.

- Long-term bucket (stock bucket): This bucket is designed for growth and includes high-risk, high-reward assets like stocks. The allocation for this bucket depends on your risk tolerance, but it's generally recommended to have 20-60% of your portfolio in stocks during retirement.

Adjusting Cash Allocation Over Time

Remember that your cash allocation strategy should evolve as you progress through retirement. In the early years of retirement, you may have a higher allocation of stocks to maximize returns. As you age, gradually shift towards more conservative investments, such as bonds and cash. By the time you reach advanced retirement years (70-80+), you may consider reducing stocks to as low as 20% of your portfolio and increasing your allocation of bonds and cash.

Tips for Effective Cash Allocation

- Consider your risk tolerance: If you want to minimize volatility, opt for a lower-risk portfolio with more cash and bond allocations. Keep in mind that this may result in lower potential profits.

- Withdraw strategically: When withdrawing from your savings and stock portfolio, aim to withdraw more during positive markets and less during downturns.

- Regularly review and rebalance your portfolio: Conduct periodic reviews to ensure your portfolio aligns with your changing financial needs and goals. Rebalance your portfolio once or twice a year or after significant life changes to maintain your desired asset allocation.

In conclusion, effective cash allocation in retirement involves understanding your financial needs, risk tolerance, and the different investment options available. By following recommended allocation strategies and making adjustments over time, you can achieve a comfortable retirement and live the lifestyle you desire.

Cash Flow Analysis: Key to Investment Decision-Making

You may want to see also

Cash vs emergency fund

Cash allocation is how investors divide their portfolios among different assets, including cash and its equivalents. Cash and cash equivalents are considered one of the three main asset classes, the other two being equities and fixed income. Each asset class has different risks and return potential, so each behaves differently over time.

Cash and cash-like assets, such as savings accounts, money market accounts, and certificates of deposit, are important pieces of the asset allocation puzzle. They offer the lowest rate of return of all asset classes but also come with very low risk, making them the most conservative and stable investment asset.

An emergency fund is a bank account with money set aside for large, unexpected expenses, such as unforeseen medical expenses or home appliance repair. It acts as a financial buffer to protect you from relying on credit cards or high-interest loans in times of need.

While cash and cash-like assets can be used as emergency funds, it is important to note that they should not be your only form of savings. In addition to an emergency fund, it is recommended to have separate savings for irregular but inevitable expenses, such as car maintenance and clothing.

- Time Horizon: Cash allocation in an investment portfolio is typically aligned with a longer time horizon, allowing for more aggressive investment strategies to maximize returns. In contrast, an emergency fund is intended for immediate or short-term financial needs, providing easy access to funds when unexpected expenses arise.

- Risk Tolerance: Cash and cash-like assets are considered conservative and stable investments due to their low risk and stable value. This makes them well-suited for those with lower risk tolerance or those seeking to balance their overall portfolio risk.

- Diversification: While holding cash can provide stability, it is important to diversify your asset allocation to maximize returns and minimize risk. This involves investing in a mix of stocks, bonds, and alternative investments, in addition to maintaining an emergency fund.

- Interest Rates: When considering cash vs emergency fund options, it is essential to look at interest rates offered by different financial institutions. High-yield savings accounts and certificates of deposit (CDs) can provide higher interest rates than regular savings accounts, but they may have restrictions on withdrawals or early redemption penalties.

- Accessibility: Emergency funds should be easily accessible and liquid, ideally in a savings account with a high-interest rate and quick access. In contrast, cash allocated for long-term investments may be tied up in less liquid assets or investments with longer maturity periods.

In summary, while cash and cash-like assets are essential for emergency funds, they are also a crucial component of a well-diversified investment portfolio. The right allocation between these two depends on individual financial goals, risk tolerance, and time horizon.

Enhancing Cash Flow: Investing Strategies for Positive Returns

You may want to see also

Cash and inflation

Cash allocation is a key component of investing, and investors should be aware of the impact of inflation on their cash holdings. Inflation refers to the increase in the average cost of goods and services over time, resulting in a decrease in purchasing power. This means that a unit of currency will not buy the same amount of goods in the future due to inflation. Thus, it is essential to consider how inflation affects cash and cash equivalents in an investment portfolio.

Cash and cash equivalents are considered conservative or stable investment assets. They offer low potential returns but also carry very low risks compared to other asset classes. Examples of cash and cash equivalents include savings accounts, money market accounts, certificates of deposit, cash management accounts, treasury bills, and money market mutual funds. These investments provide investors with liquidity and stability but may not offer significant growth potential over time.

Inflation can significantly impact cash holdings. When there is no interest generated on cash to compete with the rate of inflation, it can quickly erode the purchasing power of that cash. This is known as the

To protect against inflation, investors can consider investing in asset classes that tend to outperform the market during inflationary periods. These include tangible assets like real estate, commodities, and certain types of stocks and bonds. Real estate values and rental income often increase with inflation, making it a popular inflation hedge. Commodities, such as raw materials and agricultural products, tend to rise in price during inflation, as they are used to produce finished goods. Inflation-indexed bonds, such as Treasury Inflation-Protected Securities (TIPS), offer a variable interest rate tied to the inflation rate, protecting investors from its effects.

It is important to note that while these investments can provide a hedge against inflation, they also carry their own risks and may not always guarantee positive returns. Diversification remains key, and investors should regularly review and adjust their portfolios to align with their financial goals and risk tolerance.

Owner Cash Investment: Is It an Expense?

You may want to see also

Frequently asked questions

Cash allocation in investing refers to the percentage of an investment portfolio that is held in cash or cash-like assets, such as savings accounts, money market accounts, or certificates of deposit. Cash allocation is typically determined based on an investor's risk tolerance, financial goals, and time horizon.

Cash allocation is important in investing because it helps to balance risk and potential returns. Holding cash provides a low-risk option for investors, particularly those with shorter time horizons or lower risk tolerance. However, holding too much cash can result in missed opportunities for significant gains and lower long-term growth potential.

The right cash allocation for an investment portfolio depends on various factors, including your investment goals, risk tolerance, time horizon, and investment style. It's important to consider the potential trade-off between the safety of holding cash and the opportunity cost of missing out on potential gains from other investments. Consulting with a financial advisor can help you determine the appropriate cash allocation for your specific circumstances.