The US economy is influenced by a variety of factors, including foreign direct investment, stock market performance, and government policies. Foreign investment plays a significant role, with the US offering a stable, predictable, and transparent legal system, low taxes, and excellent infrastructure. The stock market also has an impact, affecting consumer spending and company investments, although it is not the sole determinant of the economy's health. Government policies, such as President Biden's Bidenomics, aim to stimulate the economy through strategic investments in infrastructure, clean energy, and semiconductors, attracting private sector investment and creating new jobs. These factors collectively shape the complex landscape of the US economy and its interactions with the global market.

| Characteristics | Values |

|---|---|

| Infrastructure | Roads, bridges, public transit |

| Clean energy | Electric vehicles, charging network |

| Semiconductors | |

| Biotechnology | |

| Manufacturing |

Infrastructure

The United States' aging and overburdened physical infrastructure is in dire need of investment and modernization. This includes everything from roads, bridges, and dams to water systems, electricity grids, and broadband networks. Investing in infrastructure has the potential to provide significant economic benefits, creating jobs and stimulating economic growth in the short term, while also laying the foundation for long-term productivity gains.

One of the most pressing needs is for transportation infrastructure. The American Society of Civil Engineers (ASCE) estimates that the country needs to invest $2.6 trillion by 2029 to bring its roads, bridges, and transit systems up to par. This includes repairing and replacing aging structures, many of which are well beyond their intended lifespan, as well as expanding capacity to meet growing demand. For example, the Interstate Highway System, a key piece of American infrastructure built in the 1950s, is now congested and in need of expansion and modernization to accommodate the country's growing population and changing transportation needs.

Investing in water infrastructure is another critical area. The ASCE estimates that $84 billion is needed over the next decade to upgrade and replace aging water pipes and treatment facilities, reduce flood risks, and ensure safe, reliable water supplies for communities across the country. Upgrading water infrastructure is essential not just for public health and environmental reasons, but also for economic development, as it can help attract businesses and support agricultural productivity.

Furthermore, the electricity grid requires significant investment to modernize and secure it against an increasing number of extreme weather events and cyber-attacks. This includes upgrading transmission lines, transforming distribution systems to accommodate distributed energy resources like rooftop solar, and enhancing grid resilience and security. Investing in a smarter, more flexible grid will be crucial to integrating renewable energy sources and achieving a more sustainable energy future.

Finally, expanding access to high-speed broadband, particularly in rural and underserved areas, is essential for ensuring that all Americans can participate in the digital economy. The COVID-19 pandemic has highlighted the importance of reliable internet access for remote work, education, and healthcare. Investing in broadband infrastructure can help bridge the digital divide and promote economic opportunity and social mobility in communities that have traditionally lacked access to high-speed internet.

Maximizing Your HSA: Invest or Withdraw?

You may want to see also

Clean energy

One of the central goals of the clean energy investments is to increase the amount of energy generated from renewable and clean sources, such as solar and wind power. This shift is expected to bring about several benefits, including lower energy costs, improved energy resilience, and reduced greenhouse gas emissions. To encourage this transition, the administration has offered tax credits and incentives for the adoption of clean energy technologies, such as electric vehicles (EVs) and the expansion of US solar and wind manufacturing capacity.

The Bipartisan Infrastructure Law and the Inflation Reduction Act have also spurred investments in grid-scale energy storage, with a focus on battery energy storage systems. This technology enables companies to store excess energy from renewable sources and feed it back into the grid when needed, helping to stabilize energy prices and reduce total energy costs.

The clean energy revolution is already showing positive economic impacts. The latest data indicates that private companies have announced over $360 billion in investments in clean energy manufacturing, EVs, batteries, and power generation. This has resulted in the construction of new manufacturing facilities, with spending in this area nearly doubling since President Biden took office.

Furthermore, the clean energy industry generates hundreds of billions in economic activity and is expected to continue growing rapidly. This presents a tremendous economic opportunity for the US in terms of innovation, manufacturing, and exports. The responsible development of solar, wind, water, geothermal, bioenergy, and nuclear energy sources will help ensure America's leadership in clean energy and a more secure energy future.

Warren Buffet's Berkshire Cash Reserves: Where Does it Go?

You may want to see also

Electric vehicles

The US government has shown commitment to the EV transition, with the Inflation Reduction Act (IRA) accelerating the US market for electric vehicles and battery manufacturing. This has resulted in a reported $188 billion in investments in EV and EV battery manufacturing in the US, with 195,000 direct EV-related jobs. The US has also seen a rise in private investment in EVs, with investments since 2021 outpacing every other region in the world.

Despite this, there are still challenges to be addressed. The US was the biggest net vehicle importer in 2019, and the automotive industry has seen sluggish sales since the pandemic. To ensure the US remains competitive in the global EV market, further investment is needed. This includes direct financial investment, such as grants, loan guarantees, and subsidies, as well as consumer incentives and support policies.

The transition to EVs also has the potential to impact jobs. While it is expected that close to 60,000 employees will be working on EVs by 2025, an estimated 150,000 jobs could be created by 2030 if battery-electric vehicles make up 50% of light-duty vehicles. To mitigate potential job losses, an increase in domestic battery and vehicle manufacturing, as well as a decrease in reliance on imports, is necessary.

Overall, investment in the US EV industry has the potential to create jobs, reduce the trade deficit, and bring economic benefits to the country. With the right support and investment, the US has the opportunity to become a global leader in EV manufacturing.

Dunning's Investment Path Model: A Practical Methodology Guide

You may want to see also

Semiconductor supply chains

Semiconductors are an essential component of modern technology, found in everything from laptops and mobile phones to automobiles and nuclear missile guidance systems. The semiconductor industry is among the most critical sectors of the global economy, with annual sales exceeding half a trillion dollars in 2022.

The United States has recognized the importance of this industry and is taking steps to strengthen its semiconductor supply chain. This is being done through President Biden's "Bidenomics" plan, which includes the CHIPS and Science Act, and the Bipartisan Infrastructure Law. These pieces of legislation are providing incentives and investments to boost domestic semiconductor manufacturing and secure the supply chain.

The CHIPS Act, in particular, is expected to have a positive impact on the semiconductor supply chain. A report by the Semiconductor Industry Association (SIA) and the Boston Consulting Group forecasts that it will lead to significant improvements in the resilience of the US supply chain. The report projects that US fab capacity will increase by 203% by 2032, and the country's share of global fab capacity will grow from 10% to 14%. Additionally, the US is expected to secure more than one-quarter of global capital expenditures in the semiconductor industry between 2024 and 2032, amounting to an estimated $646 billion.

However, there are still areas of vulnerability in the semiconductor supply chain that need to be addressed. The US needs to maintain access to global markets and coordinate with international partners to ensure the resilience of the supply chain. Additionally, there is a need to expand the STEM talent pipeline to develop the skilled workforce required by the growing semiconductor industry.

By investing in the semiconductor supply chain, the US can not only strengthen its economy but also enhance its national security and advance its technological leadership.

Maximizing Investment Earnings: Strategies for Optimal Utilization

You may want to see also

Innovation

Offer Tax Incentives for Research and Development (R&D)

Government tax subsidies and grants are the most effective way to increase innovation and productivity. The US should offer tax incentives and grants to reduce the cost of R&D and encourage more investment in innovation. This could include a permanent research and development tax credit.

Promote Free Trade

Opening trade and increasing competition can spark innovation by allowing new ideas to spread faster and dividing the cost of innovation over a bigger market. However, this strategy may also increase inequality.

Support Skilled Migration

Allowing more high-skilled immigrants into the country is a direct way to increase the supply of researchers and promote innovation. Immigrant college graduates, in particular, have been shown to increase patents per capita.

Train Workers in STEM Fields

The US should invest in training more workers in science, technology, engineering, and math (STEM) fields to increase the supply of researchers and promote innovation in the long term. This could include improving STEM worker training and exposing more people from disadvantaged backgrounds to role models and mentoring in these fields.

Provide Direct Grants for R&D

Government grants, especially to university researchers, can target projects with potential long-term benefits and increase the number of patents filed by private firms.

Focus on Entrepreneurs

Many radical innovations result from small entrepreneurial ventures. The US should aim to promote an efficient process of entrepreneurial entry, growth, and exit by removing obstacles such as permits, licenses, labor-market regulations, financial constraints, and tax barriers.

Regional Economic Clusters

The US should encourage the development of regional economic clusters that take advantage of innovation-rich geographic niches. These clusters can combine creative talent, terrific universities, access to venture capital, and state laws that promote innovation through tax policies and infrastructure development. Examples include Silicon Valley, Boston's Route 128, and the Research Triangle in North Carolina.

Roosevelt's Investment Strategies: A Historical Perspective

You may want to see also

Frequently asked questions

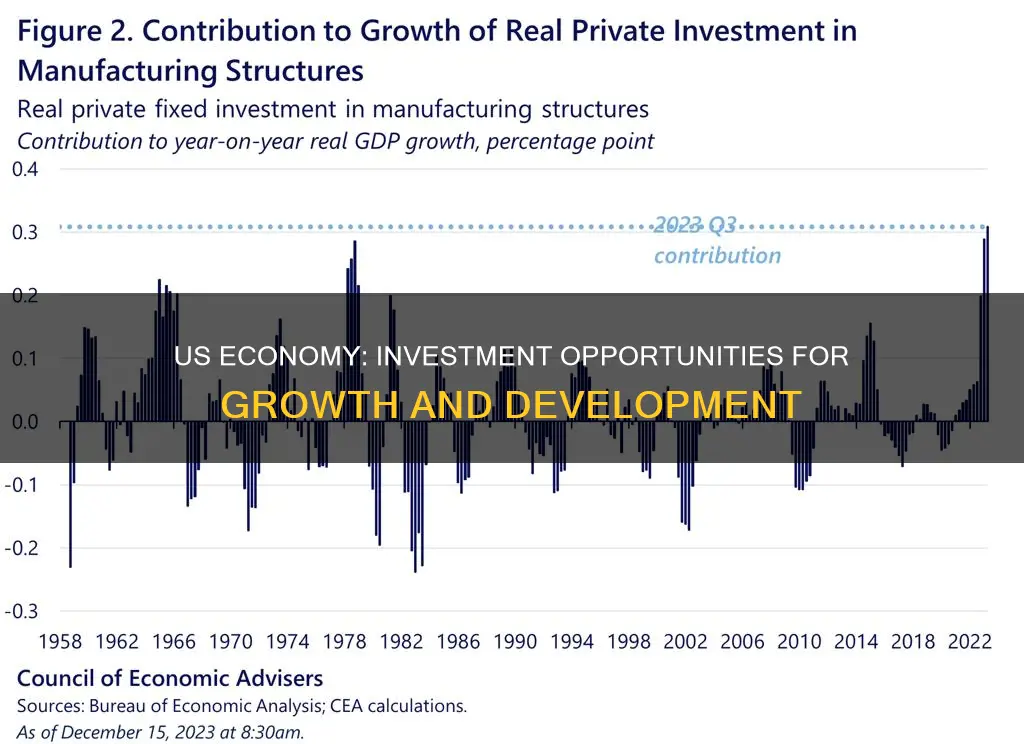

The US economy is currently experiencing a resurgence in American manufacturing, with construction of manufacturing facilities in the country having grown by nearly 100% in two years. This is partly due to President Biden's Investing in America Agenda, which is bringing manufacturing back to America and creating new, well-paying jobs.

The US has been surpassed by other countries in critical sectors such as infrastructure, clean energy, semiconductors, and biotechnology. The Biden administration is prioritising investment in these sectors, as well as electric vehicles and innovation.

FDI plays a major role in the US economy, driving economic growth and innovation, exports, and job creation. The US has traditionally been a stable and welcoming market for foreign investors, offering a predictable and transparent legal system, low taxes, and outstanding infrastructure.

The stock market enables companies to raise money and the public to profit from their growth prospects. When the stock market performs well, people generally feel more confident about their finances and are more likely to spend money. This can have a positive impact on the economy. However, stock market crashes have also led to economic recessions.