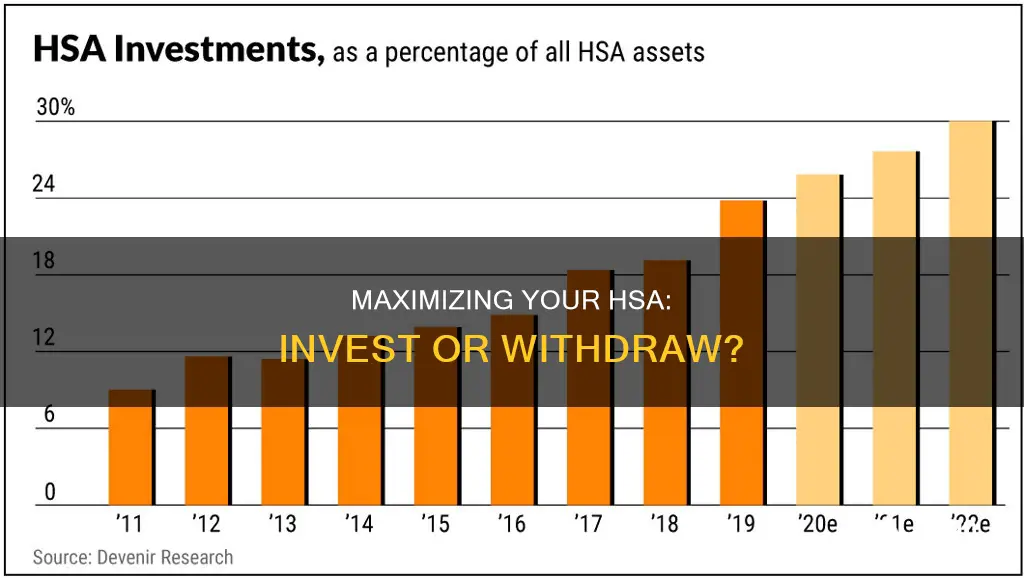

Health savings accounts (HSAs) are a great way to save for future medical expenses or boost your retirement funds. They come with a triple tax benefit: contributions are tax-deductible, earnings on the account remain tax-free as long as they are used for qualified medical expenses, and withdrawals for qualified medical expenses are also tax-free. However, if you withdraw HSA funds for non-qualified expenses, you may be charged a 20% bonus penalty in addition to income taxes on the withdrawal. So, should you keep investing in your HSA or use it? The answer depends on your unique circumstances, including your risk tolerance, future medical needs, and other retirement savings.

| Characteristics | Values |

|---|---|

| Tax advantages | No federal income tax on contributions, tax-free growth, tax-free withdrawals for qualified medical expenses |

| Investment options | Exchange-traded funds (ETFs), mutual funds, stocks, bonds |

| Eligibility | Must have a high-deductible health insurance plan |

| Minimum balance | Varies by HSA administrator |

| Fees | May include internal expenses for mutual funds, short-term redemption fees, and transaction fees |

| Withdrawal restrictions | Withdrawals for non-qualified expenses before age 65 are taxed at the ordinary income tax rate and may incur a 20% penalty |

| Rollover | HSA funds can be rolled over from year to year |

What You'll Learn

The triple tax advantage of HSAs

Health Savings Accounts (HSAs) are a great way to save for future medical expenses and come with a triple tax advantage. This means that contributions to HSAs are tax-deductible, earnings on the account are not taxed, and withdrawals are also tax-free as long as they are used for qualified medical expenses.

Firstly, individuals can contribute up to $4,150 in 2024, and families can put in up to $8,300. Those aged 55 and above can contribute an additional $1,000 as a catch-up contribution. These contributions are made from pre-tax income, so they reduce your taxable income. This is the first part of the triple tax advantage.

Secondly, any interest or earnings accrued on the account balance are not taxed, as long as the money is used for qualified medical expenses. This tax-free growth is the second part of the triple tax advantage and can be a powerful tool to grow your savings over time.

Finally, the third part of the triple tax advantage is that withdrawals from the HSA are not taxed when used for qualified medical expenses. This includes deductibles, copayments, and other out-of-pocket costs. The money can be withdrawn at any time to pay for these expenses, and there is no deadline to use the funds, so it can be a great way to save for future medical needs.

Free Cash Flow: Investment Costs and Their Inclusion

You may want to see also

When to invest in an HSA

Tax Advantages

HSAs offer a triple tax benefit that makes them attractive savings options. Contributions to HSAs are tax-deductible, earnings on the account grow tax-free, and withdrawals for qualified medical expenses are also tax-free. This means that investing in an HSA can provide significant tax advantages, especially if you are investing for the long term.

Investment Options

If you decide to invest your HSA funds, you will need to check with your HSA administrator to find the specific investment options available. Common HSA investment options include exchange-traded funds (ETFs), mutual funds, stocks, and bonds. Each of these options has its own pros and cons in terms of risk, potential returns, and fees.

Investment Threshold

Many HSA administrators require a minimum balance in your account before allowing you to invest. This investment threshold varies by provider, so be sure to check with your HSA administrator to find out the specific requirements for your account.

Retirement Savings

If you have maxed out your other tax-protected retirement savings accounts and still have money left to invest, an HSA can be a great way to boost your overall retirement savings. HSAs can be used to pay for qualified medical expenses in retirement, and any money left in the account can be withdrawn tax-free after age 65 for any reason.

Medical Expenses

If you have high medical costs or expect to incur significant medical expenses in the near future, you may want to keep your HSA funds in cash rather than investing them. This will ensure that you have enough money readily available to cover your medical bills.

Risk Tolerance

When deciding whether to invest your HSA funds, consider your risk tolerance and investment goals. If you are using your HSA primarily for short-term savings or need the money to cover near-term medical expenses, lower-risk, lower-return options such as money market funds may be more suitable. On the other hand, if you are investing for the long term or using your HSA as a supplementary retirement account, you may want to consider higher-return investments such as stocks or mutual funds.

Maximizing Your HSA: Smart Investing for Beginners

You may want to see also

Investment options

Investing in an HSA can be a great way to save for future medical expenses or boost your retirement funds. However, it's important to note that not everyone with an HSA can invest their funds, as some HSA administrators require a minimum balance before allowing investments. Additionally, if you have high medical costs, investing your HSA funds might not be the best option as you'll want to ensure you have enough cash to cover those expenses.

- Mutual funds: These can be a good choice if you're looking for a diversified investment with automatic dividend reinvestment. However, mutual funds often come with annual fees and sales commission charges, and many underperform the overall market.

- Exchange-traded funds (ETFs): ETFs offer diversification across a basket of stocks or other investments, similar to mutual funds. They typically have lower annual fees than mutual funds, and some HSAs allow ETFs to be purchased with no commissions. However, some ETFs have higher fees, and they may not outperform the indexes they track.

- Stocks: Investing in individual stocks can be a more volatile option but offers the potential to outperform the overall market. It requires more investing expertise and research time.

- Bonds: Bonds are generally less risky and less volatile than other investment options, making them a good choice for those with a lower risk tolerance or who expect to need money for future medical expenses. While they may not offer high returns, the interest rates are typically higher than bank savings accounts.

When deciding how to invest your HSA funds, it's important to consider your goals, risk tolerance, and time horizon. If you have decades until retirement, you might consider more aggressive investments such as stocks or ETFs. If you're closer to retirement, less volatile options like bonds or dividend stocks might be a better choice.

It's also important to remember that investing involves risk, including the potential loss of principal value. Be sure to do your own research and consider consulting with a qualified financial advisor before making any investment decisions.

Distribution as an Investment: Cash Flow Statement Insights

You may want to see also

Pros and cons of investing in an HSA

Health Savings Accounts (HSAs) are a great way to save for future medical expenses or boost your retirement funds. They are also a good investment option, offering a triple tax advantage. Here are some pros and cons to help you decide whether investing in an HSA is right for you.

Pros:

- Tax benefits: HSAs offer a triple tax advantage. Contributions to HSAs are tax-deductible, with individuals able to contribute up to a certain amount each year. Any earnings on the account remain tax-free as long as the money is used for qualified medical expenses. Withdrawals for qualified medical expenses are also tax-free.

- Rollover: Unused funds in your HSA roll over from year to year, so you don't have to worry about spending it within a certain time frame. This allows you to save for future medical expenses or retirement.

- Flexibility: You can use your HSA to pay for current qualified medical expenses or save for future ones. You can also invest your HSA balance in a wide range of mutual funds, stocks, bonds, or ETFs, depending on your risk tolerance and investment goals.

- No expiration: Your HSA doesn't expire, and the money is yours for life. It's not tied to your employer or health care plan, so you can change jobs or retire without losing the benefits of your HSA. You can also designate a beneficiary, transferring the benefits to your heirs.

Cons:

- High-deductible plan required: To contribute to an HSA, you must be enrolled in a high-deductible health care plan. This may not be feasible for everyone, depending on their financial situation and health needs.

- Investment minimums: Many HSAs require you to maintain a minimum cash balance before you can open an investment account. This may be a barrier for those who don't have a lot of money to contribute upfront.

- Risk of losing money: Investing in securities or stocks always carries the risk of losing money. If you need to use your HSA funds for qualified medical expenses, investing in riskier assets may not be a good idea. It's important to consider your risk tolerance and potential future medical needs when deciding how to invest your HSA funds.

Using Correlation to Make Currency Investment Decisions

You may want to see also

How to invest HSA funds strategically

A health savings account (HSA) is a tax-advantaged account that allows you to pay current medical bills, save for future medical expenses, and invest in a variety of stocks, bonds, and mutual funds. Here are some strategic ways to invest your HSA funds:

- Take advantage of employer matching contributions: Maximize any employer-matching contributions to your HSA. This will give you more money to use for qualified medical expenses and potentially free up more funds for investing.

- Contribute the maximum amount allowed: For 2024, the maximum contribution limits are $4,150 for individuals and $8,300 for families. Individuals aged 55 or older can contribute an additional $1,000.

- Consider your retirement timeline: If you are decades away from retirement, consider investing in more aggressive options such as mutual funds, exchange-traded funds (ETFs), or stocks. If retirement is only a few years away, opt for less volatile investments like bonds and dividend stocks.

- Integrate it into your overall retirement strategy: Think of your HSA as a key component of your retirement plan. Try to invest as much of your HSA funds as possible while ensuring you keep enough cash to cover your qualified medical expenses. Diversify your investments across different accounts.

- Avoid withdrawing funds: The more money you leave in your HSA, the more it will grow over time. Only withdraw funds for qualified medical expenses if possible.

- Set a "cash target": Determine how much cash you need in your HSA to cover near-term medical expenses, and invest the rest. This will ensure that you have immediate access to funds when needed while also maximizing the growth potential of your HSA.

- Take advantage of the triple tax benefit: HSA contributions are tax-deductible, earnings on the account are tax-free, and withdrawals for qualified medical expenses are also tax-free. This makes HSA a powerful tool for tax-advantaged savings and investing.

- Prepare for long-term care: Investing in an HSA can help you save for future long-term care expenses, which can be significant.

- Consider a rollover from an IRA: If you have an unexpected medical expense and your HSA balance is low, you can roll over a maximum of your annual HSA contribution limit for that year from a traditional or Roth IRA into your HSA.

Equity Method 101: Guide to Accounting for Investments

You may want to see also

Frequently asked questions

Health savings accounts (HSAs) offer a triple tax advantage: you don't pay federal income tax on contributions, you won't be taxed on withdrawals for qualified medical expenses, and your earnings from investments won't be taxed.

Investing in an HSA is a good option for those who have maxed out their retirement accounts and have additional money to invest. However, HSAs are tied to high-deductible health plans, so they may not be suitable for those with high medical costs.

Common HSA investment options include exchange-traded funds (ETFs), mutual funds, stocks, and bonds. The best option will depend on your goals and risk tolerance.