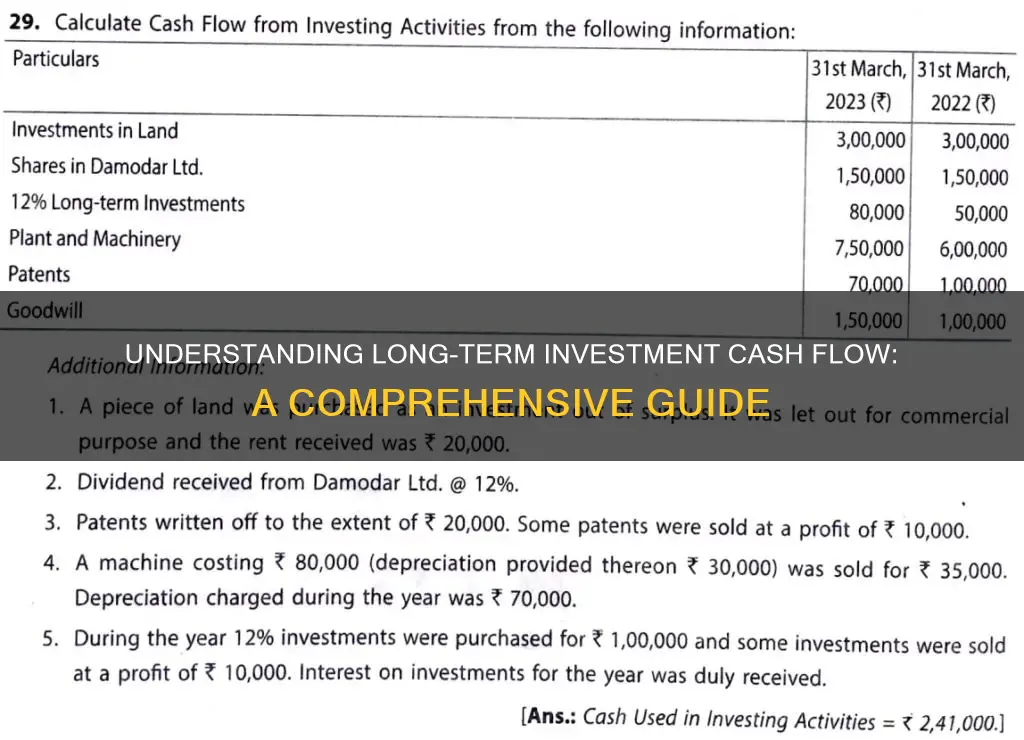

Long-term investments are a crucial aspect of financial planning, and understanding the cash flow associated with these investments is essential for making informed decisions. These investments typically involve committing capital to assets or securities with a maturity or holding period extending beyond one year. The cash flow from long-term investments can be categorized into two main types: capital gains and dividends. Capital gains arise when the investment is sold at a higher price than its purchase price, providing a return on the initial investment. Dividends, on the other hand, are periodic payments made by companies to their shareholders, representing a portion of the profits. Both capital gains and dividends contribute to the overall cash flow generated from long-term investments, offering investors a steady stream of income and potential wealth accumulation over time.

What You'll Learn

- Investment Vehicles: Long-term investments include stocks, bonds, real estate, and derivatives

- Risk and Return: Higher risk often leads to greater potential returns over time

- Time Horizon: Long-term investments typically have a maturity period of more than one year

- Tax Implications: Tax laws can affect the cash flow from long-term investments

- Diversification: Diversifying investments can reduce risk and provide stable cash flow

Investment Vehicles: Long-term investments include stocks, bonds, real estate, and derivatives

Long-term investments are a crucial component of an investment strategy, offering a means to grow wealth over an extended period. These investments are typically characterized by their potential for capital appreciation and income generation, making them a popular choice for investors seeking to build a robust financial portfolio. Here's an overview of some key long-term investment vehicles:

Stocks: Also known as equities, stocks represent ownership in a company. When you buy a stock, you become a shareholder and are entitled to a portion of the company's assets and profits. Long-term investing in stocks often involves holding these shares for an extended period, allowing investors to benefit from the company's growth and potentially earn dividends. This strategy is particularly attractive for those seeking capital appreciation, as stocks can offer significant returns over time. Diversifying your stock portfolio across various sectors and industries is essential to managing risk, ensuring that your investments are not overly exposed to the performance of any single company or market segment.

Bonds: These are fixed-income securities that represent a loan made by an investor to a borrower, typically a government, municipality, or corporation. When you buy a bond, you essentially lend money to the issuer, who promises to pay you back with interest over a specified period. Bonds are generally considered less risky than stocks, making them a stable long-term investment option. Government bonds, for instance, are often seen as a safe haven for investors due to their low default risk. However, it's important to note that bond prices can fluctuate, and interest rates play a significant role in bond performance.

Real Estate: Investing in real estate is a tangible way to build long-term wealth. This can be done through direct property purchases, such as buying and renting out residential or commercial properties, or by investing in real estate investment trusts (REITs), which are companies that own or finance income-producing properties. Real estate investments offer the potential for both rental income and property value appreciation. While this asset class may require a substantial initial investment, it can provide a steady cash flow and long-term capital growth.

Derivatives: These are financial instruments whose value is derived from an underlying asset, such as stocks, bonds, commodities, or currencies. Derivatives include options, futures, swaps, and contracts for differences. They are often used for hedging or speculative purposes. Long-term investors can utilize derivatives to gain exposure to specific assets or markets without directly owning them. For example, an investor might buy a call option on a stock, allowing them to purchase the underlying shares at a predetermined price, potentially benefiting from future price increases. However, derivatives can be complex and carry significant risks, so they should be approached with caution and a thorough understanding of their mechanics.

In summary, long-term investments provide a strategic approach to wealth accumulation, offering a range of options to suit different risk tolerances and financial goals. Stocks, bonds, real estate, and derivatives each present unique opportunities and considerations, and a well-diversified portfolio can help investors navigate the complexities of the financial markets while managing risk effectively.

Unraveling Secure Rate Term Investments: A Comprehensive Guide

You may want to see also

Risk and Return: Higher risk often leads to greater potential returns over time

When considering long-term investments, it's essential to understand the relationship between risk and return. The concept is straightforward: higher risk often correlates with greater potential returns over time. This principle is a fundamental aspect of investing and is widely accepted in financial circles.

In the investment world, risk refers to the uncertainty and potential for loss associated with an investment. It encompasses various factors, such as market volatility, credit risk, liquidity risk, and operational risk. While risk is often viewed negatively, it is a necessary component of investing, as it is the catalyst for potential gains. The idea is that by taking on calculated risks, investors can achieve higher returns compared to more conservative investments.

Over time, investments that carry higher risk tend to deliver more substantial gains. This is because these investments often have the potential to grow at a faster rate, outpacing the returns of safer, more stable options. For example, investing in the stock market, which is generally considered a higher-risk asset class, has historically provided significant long-term returns. While individual stocks may fluctuate in price, over an extended period, the market has consistently shown an upward trend, rewarding investors who are willing to take on the associated risks.

However, it's crucial to approach higher-risk investments with caution and a well-defined strategy. Diversification is a key strategy to manage risk. By spreading investments across various asset classes, sectors, and industries, investors can reduce the impact of any single investment's performance on their overall portfolio. This approach ensures that the potential downsides of higher-risk investments are mitigated, providing a more stable and consistent return over time.

In summary, understanding the correlation between risk and return is vital for long-term investors. Higher risk often leads to greater potential returns, but it requires careful consideration and a strategic approach. By embracing calculated risks and employing diversification techniques, investors can navigate the market's volatility and achieve their financial goals. This knowledge is essential for anyone looking to build a robust investment portfolio that aligns with their risk tolerance and long-term objectives.

Reinvesting Short-Term Gains: A Path to Long-Term Wealth Creation

You may want to see also

Time Horizon: Long-term investments typically have a maturity period of more than one year

Long-term investments are a crucial aspect of financial planning, especially for individuals and businesses aiming to grow their wealth over an extended period. These investments are characterized by their time horizon, which is a fundamental concept in finance. When we talk about the time horizon for long-term investments, we refer to the period during which the investment is expected to remain in place before it matures or is realized. This maturity period is typically more than one year, setting it apart from short-term investments, which are generally held for a year or less.

The extended time horizon of long-term investments is a key factor that distinguishes them from other financial instruments. It allows investors to take advantage of various benefits, such as compound interest, which can significantly boost returns over time. For instance, investing in stocks or mutual funds with a long-term perspective enables investors to benefit from the potential for capital appreciation and dividend growth. This approach often involves riding out short-term market fluctuations, which can be advantageous in the long run.

In the context of personal finance, long-term investments are often associated with retirement planning. Many individuals use these investments to build a nest egg for their future, taking advantage of the power of compounding. For example, contributing to a 401(k) or an Individual Retirement Account (IRA) with a long-term strategy can result in substantial savings over several decades. The longer time horizon provides an opportunity to weather market volatility and benefit from the potential for higher returns.

For businesses, long-term investments can take various forms, such as purchasing property, acquiring other companies, or investing in long-term projects. These investments are essential for business growth and expansion. For instance, a company might invest in new machinery with a useful life of several years, or they might acquire a competitor to gain market share, both of which are long-term strategic moves.

In summary, the time horizon is a critical aspect of understanding long-term investments. With a maturity period of more than one year, these investments offer opportunities for wealth accumulation, risk management, and financial growth. Whether for personal retirement planning or business expansion, long-term investments are a vital tool for those seeking to secure their financial future and achieve their financial goals over an extended period.

Long-Term Investing vs. Day Trading: Which is Easier?

You may want to see also

Tax Implications: Tax laws can affect the cash flow from long-term investments

Understanding the tax implications of long-term investments is crucial for investors as it can significantly impact their overall cash flow and financial decisions. When an individual or entity holds an investment for an extended period, typically more than a year, the tax treatment can vary depending on the jurisdiction and the type of investment.

In many countries, long-term capital gains are taxed at a lower rate compared to short-term gains. This is because long-term investments are generally considered a more stable and less speculative form of investment. For example, if an investor sells a long-term holding, the profit made might be taxed at a reduced rate, often referred to as the 'long-term capital gains tax.' This can result in a more favorable cash flow, especially for investors who frequently buy and sell assets.

However, the tax rules can be complex and may vary across different tax authorities. Some jurisdictions might exempt certain types of long-term investments from taxation, while others may impose taxes on the entire gain. For instance, in some countries, investments in specific sectors like renewable energy or real estate may qualify for tax incentives or reduced rates, which can positively influence cash flow. On the other hand, investments in certain high-risk areas might be subject to higher tax rates, potentially impacting the overall profitability.

Additionally, the timing of tax payments can also affect cash flow. Investors may need to consider whether to recognize gains immediately or defer them to a later year. Deferring gains can provide more flexibility in managing cash flow, especially for investors who require immediate funds for other financial obligations. It is essential to consult tax professionals to understand the specific rules and strategies to optimize cash flow while adhering to tax regulations.

In summary, tax laws play a significant role in shaping the cash flow from long-term investments. Investors should be well-informed about the tax implications of their investments to make strategic decisions. By understanding the tax treatment, investors can better manage their cash flow, plan for the future, and potentially minimize their tax liabilities, ultimately leading to more efficient financial management.

Long-Term Investment Strategies: Navigating the Market's Future

You may want to see also

Diversification: Diversifying investments can reduce risk and provide stable cash flow

Diversification is a fundamental strategy in investment management, and it involves spreading your investments across various asset classes, sectors, and geographic regions. This approach is a powerful tool to manage risk and create a more stable cash flow over the long term. By diversifying, investors can ensure that their portfolio is not overly exposed to any single asset or market, thus reducing the potential impact of any one investment's poor performance.

The primary benefit of diversification is risk reduction. When you invest in multiple assets, the performance of one investment is less likely to significantly affect the overall health of your portfolio. For example, if you own stocks in various industries, a downturn in one sector won't necessarily lead to a complete loss of investment in other areas. This strategy is particularly important for long-term investors, as it allows them to weather short-term market fluctuations and focus on the long-term growth potential of their investments.

In terms of cash flow, diversification can provide a more consistent and stable income stream. Different investments generate cash flow in various ways, such as dividends, interest payments, or rental income. By diversifying, you can ensure that your portfolio generates cash flow from multiple sources, reducing the reliance on any single investment. This stability is crucial for long-term financial planning, as it provides a more reliable foundation for meeting financial goals and obligations.

To implement diversification, investors can consider the following:

- Asset Allocation: Divide your portfolio among different asset classes like stocks, bonds, real estate, and commodities. Each asset class has its own risk and return characteristics, so a balanced allocation can help manage risk.

- Sector Allocation: Invest in various sectors such as technology, healthcare, finance, and consumer goods. Different sectors perform differently over time, so diversification across sectors can provide a more consistent return.

- Geographic Diversification: Consider international investments to spread risk across different countries and regions. This approach can also provide exposure to emerging markets and potentially higher returns.

- Regular Review: Periodically assess your portfolio's performance and make adjustments to maintain your desired level of diversification. Market conditions change, and rebalancing your portfolio can help keep it aligned with your investment strategy.

In summary, diversification is a key strategy for investors seeking to manage risk and generate stable long-term cash flow. By allocating investments across various assets, sectors, and regions, investors can create a well-rounded portfolio that is less susceptible to market volatility. This approach allows investors to stay invested in the long run, potentially benefiting from the power of compounding and achieving their financial objectives.

Understanding Short-Term Receivables: Are They Short-Term Investments?

You may want to see also

Frequently asked questions

Long-term investments are financial assets or property that are expected to generate income or be sold after a period of more than one year. These can include stocks, bonds, real estate, or other assets that are not intended for immediate sale or use in the business's operations.

Long-term investments are typically reported on the balance sheet rather than the income statement. They are not considered a source of cash flow in the short term, as they are not easily convertible to cash. However, they can influence cash flow through activities like buying or selling these investments, which may result in gains or losses.

Yes, accounting standards provide guidelines for recognizing and measuring long-term investments. For instance, the International Financial Reporting Standards (IFRS) require companies to classify investments based on their intended holding period and risk-reward profile. This classification affects how these investments are presented in the financial statements and how they impact cash flow reporting.