Understanding the impact of cash transactions on short-term investments is crucial for investors seeking to optimize their financial strategies. Short-term investments, often characterized by their liquidity and relatively low-risk nature, are frequently influenced by the timing and amount of cash inflows and outflows. This paragraph will explore the various cash transactions that can significantly affect short-term investment portfolios, including the effects of immediate cash deposits, withdrawals, and the strategic use of cash reserves to capitalize on market opportunities or mitigate potential risks. By examining these transactions, investors can make informed decisions to ensure their short-term investments remain robust and aligned with their financial goals.

What You'll Learn

- Market Timing: Cash transactions that influence short-term investment decisions, often involving quick buying or selling

- Liquidity Management: Cash flows impacting short-term investments, ensuring quick access to funds for opportunities

- Opportunity Cost: The cost of forgoing other investment options due to cash transactions in short-term portfolios

- Risk Mitigation: Cash management strategies to reduce risk in short-term investments, using cash as a buffer

- Market Sentiment: Cash movements affecting short-term investments, driven by investor emotions and market trends

Market Timing: Cash transactions that influence short-term investment decisions, often involving quick buying or selling

Market timing is a critical aspect of short-term investment strategies, and it revolves around the art of making quick and decisive cash transactions to capitalize on market trends and price movements. This strategy is particularly popular among active traders and investors who aim to profit from short-term price fluctuations in various financial markets, such as stocks, currencies, and commodities. The key principle behind market timing is to identify and act upon short-term price patterns, often within a matter of days or even hours.

One of the primary cash transactions that influence short-term investment decisions is day trading. Day traders execute trades within a single trading day, taking advantage of intraday price movements. This involves a rapid analysis of market conditions, often using technical indicators and charts, to make split-second decisions on buying or selling securities. Day traders aim to profit from small price gaps and volatility, requiring a deep understanding of market dynamics and the ability to react swiftly.

Another cash transaction that impacts short-term investments is the use of margin trading. This strategy involves borrowing funds from a broker to purchase securities, allowing investors to control a larger position with a smaller amount of capital. Margin trading enables investors to leverage market movements, potentially amplifying profits or losses. However, it also increases risk, as margin calls may require immediate cash deposits to avoid forced selling of positions.

Market makers and liquidity providers also engage in cash transactions that influence short-term markets. These market participants provide bid and ask prices for securities, facilitating trading and ensuring liquidity. Their activities can impact short-term prices, especially in less liquid markets, as they often require quick decision-making to maintain fair market prices.

In summary, market timing in short-term investments relies on various cash transactions, including day trading, margin trading, and the activities of market makers. These transactions require a keen understanding of market dynamics, technical analysis, and the ability to make rapid decisions. Successful market timers aim to capitalize on short-term price patterns, volatility, and liquidity, often within a short time frame, to achieve profitable investment outcomes.

Master Long-Term Investing: A Comprehensive Research Guide

You may want to see also

Liquidity Management: Cash flows impacting short-term investments, ensuring quick access to funds for opportunities

Liquidity management is a critical aspect of financial planning, especially for businesses aiming to maximize their short-term investment potential. Effective liquidity management ensures that a company has the necessary cash flow to seize immediate opportunities, meet short-term obligations, and maintain its financial health. Understanding which cash transactions impact short-term investments is essential for making informed decisions and optimizing cash management.

Cash Flows and Short-Term Investments:

Short-term investments are typically made with a focus on liquidity, aiming to generate returns within a year or less. These investments are highly liquid, allowing businesses to quickly convert them into cash without significant loss. Common short-term investment options include money market funds, treasury bills, and short-term bonds. When managing cash flows, it's crucial to consider the following transactions:

- Sales and Receivables: Cash received from sales is a primary source of liquidity. Efficient management of accounts receivable is vital. Businesses should ensure that sales are promptly invoiced and that payment terms are clearly communicated to customers. Quick collection of receivables ensures a steady cash inflow, enabling the company to invest in short-term opportunities.

- Payables and Expenses: Managing accounts payable is another critical aspect. Businesses should negotiate favorable payment terms with suppliers and vendors to extend payment deadlines. By carefully planning and timing expenses, companies can optimize their cash flow. Paying bills just before the due date can provide a temporary boost to liquidity, allowing for better short-term investment decisions.

- Operating Activities: Day-to-day business operations significantly impact short-term investments. This includes managing inventory levels, production costs, and operational expenses. Efficient inventory management ensures that cash is not tied up in excess stock. Regular review and adjustment of operating processes can help maintain a healthy cash flow, providing the flexibility to invest in short-term ventures.

Ensuring Quick Access to Funds:

To ensure that short-term investments are readily available when needed, companies should implement the following strategies:

- Cash Flow Forecasting: Regularly projecting cash inflows and outflows allows businesses to anticipate potential liquidity issues. Forecasting helps in identifying periods of high cash demand and enables the company to plan investments accordingly.

- Emergency Funds: Maintaining a dedicated emergency fund is essential. This fund should be easily accessible and invested in highly liquid assets. It provides a safety net during unexpected cash shortfalls, ensuring that short-term investments are not disrupted.

- Negotiate Financial Terms: When dealing with suppliers or lenders, negotiating favorable financial terms can provide more flexibility. Longer payment periods or lower interest rates can improve cash flow management and provide breathing room for short-term investments.

- Diversify Investment Portfolio: Diversifying short-term investments across various assets can reduce risk. A well-diversified portfolio ensures that the company has multiple avenues to access funds quickly, providing a safety net for immediate financial needs.

In summary, effective liquidity management involves understanding the cash transactions that impact short-term investments. By optimizing sales, payables, and operating activities, businesses can ensure a steady cash flow. Additionally, implementing strategies to quickly access funds, such as forecasting, emergency funds, and negotiating financial terms, empowers companies to make the most of short-term investment opportunities while maintaining financial stability.

Understanding Short-Term Investments: A Comprehensive Guide to H-10 Strategies

You may want to see also

Opportunity Cost: The cost of forgoing other investment options due to cash transactions in short-term portfolios

When engaging in short-term investments, cash transactions play a crucial role in shaping the overall performance and potential gains. The concept of opportunity cost comes into play here, as it represents the value of the next best alternative that is foregone when a decision is made to invest in a particular asset or strategy. In the context of short-term investments, cash transactions can significantly impact the opportunity cost, especially when considering the limited time horizon.

Opportunity cost in short-term portfolios arises from the decision to allocate cash to specific investments, which means forgoing other potential investment opportunities. For instance, when an investor decides to convert a portion of their cash holdings into a short-term bond, they are essentially sacrificing the potential returns from other investment avenues. This could include the possibility of investing in stocks, real estate, or even other short-term assets that might offer higher returns over the same period. The opportunity cost here is the difference in potential gains between the chosen investment and the alternatives that were not pursued.

The impact of cash transactions on opportunity cost becomes more pronounced in short-term investments due to the time sensitivity. Short-term investments typically aim to capitalize on market fluctuations and quick price movements within a relatively brief period. As such, the decision to convert cash into an investment should be strategic and well-informed, considering the potential trade-offs. For example, if an investor has a large amount of cash and decides to deploy it in a short-term stock trading strategy, they might miss out on the opportunity to invest in a more stable, long-term asset that could provide better risk-adjusted returns over the same period.

Understanding and managing opportunity cost is essential for investors to make optimal decisions. It involves carefully evaluating the potential returns and risks associated with different investment options and considering the time value of money. By recognizing the cost of forgoing other investment opportunities, investors can make more informed choices, ensuring that their cash transactions align with their short-term financial goals and risk tolerance. This awareness also encourages investors to continuously assess and rebalance their portfolios to optimize returns while minimizing unnecessary costs.

In summary, cash transactions in short-term investments carry an opportunity cost, which represents the value of the next best alternative investment. Investors should be mindful of this cost to make strategic decisions, ensuring that their cash allocations are well-aligned with their investment objectives and risk preferences. By understanding the potential gains forgone, investors can navigate the short-term market effectively while maximizing their overall portfolio performance.

Understanding Risk: Navigating the Investment Landscape

You may want to see also

Risk Mitigation: Cash management strategies to reduce risk in short-term investments, using cash as a buffer

Effective cash management is crucial for investors seeking to minimize risks associated with short-term investments. One powerful strategy is to utilize cash as a buffer, providing a safety net during volatile market conditions. Here are some cash management techniques to enhance risk mitigation:

Maintain a Cash Reserve: Establishing a dedicated cash reserve is fundamental. This reserve acts as a financial cushion, allowing investors to navigate unexpected market downturns or emergencies without liquidating short-term investments prematurely. Aim to hold enough cash to cover at least three to six months' worth of living expenses or a predetermined threshold that aligns with your risk tolerance. Regularly review and adjust this reserve based on market trends and personal financial goals.

Implement a Cash Flow Forecast: Create a comprehensive cash flow forecast to anticipate and manage incoming and outgoing cash. This forecast enables investors to identify potential shortfalls or surpluses, ensuring they can make informed decisions about when to invest, reinvest, or withdraw funds. By analyzing historical data and market patterns, investors can make more accurate predictions, reducing the risk of cash shortages during critical investment opportunities.

Diversify Cash Holdings: Diversification is a key principle in risk mitigation. Instead of keeping all cash in a single bank account, consider spreading it across various accounts and financial instruments. This approach can include high-yield savings accounts, money market funds, or short-term certificates of deposit (CDs). Diversification minimizes the impact of potential bank failures or market fluctuations on a single asset, providing a more stable cash position.

Utilize Cash for Strategic Investments: Cash can be a powerful tool for making strategic investments. When the market is favorable, use cash to purchase short-term investments with strong growth potential. This strategy allows investors to capitalize on opportunities while maintaining a portion of their portfolio in a liquid, cash-like state. Additionally, consider investing in short-term, low-risk instruments like government bonds or treasury bills to generate a steady income stream without exposing the entire cash reserve to market risks.

Regular Review and Rebalancing: Short-term investments and cash management require constant vigilance. Regularly review your investment portfolio and cash reserves to ensure they align with your risk profile and financial objectives. Rebalance your portfolio by adjusting the allocation of cash and investments to maintain your desired risk-reward balance. This proactive approach helps investors stay on track and adapt to changing market conditions.

By implementing these cash management strategies, investors can effectively reduce risks associated with short-term investments. Using cash as a buffer provides a sense of security, enabling investors to make more calculated decisions and navigate market volatility with confidence. It is essential to tailor these strategies to individual financial circumstances and seek professional advice when needed.

Maximize Profits: Strategies for Short-Term Investment Success

You may want to see also

Market Sentiment: Cash movements affecting short-term investments, driven by investor emotions and market trends

The concept of market sentiment is a powerful force in the world of short-term investments, often driven by the collective emotions and trends of investors. This sentiment can significantly impact cash movements, which, in turn, affect the liquidity and volatility of short-term investment portfolios. Understanding these dynamics is crucial for investors seeking to navigate the complex landscape of short-term trading.

Market sentiment refers to the overall attitude or feeling of investors towards a particular market, asset, or economic condition. It is often influenced by a variety of factors, including news, economic data, company earnings, and even social media trends. When investors are optimistic, they tend to buy more, driving up asset prices and increasing cash outflows from short-term investments. Conversely, during periods of negative sentiment, investors may sell off assets, leading to a decrease in prices and potential cash inflows.

One of the key drivers of market sentiment is investor confidence. When investors feel confident about the market's prospects, they are more likely to invest, especially in short-term opportunities. This increased demand for assets can lead to a rise in prices, prompting investors to sell their holdings and realize gains. As a result, cash transactions in short-term investments may increase as investors take advantage of favorable market conditions.

On the other hand, negative market sentiment can trigger a flight to safety, where investors move their cash to more stable assets or even to cash itself. This behavior can be driven by various factors, such as economic uncertainty, geopolitical tensions, or a sudden decline in asset prices. During these periods, short-term investors may experience cash inflows as investors seek to preserve their capital.

Additionally, market trends and technical indicators play a significant role in shaping investor sentiment. Technical analysts often use price charts and historical data to identify patterns and trends, which can influence investors' decisions. For instance, a rising price trend might encourage investors to buy more, while a downward trend could prompt selling, affecting cash movements in short-term investments.

In summary, market sentiment, driven by investor emotions and trends, is a critical factor in understanding cash movements affecting short-term investments. Investors should be aware of the impact of sentiment on their trading strategies, as it can lead to both cash inflows and outflows, depending on the prevailing market conditions. Staying informed about economic news, company announcements, and market trends is essential for making informed investment decisions in this dynamic environment.

Navigating Long-Term Investments: Key Factors to Consider

You may want to see also

Frequently asked questions

Short-term investments are assets that are expected to be converted into cash or sold within one year or the business's operating cycle, whichever is longer. These investments are typically low-risk and highly liquid, providing quick access to funds.

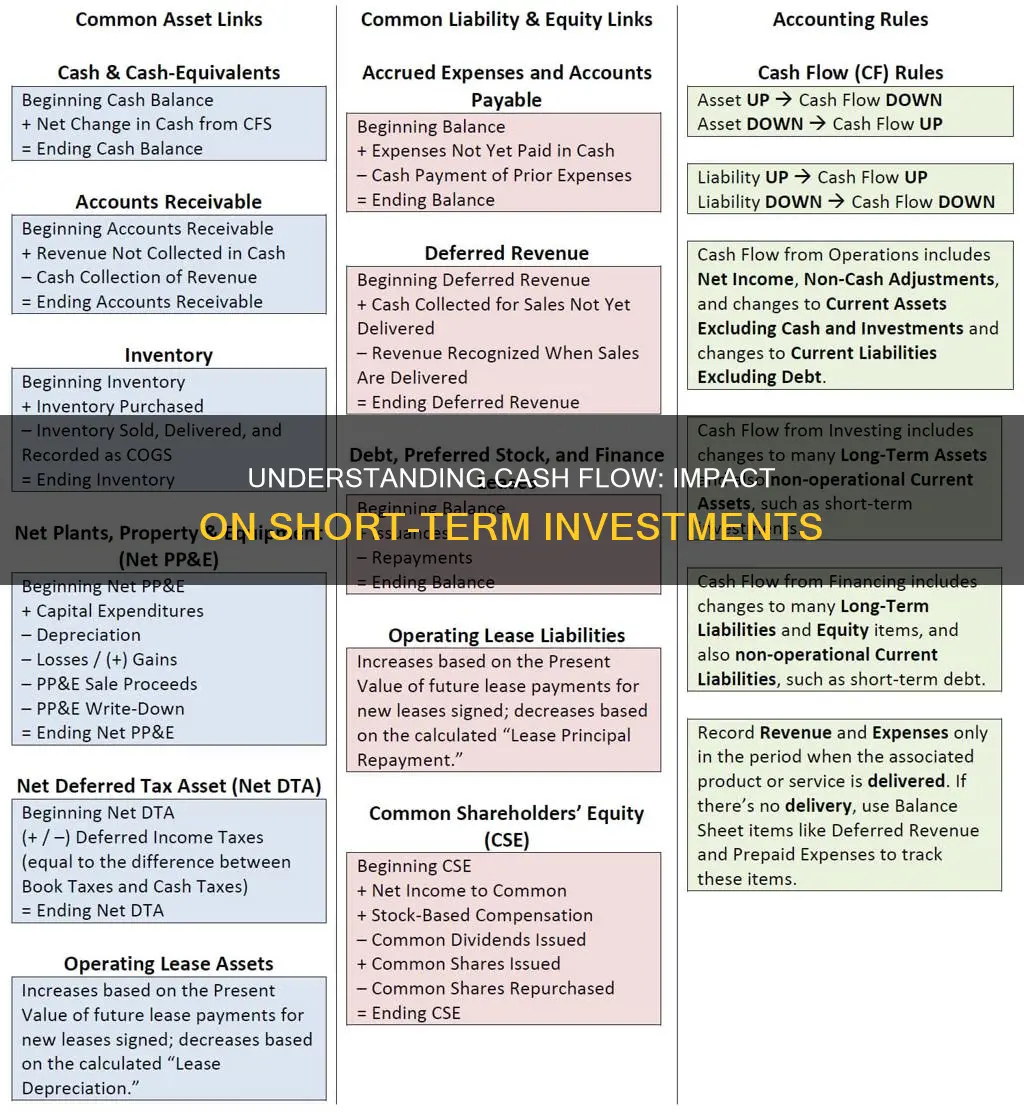

Cash transactions, such as selling assets or receiving payments, directly affect short-term investments by influencing the liquidity and cash flow of the investment portfolio. These transactions can provide the necessary funds for further short-term investments or cover short-term financial obligations.

No, not all cash sales are classified as short-term investments. Short-term investments specifically refer to the portion of the investment portfolio that is highly liquid and intended for short-term goals. Cash sales from long-term assets or investments are not typically considered short-term.

Yes, cash transactions can influence the timing of short-term investments. For example, receiving a large cash payment might prompt an investor to deploy the funds into short-term opportunities, while selling an asset may require time to liquidate and transfer the cash before it can be reinvested.

Short-term investments and long-term investments have distinct characteristics. Short-term investments are more responsive to cash transactions as they aim to provide quick access to funds. In contrast, long-term investments may not be as directly affected by short-term cash flows and are often held for extended periods to realize potential capital appreciation.