Equilibrium GDP is a key concept in economics, representing the point at which an economy's total output or production (GDP) is equal to the total spending on consumption and investment. This balance is crucial because it ensures that what is produced is also purchased, avoiding excess inventory or shortages. When actual spending deviates from GDP, market forces will push the economy back towards equilibrium. If spending exceeds output, businesses will deplete their inventories, prompting them to increase production. Conversely, if spending falls short of output, inventories will accumulate, signalling producers to reduce output.

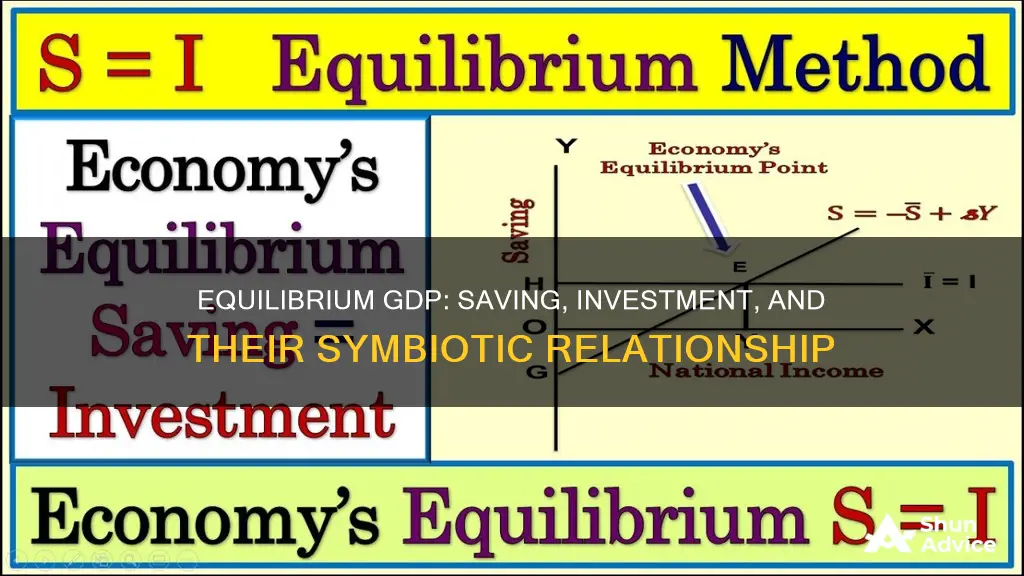

The equilibrium level of GDP is influenced by the interaction of consumption and investment. Consumption is typically a function of disposable income, implying that higher income leads to greater consumption. Investment, on the other hand, is driven by factors such as the expected rate of return and interest rates. At equilibrium, the level of savings, which is the difference between disposable income and consumption, equals planned investment. This equality is essential because savings represent a leakage from the income stream, while investment introduces an injection of spending. If savings exceed investment, GDP is too high, and output will fall. Conversely, if investment surpasses savings, GDP is too low, and output will rise until equilibrium is restored.

Understanding equilibrium GDP and the dynamics between savings and investment is fundamental to macroeconomic analysis and policy formulation. It provides insights into how changes in consumption, investment, government spending, and other factors influence the overall output and stability of an economy. By recognizing these relationships, economists and policymakers can make informed decisions to promote economic growth, full employment, and price stability.

What You'll Learn

- Equilibrium GDP occurs when planned expenditures equal GDP

- Saving is the difference between disposable income and consumption

- Unplanned inventory adjustments occur when there is a difference between what is produced and purchased

- The leakages-injections approach states that equilibrium GDP is when saving equals planned investment

- Actual investment consists of what is planned plus or minus any unplanned changes in inventory investment

Equilibrium GDP occurs when planned expenditures equal GDP

Equilibrium GDP is a state where the level of planned expenditures, including consumption and planned investment, is equal to the level of GDP. In this scenario, saving, which is the difference between disposable income and consumption, is also equal to planned investment. This equilibrium occurs when there is no discrepancy between saving and planned investment, and it ensures that production and spending plans are aligned without any unintended changes in inventories.

The concept of equilibrium GDP can be understood through the "leakages-injections" approach. Saving is considered a "leakage" from the income-expenditures stream, as it represents money that is not spent on consumption or investment. On the other hand, investment is considered an "injection" into the income-expenditures stream, as it involves spending above what is earned by households. When leakage exceeds injection, aggregate spending will be less than GDP, leading to a decline in output and income. Conversely, when injection exceeds leakage, aggregate expenditures surpass planned GDP, resulting in an increase in output and income.

Equilibrium GDP is crucial because it represents the point at which the economy is in balance, with no excess demand or supply. At this level, businesses are producing what consumers are willing to purchase, and there is no unintended inventory investment or disinvestment. Any difference between saving and planned investment disrupts this balance, leading to changes in production and spending plans until equilibrium is restored.

The relationship between saving and planned investment is central to understanding equilibrium GDP. When saving exceeds planned investment, businesses experience unplanned inventory investment, as sales are lower than expected. Conversely, when planned investment is higher than saving, there is an unplanned decrease in inventories, as sales exceed expectations. These unplanned changes in inventories drive businesses to adjust their production plans until equilibrium is reached, where saving equals planned investment.

Equilibrium GDP is a key concept in economics, representing the point at which an economy's production and spending are in balance. The "leakages-injections" approach illustrates how saving and investment interact to influence equilibrium GDP, with saving acting as a leakage and investment as an injection. Understanding the dynamics between saving, planned investment, and equilibrium GDP provides insights into the mechanisms that drive economic adjustments and the pursuit of stability in an economy.

Savings and Investment: Finding Equilibrium Balance

You may want to see also

Saving is the difference between disposable income and consumption

Consumption is the largest component of Aggregate Demand in the United States, and it is closely related to disposable personal income. The relationship between consumption and disposable personal income is called the consumption function. It can be represented as an equation, a schedule in a table, or a curve on a graph. The consumption function states that consumption equals autonomous consumption plus the marginal propensity to consume multiplied by disposable income.

The marginal propensity to consume (MPC) is the percentage of each additional dollar of disposable income that is spent immediately. It captures how changes in current income lead to changes in current consumption. When disposable income increases, consumption also increases, but not as much. This means that when disposable income goes up, people consume a smaller fraction of their income. The marginal propensity to save (MPS) is the fraction of additional disposable income that is saved.

The personal savings rate is the percentage of disposable income that is put into savings for retirement or other financial goals. When disposable income increases, the personal savings rate may increase as well, as individuals have more income to allocate towards savings.

The concept of saving being the difference between disposable income and consumption can be applied to understanding equilibrium GDP. Equilibrium GDP occurs when the level of planned expenditures, including consumption and planned investment, equals the level of GDP. At this point, saving is equal to the difference between disposable income and consumption.

Savings vs Investments: What's the Real Difference?

You may want to see also

Unplanned inventory adjustments occur when there is a difference between what is produced and purchased

The concept of equilibrium GDP is central to understanding why savings must equal planned investment. Equilibrium GDP is the point at which the level of planned expenditures, including consumption and planned investment, is equal to the level of GDP. At this point, there is no difference between what is produced and what is purchased.

However, in reality, there is often a discrepancy between what is produced and what is purchased, leading to unplanned inventory adjustments. This can occur when actual GDP is higher or lower than the equilibrium level. For example, if a firm plans to increase its inventory of denim from 1000 to 2000 units, expecting sales of 10,000 units, it will produce 11,000 units. If actual sales are lower than expected, the firm will be left with an unplanned inventory accumulation. Conversely, if demand and sales are higher than anticipated, an unplanned inventory reduction occurs.

Unplanned inventory adjustments, or changes, can also be understood as the difference between actual investment and planned investment. Actual investment includes both planned investment and any unplanned changes in inventory investment. When aggregate spending is less than equilibrium GDP, businesses experience an unplanned increase in inventories, as sales are lower than expected. Conversely, when aggregate expenditures exceed GDP, there is an unplanned decrease in inventories, as sales surpass expectations.

These unplanned inventory adjustments have significant implications for businesses. In the case of an unplanned increase in inventories, firms will likely revise their production plans downward, producing less output in the future. Conversely, an unplanned decrease in inventories will lead businesses to increase production to replenish their stocks. These adjustments continue until the level of saving equals planned investment, restoring equilibrium.

John Maynard Keynes, often credited as the originator of modern macroeconomics, revolutionized economic thinking with his book, "The General Theory of Employment, Interest, and Money." He challenged the classical view that markets were self-correcting and provided an explanation for recessions. Keynesian economics emphasizes that saving and investment decisions may not always be coordinated, and prices and wages may not be flexible downward, leading to periods of recession.

Tracking Savings and Investments: Quicken's Smart Money Management

You may want to see also

The leakages-injections approach states that equilibrium GDP is when saving equals planned investment

The leakages-injections approach is a fundamental tool for understanding the determination of equilibrium levels of output within an economy. It highlights the importance of balancing the flow of income through savings, taxes, and imports with funds being added back to the economy through investments, government spending, and exports. When equilibrium is achieved, there is neither excess supply nor demand, resulting in a stable output level.

Leakages, also known as withdrawals, represent the portion of income that is not spent on domestic goods and services but is instead saved, used for tax payments, or directed towards imports. On the other hand, injections refer to the funds introduced into the economy through investment, government spending, and exports, enhancing the flow of income.

In a simple economy model, households provide factors of production, such as labor and capital, to firms. Firms, in return, remunerate households with income in the form of wages, rent, and profits. This income is then used by households to purchase goods and services produced by firms, thus completing the circular flow of income.

The leakages-injections approach emphasizes that equilibrium GDP is attained when savings equal planned investment. This equilibrium level of output is reached when total leakages equal total injections, resulting in a stable output with no excess supply or demand. In mathematical terms, equilibrium can be expressed as:

\( S + T + M = I + G + X \)

Where:

- \(S\) is savings

- \(T\) is taxes

- \(M\) is imports

- \(I\) is investment

- \(G\) is government spending

- \(X\) is exports

For instance, consider the following example:

The consumption and investment schedules for a private closed economy are given as:

To determine:

- The equilibrium level of GDP

- The level of saving at the equilibrium level of GDP

Solution:

- Equilibrium GDP occurs when planned expenditures, including consumption and planned investment, equal the level of GDP. In this case, equilibrium occurs at a GDP of $7400. The calculation is as follows: $7320 + $80 = $7400.

- Saving is calculated as the difference between disposable income (DI) and consumption. When GDP = DI = $7400, saving is $80. So, 80 = $7400 - $7320.

In conclusion, the leakages-injections approach underscores the significance of managing the flow of income and funds within an economy to maintain equilibrium and achieve stable output. Equilibrium GDP is attained when savings equal planned investment, ensuring a balance between leakages and injections.

Maximizing Small Savings: Smart Strategies for Investing Wisely

You may want to see also

Actual investment consists of what is planned plus or minus any unplanned changes in inventory investment

In economics, the concept of 'planned investment' is distinct from 'actual investment'. Actual investment is the sum of planned investment and any unplanned changes in inventory investment. In other words, actual investment is the investment expenditure that is actually incurred over a period of time.

Inventory investment is a component of Gross Domestic Product (GDP). It refers to the difference between goods produced (production) and goods sold (sales) in a given year. The mathematical relationship can be expressed as:

> Inventory investment = production – sales

If production exceeds sales, there is a positive inventory investment, leading to an increase in the stock of inventories. Conversely, if sales are greater than production, there is a negative inventory investment, resulting in a decline in inventories.

Unintended inventory investment occurs when customers buy a different amount than expected. For example, if customers buy less than anticipated, inventories build up unintentionally, resulting in a positive unplanned inventory investment. On the other hand, if customers buy more than expected, inventories decline unexpectedly, leading to a negative unplanned inventory investment.

In the context of macroeconomic equilibrium, equilibrium in the goods market occurs when the supply of goods (output) equals the demand for goods (the sum of various types of expenditure). If there is a mismatch between supply and demand, it leads to disequilibrium, reflected in positive or negative unplanned inventory investment.

At the equilibrium level of GDP, saving equals planned investment. However, actual investment will equal actual saving, as any unplanned changes in inventory investment act as a balancing item. For instance, if aggregate spending is less than equilibrium GDP, businesses will have unplanned inventory investment on top of what was planned. Conversely, if aggregate expenditures exceed GDP, there will be less inventory investment than planned as businesses sell more than expected, resulting in a negative unplanned inventory investment.

In summary, actual investment consists of what is planned, plus or minus any unplanned changes in inventory investment. This unplanned component ensures that actual investment aligns with actual saving, even when there is a discrepancy between planned investment and saving.

Hong Kong Savings: Best Places to Invest Your Money

You may want to see also

Frequently asked questions

Equilibrium GDP is the level of output where the production of final goods and services in the economy results in a flow of income that is equal to the value of that output. In other words, equilibrium GDP occurs when planned expenditures (consumption and planned investment) are equal to the level of GDP.

Savings represent a "leakage" from the income-expenditures stream, as people withdraw spending from their disposable income. On the other hand, investment by businesses is an "injection" into this stream, as they add spending to the flow of income and expenditures. If savings exceed planned investment, there is a leakage that causes a level of GDP that cannot be sustained, and the output will fall. Conversely, if planned investment is greater than savings, there is an injection that drives GDP upward. In either case, the imbalance disturbs the equilibrium.

Equilibrium is achieved when leakages (savings) equal injections (planned investment). This balance ensures that the total spending (consumption plus investment) is equal to output (GDP).

If savings are greater than planned investment, there is an excess of leakage, leading to a reduction in output. Conversely, if planned investment exceeds savings, there is an excess of injection, causing an increase in output. In both cases, the economy adjusts until savings equal planned investment, restoring equilibrium.