High-speed traders are buying stocks quicker than the average long-term investor, and selling them back at marked-up prices. IEX, a stock market alternative, aims to level the playing field in the stock market by eliminating advantages for high-speed traders. IEX creates a speed bump to slow down trading so traders can't use relatively higher speeds to their advantage. This delay slows every trader down by 350 millionths of a second. The speed bump will have little effect on investors looking for a long-term investment, says IEX.

| Characteristics | Values |

|---|---|

| High-speed trading | High-speed traders buy stocks quicker than the average long-term investor and sell them back at marked-up prices. |

| IEX | Aims to level the playing field in the stock market by eliminating advantages for high-speed traders. |

| Long-term investment | Focus on diversification, risk-adjusted returns, staying fully invested, low turnover, and time-tested investment principles. |

| Trading | Placing speculative bets on single stocks rarely makes sense for investors saving for long-term goals like retirement. |

| Market timing | Retail investors like to try their hand, which can not only lock in losses but also put them at risk of missing the best days. |

| Impulse to sell | It's an incredibly bad time for people who don't have to sell to be selling, because they are selling into an avalanche. |

What You'll Learn

- High-speed trading can lead to short-term gains at the expense of long-term investors

- IEX says it aims to level the playing field in the stock market by eliminating advantages for high-speed traders

- Retail investors should avoid the impulse to time the market, which can be difficult even for professional traders

- Long-term investors rarely focus on speculative bets on single stocks

- IEX says a speed bump will have little effect on investors looking for a long-term investment

High-speed trading can lead to short-term gains at the expense of long-term investors

Every day, high-speed traders are buying stocks quicker than the average long-term investor, and selling them back at marked-up prices. IEX says it aims to level the playing field in the stock market by eliminating advantages for high-speed traders. IEX is a stock market alternative that says it will protect the average investor.

For investors betting heavily on a few names or aggressively moving in and out of trades trying to beat the market, trading is more aptly classified as gambling. And that's not necessarily a bad thing - plenty of people really enjoy playing Blackjack and can win big doing so. But that doesn't mean you should put your 401(k) or down payment savings in a slot machine. In a stark contrast to trading, long-term investors generally focus on diversification, risk-adjusted returns, staying fully invested, low turnover, and time-tested investment principles.

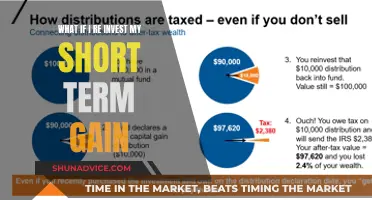

Traders try to pick the next unicorn or turn a quick profit. Experts typically advise retail investors to avoid the impulse to time the market, which can be difficult even for professional traders. Bank of America said that trading over a one-day period is "only marginally better than a coin-flip", while noting that "the probability of losing money plummets to 0% over a 20-year time horizon." Still, retail investors like to try their hand, which can not only lock in losses, but also put them at risk of missing the best days.

Stock picking and actively trading on your accounts is a very different strategy compared to long-term investing. Individual investors who frequently buy and sell stocks may make decisions based on factors like momentum, brand advocacy, very low share price, perceived industry growth, or as evidenced recently, recommendations in online forums like Reddit. For investors saving for long-term goals like retirement, placing speculative bets on single stocks rarely makes sense. But that doesn't mean actively trading or taking a flyer on a specific company is a bad idea. Just like with everything in life, it comes down to moderation.

Unraveling the Mystery: BP in Investment Context

You may want to see also

IEX says it aims to level the playing field in the stock market by eliminating advantages for high-speed traders

IEX, a stock market alternative, aims to level the playing field in the stock market by eliminating advantages for high-speed traders. IEX creates a "speed bump" to slow down trading so traders can't use relatively higher speeds to their advantage. This delay slows every trader down by 350 millionths of a second. The "speed bump" will have little effect on investors looking for a long-term investment, says IEX.

IEX is a stock market alternative that says it will protect the average investor. Every day, high-speed traders are buying stocks quicker than the average long-term investor, and selling them back at marked-up prices. Traders try to pick the next unicorn or turn a quick profit. In a stark contrast to trading, long-term investors generally focus on diversification, risk-adjusted returns, staying fully invested, low turnover, and time-tested investment principles.

IEX creates a "speed bump" to slow down trading so traders can't use relatively higher speeds to their advantage. This delay slows every trader down by 350 millionths of a second. The "speed bump" will have little effect on investors looking for a long-term investment, says IEX.

IEX is a stock market alternative that says it will protect the average investor. Every day, high-speed traders are buying stocks quicker than the average long-term investor, and selling them back at marked-up prices. Traders try to pick the next unicorn or turn a quick profit. In a stark contrast to trading, long-term investors generally focus on diversification, risk-adjusted returns, staying fully invested, low turnover, and time-tested investment principles.

Unlocking Long-Term Wealth: Are Trading Securities a Wise Investment Strategy?

You may want to see also

Retail investors should avoid the impulse to time the market, which can be difficult even for professional traders

Retail traders NEED to trade like the professionals do; unfortunately, very few retail traders actually have access to professional traders. They only have access to retail traders teaching retail traders. Retail traders begin settling for smaller and smaller profits which then forced them to choose cheaper brokers, abandon trading tools, software, charting, and other necessary and vital tools and aspects of their trading process.

The “Buy and Hold” strategy is the safest way to prevent manipulations. In a stark contrast to trading, long-term investors generally focus on diversification, risk-adjusted returns, staying fully invested, low turnover, and time-tested investment principles. Traders try to pick the next unicorn or turn a quick profit.

Plenty of people really enjoy playing Blackjack and can win big doing so. But that doesn't mean you should put your 401(k) or down payment savings in a slot machine. Stock picking and actively trading on your accounts is a very different strategy compared to long-term investing. Individual investors who frequently buy and sell stocks may make decisions based on factors like momentum, brand advocacy, very low share price, perceived industry growth, or as evidenced recently, recommendations in online forums like Reddit.

Understanding the Jargon: Decoding Business Investment Terminology

You may want to see also

Long-term investors rarely focus on speculative bets on single stocks

Long-term investors generally focus on diversification, risk-adjusted returns, staying fully invested, low turnover, and time-tested investment principles. Trading is more aptly classified as gambling for investors betting heavily on a few names or aggressively moving in and out of trades trying to beat the market. Stock picking and actively trading on your accounts is a very different strategy compared to long-term investing.

Retail investors like to try their hand at trading, which can not only lock in losses, but also put them at risk of missing the best days. Every day, high-speed traders are buying stocks quicker than the average long-term investor, and selling them back at marked-up prices. IEX, a stock market alternative, says it aims to level the playing field in the stock market by eliminating advantages for high-speed traders.

IEX creates a "speed bump" to slow down trading so traders can't use relatively higher speeds to their advantage. This delay slows every trader down by 350 millionths of a second. The "speed bump" will have little effect on investors looking for a long-term investment, says IEX.

For investors saving for long-term goals like retirement, placing speculative bets on single stocks rarely makes sense. Just like with everything in life, it comes down to moderation.

CSX's Short-Term Investments: A Drop in the Bucket

You may want to see also

IEX says a speed bump will have little effect on investors looking for a long-term investment

IEX, a stock market alternative, has introduced a "speed bump" to slow down trading by delaying every trader by 350 millionths of a second. This move aims to level the playing field by eliminating advantages for high-speed traders, who buy stocks quicker than the average long-term investor and sell them back at marked-up prices.

The speed bump is designed to protect the average investor by making it more difficult for high-speed traders to gain an edge. However, IEX claims that this delay will have little effect on investors looking for a long-term investment.

Long-term investors generally focus on diversification, risk-adjusted returns, staying fully invested, low turnover, and time-tested investment principles. They avoid the impulse to time the market, which can be difficult even for professional traders. Bank of America noted that trading over a one-day period is "only marginally better than a coin-flip," while noting that "the probability of losing money plummets to 0% over a 20-year time horizon."

IEX's speed bump is a strategic move to encourage more stable and thoughtful trading practices, which can benefit investors looking for a long-term investment. By reducing the advantage of high-speed trading, IEX aims to create a more level playing field for all investors, promoting a more stable and predictable market environment.

In conclusion, IEX's speed bump is a well-considered move that should have little impact on investors looking for a long-term investment. By reducing the influence of high-speed trading, IEX aims to encourage a more thoughtful and stable approach to investing, which can benefit investors in the long run.

Notes Receivable: Unlocking Long-Term Investment Potential

You may want to see also

Frequently asked questions

The New York Stock Exchange is a stock market alternative that aims to level the playing field in the stock market by eliminating advantages for high-speed traders.

The IEX is a stock market alternative that says it will protect the average investor. It creates a "speed bump" to slow down trading so traders can't use relatively higher speeds to their advantage.

IEX says it aims to level the playing field in the stock market by eliminating advantages for high-speed traders.

Long-term investors generally focus on diversification, risk-adjusted returns, staying fully invested, low turnover, and time-tested investment principles. Experts typically advise retail investors to avoid the impulse to time the market, which can be difficult even for professional traders. Bank of America said that trading over a one-day period is "only marginally better than a coin-flip", while noting that "the probability of losing money plummets to 0% over a 20-year time horizon."