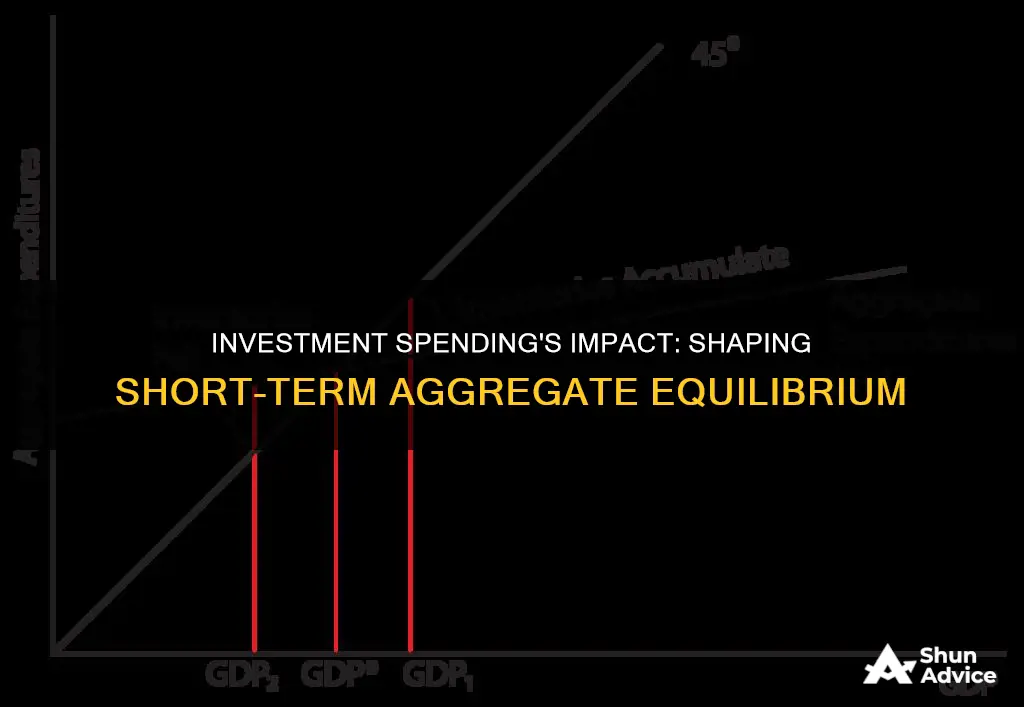

Investment spending plays a crucial role in shaping the short-term aggregate equilibrium of an economy. When businesses and individuals invest in capital goods, infrastructure, or financial assets, it directly influences the overall demand for goods and services. This increased investment spending can stimulate economic activity, leading to higher production levels and, consequently, an upward shift in the aggregate demand curve. As a result, the short-term aggregate equilibrium, which represents the economy's output and price level at full employment, is affected. Understanding these dynamics is essential for policymakers and economists as they navigate the complexities of economic growth and stability.

| Characteristics | Values |

|---|---|

| Definition | Investment spending refers to the purchase of capital goods, such as machinery, equipment, and buildings, by businesses and individuals. |

| Impact on Aggregate Demand | An increase in investment spending directly boosts aggregate demand in the short term. It leads to higher consumption of goods and services, creating a ripple effect throughout the economy. |

| Multiplier Effect | The multiplier effect suggests that an initial increase in investment spending will lead to a larger increase in aggregate demand. This is because the initial spending generates additional income, which is then spent again, creating a cycle of increased demand. |

| Interest Rates | Higher investment spending can lead to an increase in interest rates as demand for loanable funds rises. This may discourage borrowing for consumption, potentially offsetting some of the positive effects. |

| Inventory Levels | Increased investment can lead to higher inventory levels as businesses produce more to meet expected future demand. This can create a temporary surplus, which may put downward pressure on prices. |

| Uncertainty and Risk | Short-term fluctuations in investment spending can be volatile, especially during economic downturns or periods of high uncertainty. This volatility may lead to unpredictable effects on aggregate demand. |

| Government Policies | Government fiscal policies, such as tax incentives or subsidies for investment, can further stimulate short-term aggregate demand. |

| Time Horizon | The effects of investment spending on aggregate equilibrium are typically more pronounced in the short term, with longer-lasting impacts on economic growth and development. |

| Market Expectations | Expectations of future economic growth can influence investment decisions, creating a self-fulfilling prophecy where increased investment leads to higher demand and vice versa. |

| Inflationary Pressure | Sustained increases in investment spending can contribute to inflationary pressure, especially if aggregate demand outpaces supply. |

What You'll Learn

- Multiplier Effect: Investment spending can create a chain reaction, amplifying its impact on aggregate demand

- Interest Rates: Lower rates encourage investment, potentially boosting short-term economic activity

- Consumer Confidence: Increased investment may inspire more consumer spending, further stimulating the economy

- Government Policies: Fiscal policies can either support or hinder investment's short-term effects

- Business Investment: Firms' decisions to invest can significantly influence aggregate demand in the short run

Multiplier Effect: Investment spending can create a chain reaction, amplifying its impact on aggregate demand

The concept of the multiplier effect is a powerful tool to understand how investment spending can significantly influence the short-term aggregate equilibrium of an economy. When businesses or individuals invest, it sets off a chain reaction that can boost economic activity far beyond the initial investment. This phenomenon is often referred to as the multiplier effect.

To illustrate, let's consider a simple example. Suppose a company decides to invest $100,000 in new machinery and equipment. This initial investment is likely to have a direct impact on the economy by increasing the aggregate demand. However, the multiplier effect comes into play as the recipients of this new income spend a portion of it, which then becomes income for others, and so on.

As the recipients of the initial investment spend their additional income, they generate more demand for goods and services. This increased demand encourages businesses to produce more, leading to higher employment and further income generation. The initial $100,000 investment, through the multiplier effect, can thus lead to a much larger increase in aggregate demand. Economists often estimate the multiplier effect by considering the marginal propensity to consume, which is the fraction of additional income that is spent rather than saved.

For instance, if the marginal propensity to consume is 0.8, it means that 80% of any additional income is spent. This implies that the $100,000 investment could potentially lead to a total increase in aggregate demand of $125,000 (the initial $100,000 plus 80% of that amount). This chain reaction continues, with each new round of spending generating further income and demand.

The multiplier effect is a critical concept in understanding the short-term impact of investment spending. It highlights how a relatively small increase in investment can lead to a substantial boost in aggregate demand, economic activity, and potentially even employment. This mechanism is particularly important during economic downturns or recessions, where governments and central banks often use fiscal and monetary policies to stimulate investment, thereby creating a positive feedback loop that can help stabilize the economy.

Non-Operating Assets: Are They Short-Term Investments?

You may want to see also

Interest Rates: Lower rates encourage investment, potentially boosting short-term economic activity

Lower interest rates have a significant impact on the economy, particularly in the short term, as they directly influence investment spending. When interest rates are reduced, borrowing becomes cheaper for businesses and individuals. This reduction in cost encourages investment, as companies can finance new projects, expand operations, or purchase equipment at a lower cost. As a result, the aggregate demand for goods and services increases, leading to higher economic activity.

The relationship between interest rates and investment is a critical aspect of short-term economic management. Central banks often use interest rate adjustments as a tool to stimulate the economy during downturns or to cool it down when inflation becomes a concern. Lower rates provide an incentive for businesses to invest, which can lead to increased production, job creation, and ultimately, higher economic growth. This is especially true for industries that rely heavily on capital investment, such as manufacturing, construction, and technology.

The mechanism works as follows: When interest rates are low, the cost of capital decreases, making it more attractive for businesses to invest in long-term projects. This can lead to a surge in business confidence, as lower borrowing costs reduce financial constraints, allowing companies to take on more risk and invest in innovative ideas. As a result, the overall investment spending in the economy increases, which directly contributes to the short-term aggregate demand.

Additionally, lower interest rates can indirectly boost investment by increasing consumer spending. When rates are low, individuals may feel more comfortable taking out loans for major purchases, such as houses or cars. This increased consumer borrowing can stimulate demand for goods and services, further encouraging businesses to invest in production and expansion. As a result, the economy experiences a multiplier effect, where initial lower interest rates lead to a chain reaction of increased investment and economic activity.

However, it is important to note that the impact of lower interest rates on investment and economic activity is not instantaneous and can vary depending on various economic factors. Other variables, such as consumer confidence, business sentiment, and the overall health of the financial system, also play a role in determining the effectiveness of interest rate changes. Nonetheless, managing interest rates is a powerful tool for policymakers to influence short-term economic outcomes and guide the economy towards a desired trajectory.

Maximizing Your $50K: Short-Term Investment Strategies for Quick Returns

You may want to see also

Consumer Confidence: Increased investment may inspire more consumer spending, further stimulating the economy

Increased investment spending can have a significant impact on the short-term aggregate equilibrium of an economy, particularly through its influence on consumer confidence and spending. When businesses invest more, it often indicates a positive outlook and a belief in future growth. This optimism can be contagious, spreading to consumers who may feel more secure about their financial prospects. As a result, consumer confidence tends to rise, which is a crucial factor in the short-term economic outlook.

Consumer confidence is a measure of how optimistic or pessimistic consumers are about the economy and their personal financial situations. When investment spending increases, it can create a ripple effect in the market. Businesses may experience higher demand for their products or services, leading to increased sales and revenue. This success can encourage firms to further invest, expand operations, and potentially hire more employees, all of which contribute to a positive economic cycle. As consumers witness these positive economic indicators, their confidence grows, making them more inclined to spend.

The relationship between investment and consumer spending is a critical aspect of short-term economic dynamics. When consumers are confident, they are more likely to make purchases, whether it's for durable goods, services, or even luxury items. This increased consumer spending directly contributes to the aggregate demand in the economy. As aggregate demand rises, businesses are more likely to produce and invest further to meet this growing demand, creating a self-reinforcing loop.

Moreover, the impact of increased investment on consumer confidence is not limited to the immediate effects on demand. When consumers see that businesses are investing and growing, they may interpret this as a sign of economic stability and resilience. This perception can further boost their confidence, encouraging them to make long-term financial plans and potentially save less and spend more. As a result, the initial investment spending can lead to a sustained period of increased consumer spending, which is vital for a robust short-term economic recovery.

In summary, investment spending plays a pivotal role in shaping the short-term aggregate equilibrium by influencing consumer confidence and spending. The positive feedback loop between increased investment, rising consumer confidence, and subsequent spending can stimulate economic growth. This mechanism highlights the importance of managing and encouraging investment to ensure a healthy and dynamic economy, especially during periods of economic transition or recovery.

Navigating Short-Term Investments: Operating Assets and Their Role

You may want to see also

Government Policies: Fiscal policies can either support or hinder investment's short-term effects

Government fiscal policies play a crucial role in shaping the short-term effects of investment spending on the aggregate economy. These policies, which include government spending and taxation, can either stimulate or restrict investment, thereby influencing economic growth and stability. When the government implements expansionary fiscal policies, it typically increases its spending or decreases taxes, leading to an injection of money into the economy. This can have a direct impact on investment spending, as businesses may respond to the increased demand and potential market growth by investing in new projects, infrastructure, or expansion. As a result, the short-term aggregate demand for goods and services rises, potentially leading to higher production and employment levels.

On the other hand, contractionary fiscal policies, characterized by reduced government spending or increased taxes, can have the opposite effect. Such policies may discourage investment as businesses face reduced consumer demand and potential market uncertainty. This can lead to a decrease in investment spending, causing a short-term slowdown in economic growth. The key lies in the timing and magnitude of these fiscal policy adjustments. A well-timed expansionary fiscal policy can provide a much-needed boost to investment, especially during economic downturns or recessions, helping to stabilize the economy and promote recovery.

In the short term, the impact of fiscal policies on investment is often more pronounced in industries that are highly sensitive to changes in government spending or taxation. For example, infrastructure projects, such as road construction or renewable energy initiatives, may experience a surge in investment when the government allocates additional funds. Conversely, sectors heavily reliant on consumer spending might witness a temporary decline in investment if the government's contractionary measures lead to reduced consumer confidence and spending power.

The effectiveness of fiscal policies in influencing investment spending also depends on the overall economic environment and the specific characteristics of the investment projects. During periods of high economic growth, the impact of fiscal stimulus on investment might be more modest, as businesses may already be operating at full capacity. However, in a recession, the same fiscal policies can have a more significant and positive effect on investment, helping to stimulate economic activity and create a virtuous cycle of growth.

In summary, government fiscal policies have a direct and significant impact on the short-term effects of investment spending. Expansionary policies can support and encourage investment, while contractionary measures may hinder it. Understanding these dynamics is essential for policymakers to make informed decisions that optimize economic growth and stability, especially during critical junctures in the business cycle.

Maximizing Profits: A Beginner's Guide to Short-Term Rental Investing

You may want to see also

Business Investment: Firms' decisions to invest can significantly influence aggregate demand in the short run

Business investment plays a crucial role in shaping the short-term aggregate demand in an economy. When firms decide to invest, they are essentially allocating resources towards capital goods, research and development, or expansion projects. This investment spending has a direct impact on the overall demand for goods and services in the short run.

In the short term, an increase in business investment can lead to a boost in aggregate demand. As firms invest, they purchase new machinery, hire additional workers, and expand their production capabilities. This, in turn, results in higher output and a greater supply of goods and services in the market. With more products available, consumers have a wider range of choices, and their purchasing power increases, leading to higher consumption. This upward trend in consumption further stimulates demand, creating a positive feedback loop.

The relationship between business investment and aggregate demand is particularly significant during economic downturns or recessions. During these periods, consumer confidence may be low, and government spending could be constrained. However, firms with a forward-looking perspective often recognize the potential for future growth and decide to invest in new projects. This strategic investment can help stimulate the economy by creating jobs, increasing income, and driving consumer spending. As a result, the aggregate demand curve shifts upward, contributing to economic recovery.

On the other hand, a decrease in business investment can have the opposite effect, leading to a reduction in aggregate demand. If firms become more cautious and reduce their investment, it may indicate a lack of confidence in the current economic conditions or future prospects. This reduction in investment can result in lower production, fewer job opportunities, and decreased consumer spending. Consequently, the aggregate demand for goods and services declines, potentially leading to a downward spiral of reduced output and further decreased demand.

Understanding the impact of business investment on short-term aggregate demand is essential for policymakers and businesses alike. Governments can utilize fiscal and monetary policies to encourage investment during economic downturns, helping to stabilize the economy. Businesses, on the other hand, can make informed decisions regarding investment strategies, considering both short-term and long-term market conditions to optimize their contribution to overall economic growth.

Unlocking the Long-Term Potential: Savings vs. Investments

You may want to see also

Frequently asked questions

Investment spending plays a crucial role in the short-term aggregate equilibrium as it directly impacts the level of economic activity. When investment spending increases, it leads to a higher demand for goods and services, which in turn stimulates production. This can result in a shift of the aggregate demand curve to the right, causing an increase in the equilibrium price level and output. The effect is particularly notable in the short term, where the economy may experience a boost in economic growth and a temporary rise in inflation.

The short-term aggregate equilibrium is a concept that describes the relationship between the economy's total demand and supply in the near term. When investment spending increases, it creates a multiplier effect. This means that the initial increase in investment leads to a larger overall increase in economic activity. The multiplier is calculated as the sum of the marginal propensity to consume and the marginal propensity to import. As a result, the economy's total demand rises, leading to higher production and potentially a new equilibrium with a higher price and output level.

While investment spending can have a positive impact on the short-term aggregate equilibrium, there are certain considerations. One potential drawback is the possibility of a temporary economic boom, which may lead to overheating. If investment spending is too rapid and excessive, it can cause a surge in aggregate demand that outpaces the economy's production capacity. This could result in inflationary pressures and a subsequent correction, where the economy may experience a slowdown or even a recession. Additionally, the effectiveness of investment spending may vary depending on factors like the state of the business cycle, interest rates, and consumer confidence.