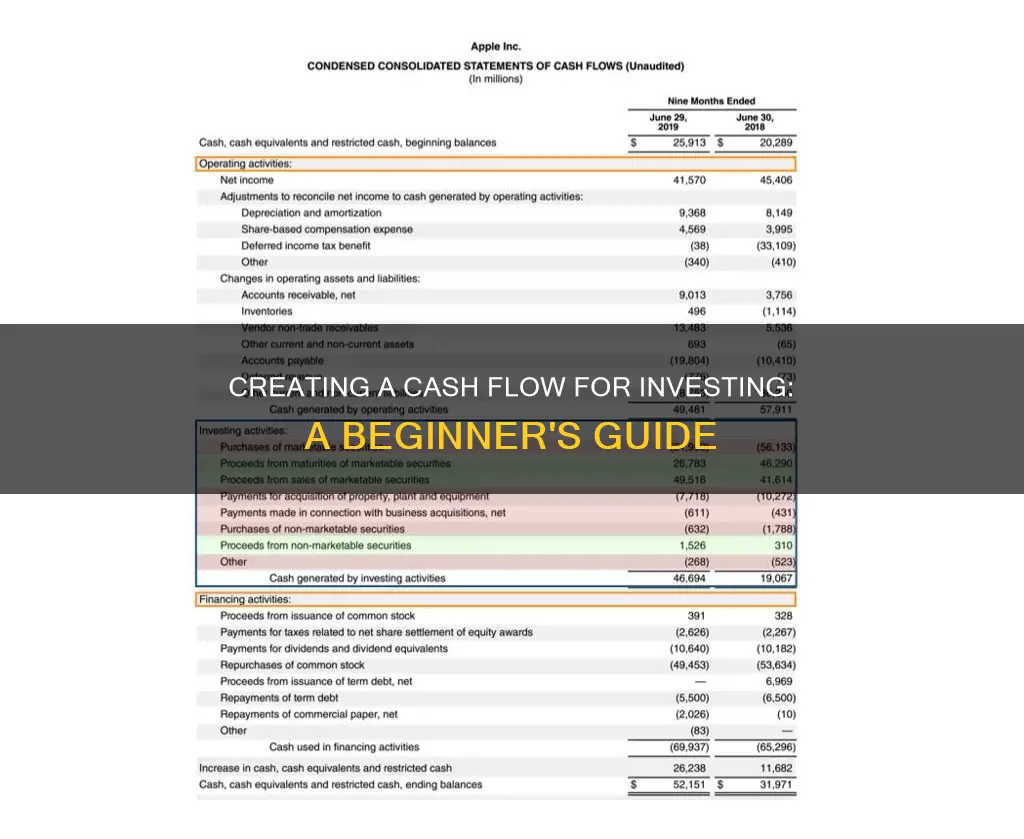

A cash flow statement is a financial report that details how cash entered and left a business during a reporting period. It is one of the three fundamental financial statements that financial leaders use, alongside the income statement and balance sheet. A typical cash flow statement is divided into three sections: cash flow from operating activities, cash flow from investing activities, and cash flow from financing activities. This article will focus on how to create investing cash flow.

| Characteristics | Values |

|---|---|

| Purpose | To provide a detailed picture of what happened to a business’s cash during an accounting period |

| Types | Cash flow from operating activities, cash flow from investing activities, and cash flow from financing activities |

| Calculation Methods | Direct method and indirect method |

| Reporting Period | Monthly, quarterly, or annually |

What You'll Learn

Investing in physical assets

Tangible assets are diverse, and investors must either focus on assets with a large market or have enough expertise to trade in niche markets. They are a good addition to a portfolio that includes conventional investments such as equities or bonds, providing additional risk diversification. Tangible asset funds offer a middle ground, allowing investors to participate in forward-looking tangible assets such as renewable energy while ensuring balanced risk diversification.

Gold and real estate are popular tangible assets that have a firm place in many well-structured portfolios. Tangible assets are used for diversification and value preservation, and some can form part of high-risk speculation. They are particularly attractive when interest rates are low, as they are stable in value and are considered a crisis-resistant alternative for investing money.

The popularity of tangible assets increases during times of inflation, crisis, or low-interest rates. With low-interest rates, tangible assets often provide better returns than traditional investments such as savings accounts or fixed-term deposits. They are also not dependent on monetary value, so they protect assets in times of high inflation. Tangible assets are considered crisis-proof; for example, owning real estate or investing in gold protects against a total loss of assets.

Real estate is generally regarded as a stable and low-risk investment with solid returns. It can balance out the inflation rate and the rising price level. Rental income tied to the consumer price index and the average price level can ultimately provide inflation compensation. However, real estate is often a long-term investment, and its performance is not always predictable. There is also a risk of fluctuating income and payment defaults.

Precious metals such as gold, silver, and platinum are considered beneficial investments, often seen as crisis-proof and even serving as a transition currency in extreme cases. They are a limited resource, increasing their value, and their "perpetual" value is widely recognised. Gold, in particular, tends to be in higher demand when inflation rises. Precious metals are also fairly easy to buy and sell, with a large, international market. However, they are a speculative investment that does not provide interest or dividends, and they are subject to fluctuations in demand and technological development.

Renewable energy, such as wind or solar power, is a newer type of tangible asset investment. Investors typically participate through shareholdings or funds, rather than purchasing their own wind farms or solar plants. The renewable energy market is one of the fastest-growing markets, with increasing demand and supply. Investments in this area are not only economically beneficial but also environmentally positive, paving the way for the energy transition. Many countries have committed to expanding renewable energy supply systems, which will contribute to the stability of investments in this sector.

Other tangible assets include means of transport such as ships, aircraft, or containers, which are leased to large logistics companies. However, this area is closely linked to the global economy, and an economic crisis can strongly impact the trade in goods.

Tangible asset funds allow investors to diversify their capital and reduce the risk of cluster risks. These funds promote a widely diversified portfolio and require relatively small investment amounts. They are subject to strict regulations to protect investors and maintain transparency. By investing in funds, individuals can benefit from high flexibility, as fund units can be bought and sold at any time.

When investing in tangible assets, it is important to consider the business model, economic performance, transparency, costs, income, and how the investment contributes to the diversification of your portfolio. Tangible assets provide a concrete, material value and help safeguard your investment in times of crisis and against rising inflation. However, they are not completely "safe" and do carry a certain risk of loss of value.

Cash App Investing: Are There Any Fees Involved?

You may want to see also

Investing in securities

Investment securities are a category of securities, which are tradable financial assets. They are purchased with the intention of holding them for investment. Securities can take the form of equity (ownership stakes) in corporations or debt securities.

There are three main types of securities: equity, debt, and hybrids. Equity securities are financial assets that represent ownership of a corporation. The most common type of equity security is common stock. Equity securities often pay out dividends, and they entitle the holder to some control of the company via voting rights.

Debt securities are debt instruments where a lender (investor) lends money to a borrower (often a government or corporation) in return for regular interest payments. The principal is returned to the investor at maturity. The most common types of debt securities are government and corporate bonds.

Hybrid securities combine aspects of both debt and equity securities. Examples include equity warrants, convertible bonds, and preference shares.

When investing in securities, it is important to understand the different types and the associated risks. Negative cash flow from investing activities does not always indicate poor financial health. It could mean that a company is investing in assets, research, or other long-term development activities that are important for the company's health and continued operations.

Extra Cash: Smart Investment Strategies for Beginners

You may want to see also

Investing in joint ventures

When considering investing in a joint venture, it's important to keep in mind the following key points:

- Shared Resources and Expertise: Joint ventures allow participants to leverage the combined resources, knowledge, and talent of all involved parties. This can include manufacturing processes, distribution channels, technological advancements, and more. By working together, companies can achieve greater efficiency and cost savings.

- Market Expansion: One of the primary reasons for forming a joint venture is to enter a foreign market by partnering with a local business. This provides an established distribution network and helps navigate restrictions on foreign entities in some countries.

- Risk Mitigation: Joint ventures distribute risks and liabilities among the participants. This shared risk approach can be advantageous when undertaking major investments or projects.

- Legal Structure: Joint ventures can take on various legal structures, including corporations, partnerships, limited liability companies (LLCs), or other business entities. It's important to carefully draft the JV agreement to establish rights, obligations, and profit-sharing arrangements.

- Control and Decision-Making: Joint ventures involve relinquishing a degree of control, as decisions are made collaboratively. It's crucial that all parties share the same goals and level of commitment to ensure the venture's success.

- Tax Considerations: Joint ventures are typically taxed as separate entities, but the specific tax structure depends on the chosen legal framework. It's important to understand the tax implications for each participant.

- Exit Strategy: Joint ventures are usually formed for specific projects or goals, so it's important to have a clear exit strategy in place. This can include options such as selling the new business, spinning off operations, or transitioning to employee ownership.

When investing cash flow in a joint venture, it's essential to carefully evaluate the potential benefits and risks. Joint ventures offer access to new opportunities, shared resources, and reduced costs. However, they also come with complexities in decision-making, potential cultural differences, and the need for a well-defined exit strategy. By carefully considering these factors, investors can make informed decisions about investing in joint ventures to create positive cash flow.

Understanding Cash Flow: Investing Activities Explained

You may want to see also

Buying new assets

When it comes to creating an investment cash flow, buying new assets is a crucial component. This involves investing in long-term assets, such as property, facilities, and equipment, that can enhance the company's operations and future profitability. Here are some key considerations and strategies for this aspect:

- Understanding Cash Flow from Investing Activities: This section of the cash flow statement details the cash inflows and outflows related to the purchase or sale of long-term assets. It's important to recognise that negative cash flow in this area doesn't always indicate poor financial health. Instead, it may signify that the company is investing in its long-term growth, which can lead to significant gains in the future.

- Types of Asset Investments: Businesses can invest in a variety of long-term assets, including real estate, dividend stocks, bonds, and even acquiring other profit-generating businesses. The choice between long-term and short-term investments depends on the company's financial stability, risk tolerance, and long-term vision.

- Real Estate Investments: Investing in real estate properties offers benefits such as rental income, capital appreciation, tax advantages, and equity. It's a stable and secure option for businesses looking to expand their operations and increase their market share.

- Stocks and Bonds: These investments provide consistent and predictable income through dividends, interest, or capital gains. They also offer opportunities for diversification and ensure a regular income stream, making them a reliable choice for generating cash flow.

- Other Options: Businesses can also explore investing in REITs (real estate investment trusts), peer-to-peer lending, or acquiring other small businesses. Each of these options comes with its own set of benefits, such as diversification, liquidity, and business ownership.

- Risk Management: Investing in new assets carries various risks, including market, liquidity, credit, operational, and legal risks. To mitigate these risks, businesses should diversify their investments, conduct thorough due diligence, and regularly monitor the performance of their investments to ensure they align with their goals and risk tolerance.

- High-Return Strategies: Businesses can aim for high returns by carefully selecting their investments and maximising their cash flow efficiency. This involves understanding the net present value (NPV) and internal rate of return (IRR) of their investments, as well as considering the payback period to assess the risk and potential of each investment.

- Software Tools: Utilising cash flow management software, such as Agicap, can help businesses automate the analysis and management of their cash flow investments. These tools provide real-time data and advanced insights, enabling businesses to make data-driven decisions about their investment strategies.

Understanding Proceeds From Equipment Sales: Cash From Investing?

You may want to see also

Receiving interest or dividends

To receive interest, you can consider investing in bonds, savings accounts, or money market products. These investments typically offer fixed interest rates, and the interest is taxed at your usual income tax rate. Mutual funds and exchange-traded funds (ETFs) that invest in bonds or money markets will also pass on the interest payments to you as "interest dividends".

To receive dividends, you need to own stocks or shares in a company that pays dividends. Dividends are usually paid per share of stock, and companies that pay dividends tend to be well-established and less volatile. Dividend stocks can provide a stable and growing income stream, making them attractive to investors seeking regular income. Dividends can be paid out in cash or in the form of additional shares, known as stock dividends.

It's important to note that not all stocks pay dividends, so if you're interested in investing for dividends, you need to choose dividend stocks specifically. Additionally, mutual funds that hold dividend-paying stocks will also distribute those dividends to their investors.

In summary, receiving interest or dividends is an important part of investing, and it can provide a steady source of income. By investing in the right types of assets, such as bonds for interest and dividend-paying stocks for dividends, you can generate regular cash flow from your investments.

Cash Investment Strategies: Your Guide to Profitable Opportunities

You may want to see also