Investing in Malaysia can be an attractive option for foreigners seeking to diversify their portfolios and tap into the country's growing economy. Malaysia offers a range of investment opportunities, from property to stocks and bonds, providing a gateway to the Southeast Asian market. This guide will explore the various avenues available for foreign investors, including the legal and regulatory framework, tax considerations, and practical steps to get started, ensuring a comprehensive understanding of the investment landscape in Malaysia.

What You'll Learn

- Visa and Residency: Understand visa requirements and residency options for foreign investors in Malaysia

- Tax Benefits: Explore tax incentives and deductions available to foreign investors in Malaysia

- Investment Options: Discover various investment avenues like property, stocks, and mutual funds for foreigners

- Regulations and Compliance: Learn about legal requirements and compliance for foreign investors in Malaysia

- Market Analysis: Research and analyze the Malaysian market to make informed investment decisions

Visa and Residency: Understand visa requirements and residency options for foreign investors in Malaysia

When considering investment opportunities in Malaysia, understanding the visa and residency requirements is crucial for foreign investors. Malaysia offers various visa options tailored to different investment activities and durations. Here's a breakdown of the key considerations:

Types of Visas:

- Business Visa: This visa is suitable for individuals planning to engage in business activities, including investment. It typically allows for stays of up to 12 months, with extensions possible.

- Work Permit: Required for foreign employees of Malaysian companies. The duration depends on the employment contract.

- Entrepreneur Visa: Designed for individuals who wish to establish a business in Malaysia. It offers a longer stay and may lead to residency status.

- Retirement Visa: Aimed at retirees who wish to reside in Malaysia permanently.

Visa Application Process:

The visa application process involves submitting documents such as a valid passport, proof of funds, investment plans, and supporting letters from Malaysian authorities or financial institutions. The specific requirements vary depending on the visa type.

Residency Options:

- Long-Term Resident Visa: Foreign investors who have invested a substantial amount in Malaysia may be eligible for this visa, which allows for extended stays and potential permanent residency.

- Malaysia My Second Home Program: This program offers a 10-year residence permit to foreign investors who invest a minimum amount in approved property projects in Malaysia.

- Entrepreneur Visa with Residency: As mentioned earlier, the Entrepreneur Visa can lead to residency if the business venture is successful and meets certain criteria.

Important Considerations:

- Investment Amount: The level of investment required for residency varies. Higher investment amounts often lead to more favorable residency options.

- Business Plan: A well-defined business plan is essential for visa applications, especially for Entrepreneur Visas.

- Financial Stability: Demonstrating financial stability through bank statements and proof of funds is crucial.

- Legal Compliance: Adhering to Malaysian immigration laws and regulations is essential to avoid any legal complications.

Remember, this is a general overview. It's crucial to consult with Malaysian immigration authorities or a qualified immigration lawyer for personalized advice based on your specific investment plans and circumstances.

Finding Initial Investment: Utilizing Positive Cash Flow Strategies

You may want to see also

Tax Benefits: Explore tax incentives and deductions available to foreign investors in Malaysia

When considering investment opportunities in Malaysia, understanding the tax benefits and incentives can significantly impact your financial strategy. Malaysia offers a range of tax incentives to attract foreign investors and promote economic growth. Here's an overview of the tax benefits available:

Corporate Tax Incentives: Foreign investors can take advantage of Malaysia's corporate tax system, which provides tax relief and incentives. The country operates a territorial tax system, taxing only income earned within its borders. Foreign companies can benefit from a reduced corporate tax rate of 17% for the first RM500,000 of profit and 20% thereafter, which is lower than the standard rate of 24%. Additionally, the government offers tax holidays for new investments, allowing companies to be exempt from corporate tax for a specified period, typically 5 to 10 years, depending on the industry and location. This incentive encourages long-term investments and can significantly reduce tax liabilities for foreign businesses.

Presumptive Tax Scheme: This scheme is designed to simplify tax compliance for small and medium-sized enterprises (SMEs). Foreign investors who establish SMEs in Malaysia can opt for this scheme, which allows them to pay a fixed percentage of their turnover as tax instead of the standard corporate tax rate. The presumptive tax rate varies depending on the industry and turnover, providing a cost-effective tax solution for small businesses.

Investment Tax Allowance (ITA): The ITA is a valuable incentive for foreign investors in specific sectors. It allows investors to claim an allowance against their taxable income, effectively reducing their tax payable. The ITA is available for investments in approved industries, such as manufacturing, agriculture, and tourism. Investors can claim a percentage of their investment as a tax allowance, providing a direct reduction in tax liabilities. For example, for investments in the manufacturing sector, a 100% ITA is offered for the first RM500,000 of qualifying capital expenditure.

Export-Oriented Enterprises: Malaysia encourages foreign investors to establish export-oriented businesses, and this is reflected in the tax benefits. Exporters can claim a tax allowance based on their export sales. The allowance is calculated as a percentage of the export turnover, providing a significant tax incentive for businesses focused on international markets.

Transfer Pricing Rules: Foreign investors should be aware of Malaysia's transfer pricing regulations, which ensure that related-party transactions are taxed appropriately. The country has strict rules to prevent profit shifting and ensures that prices charged for goods and services between related entities are at arm's length. Understanding these rules is essential to ensure compliance and avoid potential tax disputes.

In summary, Malaysia's tax incentives and deductions provide a favorable environment for foreign investors. From corporate tax holidays to specific industry allowances, these benefits can significantly impact investment decisions. Foreign investors should carefully review the available incentives and consult tax professionals to maximize their tax efficiency and ensure compliance with Malaysian tax laws.

Invest with SRS and DBS: A Smart Guide

You may want to see also

Investment Options: Discover various investment avenues like property, stocks, and mutual funds for foreigners

When it comes to investing in Malaysia for foreigners, there are several options available, each with its own set of advantages and considerations. Here's an overview of some popular investment avenues:

Property Investment:

Malaysia offers an attractive property market for foreign investors, providing an opportunity to build wealth and diversify portfolios. Foreigners can invest in residential or commercial properties, with the option to purchase directly or through a local company. The country's real estate market has seen steady growth, and popular areas include Kuala Lumpur, Penang, and Johor Bahru. It is crucial to research and understand the local property laws and regulations, as well as seek professional advice to ensure a smooth investment process. Property investment can be a long-term strategy, offering rental income and potential capital appreciation.

Stocks and Equities:

Investing in the Malaysian stock market is another viable option for foreigners. The country's stock exchange, Bursa Malaysia, provides access to a range of companies and sectors. Foreign investors can purchase shares in local companies, offering the potential for capital gains and dividends. It is recommended to conduct thorough research on companies, analyze market trends, and consider seeking advice from financial advisors to make informed investment decisions. Diversification is key, and investors can explore various sectors such as banking, healthcare, and technology.

Mutual Funds and Exchange-Traded Funds (ETFs):

Mutual funds and ETFs are popular investment vehicles that allow foreigners to gain exposure to the Malaysian market. These funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. Mutual funds are managed by professionals, offering a hands-off approach, while ETFs track specific indexes and provide liquidity. Investing in mutual funds or ETFs can be a low-cost way to invest in a basket of companies, reducing risk through diversification.

Business and Entrepreneurship:

For those seeking a more active investment approach, starting a business in Malaysia can be an option. Foreign entrepreneurs can explore various sectors and industries, contributing to the country's economic growth. Malaysia offers incentives and support for foreign investors, including tax benefits and streamlined business registration processes. This avenue allows for direct involvement in the local market and the potential for long-term wealth creation.

When considering investment options, it is essential to assess your risk tolerance, investment goals, and the level of involvement you are comfortable with. Each investment avenue has its own set of risks and rewards, and seeking professional financial advice is highly recommended to navigate the complexities of investing in Malaysia as a foreigner.

Foreign Investment's Impact: Balancing Trade Deficits

You may want to see also

Regulations and Compliance: Learn about legal requirements and compliance for foreign investors in Malaysia

When considering investment opportunities in Malaysia, foreign investors must navigate a specific legal landscape to ensure compliance and a smooth process. Malaysia has implemented various regulations to attract foreign capital while also safeguarding its domestic market. Here's an overview of the key considerations regarding regulations and compliance for foreign investors:

Legal Framework: Malaysia's legal system is based on common law and English legal principles, which provides a familiar framework for many foreign investors. The primary legislation governing foreign investment is the Investment Incentives Act 1968, which offers incentives and guarantees to investors. This act, along with other supporting legislation, outlines the rights and obligations of foreign investors, ensuring a transparent and structured environment. It is essential to understand that specific industries, such as banking, telecommunications, and agriculture, may have additional regulations and licensing requirements, so investors should research these sectors' unique rules.

Incentives and Tax Benefits: The Malaysian government provides various incentives to attract foreign investors, which can significantly impact the investment strategy. These incentives include tax holidays, tax exemptions, and reduced corporate tax rates for certain industries and projects. For instance, the Malaysia Digital Economy Corporation (MDEC) offers incentives for digital economy-related investments, including tax breaks and grants. Understanding these incentives and their eligibility criteria is crucial for maximizing the benefits of investing in Malaysia.

Registration and Licensing: Foreign investors must register their businesses and obtain the necessary licenses to operate legally in Malaysia. The process typically involves submitting detailed applications to the relevant government agencies, such as the Companies Commission of Malaysia (CCM) and the Ministry of Domestic Trade and Consumer Affairs (MDTCA). The CCM is responsible for company registration, while the MDTCA oversees business licensing and compliance. Investors should be prepared to provide comprehensive documentation, including business plans, financial statements, and proof of capital.

Foreign Investment Approval: Certain foreign investments require approval from the Investment Committee of Malaysia (ICM), a body that assesses and approves major investments. The ICM considers factors such as the industry, investment amount, and potential impact on the local economy. Applications are evaluated based on specific criteria, and the ICM may request additional information or assessments. This process ensures that significant foreign investments align with Malaysia's economic goals and strategic priorities.

Compliance and Ongoing Obligations: After establishing an investment, foreign entities must adhere to ongoing compliance requirements. This includes maintaining accurate financial records, filing annual reports, and adhering to industry-specific regulations. Foreign investors should also stay updated on any changes in legislation that may affect their operations. Regular engagement with relevant government departments is essential to ensure compliance and take advantage of any new incentives or support programs.

Understanding the legal and regulatory environment is paramount for foreign investors to navigate the investment process in Malaysia successfully. By being aware of the incentives, registration processes, and ongoing compliance obligations, investors can make informed decisions and establish a solid foundation for their ventures in the country.

Warren Buffet's Berkshire Cash Reserves: Where Does it Go?

You may want to see also

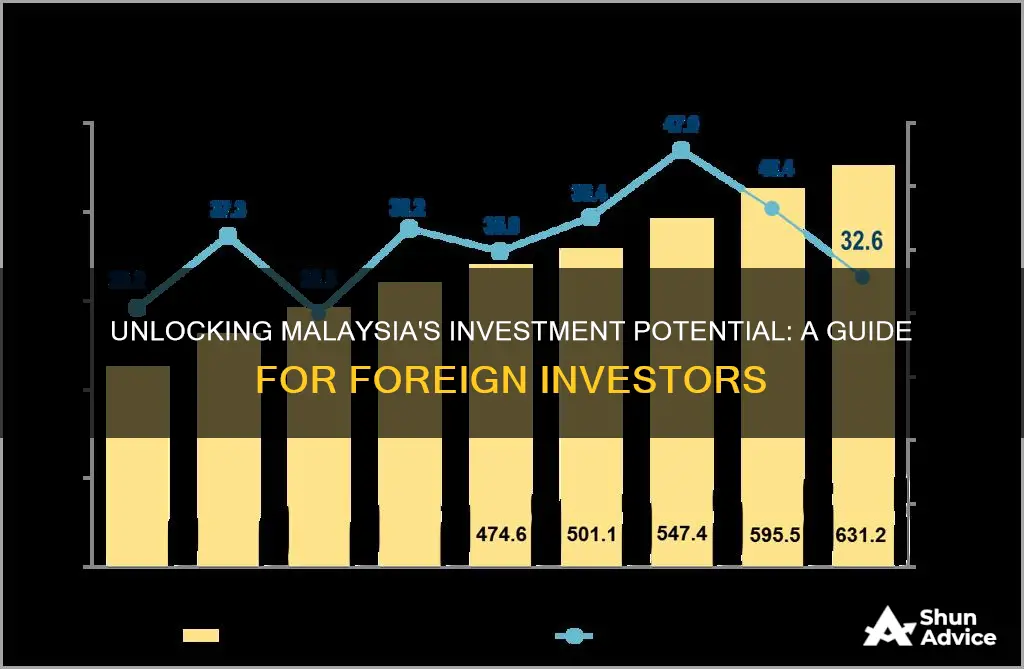

Market Analysis: Research and analyze the Malaysian market to make informed investment decisions

When considering investing in Malaysia as a foreigner, a comprehensive market analysis is crucial to making informed decisions. Malaysia offers a range of investment opportunities, but understanding the local market dynamics is essential for success. Here's a step-by-step guide to conducting a thorough market analysis:

- Economic Overview: Begin by studying Malaysia's economic landscape. Research its GDP growth, inflation rates, and key economic indicators. Understanding the country's economic health provides a foundation for assessing investment risks and potential returns. Look for factors like political stability, currency strength, and trade policies that could impact your investments.

- Industry and Sector Analysis: Identify the dominant industries in Malaysia and evaluate their growth prospects. Sectors such as palm oil, agriculture, manufacturing, and tourism are significant contributors to the country's economy. Analyze industry reports and market research to understand the competitive landscape, market share of local and international companies, and emerging trends. This research will help you decide whether to invest in established industries or explore emerging sectors.

- Market Entry Requirements: Familiarize yourself with the legal and regulatory framework for foreign investors in Malaysia. Research the types of business structures available, such as sole proprietorships, partnerships, or limited liability companies. Understand the registration process, licensing requirements, and any specific restrictions or incentives for foreign investors. The Malaysian government often provides resources and guidelines to assist foreign investors, so utilize these official sources for accurate information.

- Market Research and Consumer Behavior: Conduct in-depth market research to understand local consumer preferences, purchasing power, and spending habits. This is particularly important if your investment involves consumer-facing businesses or products. Analyze demographic data, income distribution, and cultural factors that influence consumer behavior. Understanding the local market will help you tailor your products or services to meet the needs and expectations of Malaysian consumers.

- Competitive Analysis: Identify your potential competitors in the Malaysian market. Research local businesses, both established and emerging, that operate in your chosen industry. Assess their strengths, weaknesses, and market positioning. Understanding the competitive landscape will help you identify gaps in the market and develop strategies to differentiate your investment. This analysis can also reveal potential partnerships or acquisition targets.

- Financial and Legal Due Diligence: Perform a thorough financial analysis of potential investment opportunities. Review financial statements, cash flow projections, and historical performance of companies or projects you are considering. Assess the financial health and stability of the investment. Additionally, seek legal advice to understand any tax implications, contract requirements, and dispute resolution processes specific to Malaysia.

By following these steps, foreign investors can conduct a comprehensive market analysis, enabling them to make well-informed decisions when investing in Malaysia. This research-driven approach minimizes risks and increases the likelihood of a successful investment strategy.

Acorns Investing: Scam or Legitimate Investment Opportunity?

You may want to see also

Frequently asked questions

Foreign investors can invest in Malaysia's stock market through a process known as "e-IPO" (Electronic Initial Public Offering). This allows them to apply for shares in newly listed companies. Investors need to open a securities account with a licensed stockbroker in Malaysia and provide the necessary documentation, including proof of identity and residence.

Malaysia offers various tax incentives and benefits to attract foreign investors. The country operates a territorial tax system, meaning only income earned within Malaysia is taxed. Foreign investors may be eligible for tax exemptions or reduced rates on certain types of income, such as dividends, interest, and capital gains. It is advisable to consult a tax professional to understand the specific tax obligations based on individual circumstances.

Foreigners are generally allowed to purchase property in Malaysia, but there are some restrictions and guidelines. For residential properties, foreigners can buy under certain conditions, such as through a Malaysian company or a nominee. However, for commercial and industrial properties, there are specific regulations and restrictions. It is recommended to seek legal advice and understand the latest property investment laws to ensure compliance with Malaysian regulations.