Investing can be a daunting task, especially for beginners. However, with GCash, investing is made easy and accessible. GCash is the leading mobile wallet in the Philippines, with over 33 million users as of 2020. One of its features, GInvest, allows users to invest with a minimum of Php50, making it a great option for those who want to grow their money without needing a large amount of capital. In this article, we will discuss how to invest using GCash, the investment options available, and the benefits of using this platform.

| Characteristics | Values |

|---|---|

| Minimum Investment Amount | PHP50 |

| Investment Options | Global Consumer Trends Fund, MMF, Philippine Smart Equity Index Fund, Philippine Total Return Bond Fund, Global Technology Feeder Fund, ATRAM Peso Money Market Fund, ATRAM Total Return Peso Bond Fund, ATRAM Philippine Equity Smart Index Fund, ATRAM Global Technology Feeder Fund, ATRAM Global Consumer Trends Feeder Fund, ALFM Global Multi-Asset Income Fund, Philippine Stock Index Fund |

| Registration Process | Download GCash app, click "GInvest", fill out personal information, confirm account via email, fill out Risk Profile Questionnaire |

| Cash-in and Cash-out Transactions | Done through the GCash wallet |

| Account Verification | Required for users to start investing |

| Commission and Sales Fees | None |

What You'll Learn

How to register for GInvest

GInvest is an investment platform of GCash, a mobile wallet platform in the Philippines. It allows users to invest in the company through various investment funds made possible by Globe and their partner, ATRAM Trust Corporation.

To register for GInvest, follow these steps:

Step 1:

Open the GCash app and tap "GInvest" on the dashboard. This will lead you to the "Show More" screen. From there, go to the Financial Services section and tap "Invest Money".

Step 2:

Confirm your email address. The default email address registered with your GCash account will be displayed. GInvest will send all correspondences to this email address.

Step 3:

Tap "Proceed" to start the registration process. You will then be asked to answer a few questions to determine your investor profile and risk appetite. These questions may include:

- What is your net worth (approximate)?

- What is the source of your funds?

- What is the purpose of your investment?

- How much do you see yourself investing?

- How frequently do you plan to invest?

- How knowledgeable are you as an investor?

- Which of the following have you invested in?

- Do you have a regular liquidity requirement?

Step 4:

After answering the questionnaire, indicate whether you are a U.S. citizen or not, then carefully read through the Terms and Conditions. It is important to understand your rights, limitations, and expectations as an investor.

Step 5:

Tick the box to confirm your agreement with the terms and conditions, then tap "Confirm".

Step 6:

Upon confirmation, you will receive a risk profile assessment result based on your answers to the investor profile questionnaire.

Step 7:

Wait for your email or SMS confirmation that your GInvest application has been approved. Once approved, you can start investing!

With GInvest, you can begin investing with a minimum amount of Php50, making it an excellent platform for beginners to enter the world of investing.

Derivatives in Investment Banking: A Common Practice?

You may want to see also

Completing the Risk Profile Questionnaire

To start investing on GInvest, you must first complete the Risk Profile Questionnaire (RPQ) to register your GInvest account. The RPQ will determine what type of investor you are, ranking users as "conservative", "moderate aggressive", and "aggressive". Each profile will have different investment options, interest rates, and minimum investment requirements. Aggressive investors typically earn more but are also more exposed if the investment fails.

You may invest in funds that have a higher or lower risk classification than your own risk profile. However, if the funds have a higher risk classification than your own risk profile, you will only need to acknowledge a waiver by clicking 'Proceed'. Fund managers recommend that investors allocate no more than 20% of their investment portfolio to more aggressive funds and maintain 80% of their investments within their Risk Appetite/Profile.

The Bangko Sentral ng Pilipinas (BSP) mandates that investment account owners retake the RPQ every 3 years from the account opening date. You will receive a notification from GCash if you are required to update your Risk Appetite.

Note that some users have reported issues with updating their risk profile, with the app getting stuck on the update page and unable to complete the process.

A Secure Investment: T-Bills with CPF Funds

You may want to see also

Choosing an investment fund

GInvest is an investment platform of GCash, the Philippines' leading mobile wallet platform. It is an excellent option for beginners as it has a minimal investment amount of as low as Php50 and offers flexible investment options.

- Assess your risk appetite: Before choosing an investment fund, it is important to assess your risk appetite or tolerance. This refers to the level of risk you are willing to accept in investing. GInvest will determine what type of investor you are, ranking users as "conservative", "moderate aggressive", or "aggressive". Your risk appetite will influence the investment options available to you, as well as the interest rates and minimum investment amounts.

- Complete the Risk Profile Questionnaire: To register your GInvest account, you will need to complete a Risk Profile Questionnaire. This will help GInvest assess your risk tolerance and determine the appropriate investment options for you. You will be asked questions about your estimated net worth, source of funds, desired investment program, purpose of your investment, and estimated investment amount.

- Understand the different investment funds: GInvest offers a variety of investment funds, including the ATRAM Peso Money Market Fund, ATRAM Total Return Peso Bond Fund, ATRAM Philippine Equity Smart Index Fund, ATRAM Global Technology Feeder Fund, and ATRAM Global Consumer Trends Feeder Fund. Each fund has a different risk rating, investment strategy, and minimum investment amount. Be sure to research and understand the details of each fund before making a decision.

- Consider your financial goals: Different investment funds will align with different financial goals. For example, conservative investors who are risk-averse may opt for money market or fixed-income funds, while aggressive investors who are market-savvy may invest in local or international stocks. Consider your financial goals and choose an investment fund that aligns with your objectives.

- Diversify your investments: To balance out the risk, consider allocating your investments across multiple funds. This can help reduce the potential losses associated with placing your money in just one type of fund.

Remember, investing involves risks, and there is no guarantee of earning a lot of money. Always conduct your own research and only invest money you can afford to lose.

Investing Without Cash: Strategies for Success

You may want to see also

Buying units from your chosen fund

Once you've established your profile, you can select from a number of investment options that GInvest offers. Depending on your risk profile, you will be given a number of options that may suit you, ranging from ATRAM Global Consumer Trends Feeder Fund to ATRAM Philippine Equity Smart Index Fund and many others. Each investment product has a risk rating to help you make the right choice for your investment needs.

Now, you can invest by buying units from your chosen investment option. In order to invest your money, click "Buy". You can choose your own investment amount (with a minimum of P50) which will be deducted from your GCash balance.

An SMS will confirm that your buy order is pending. Another SMS will confirm that your order has been approved.

You can also set up your GInvest profile to set reminders for investment schedules.

Dividends from Investments: Operating Cash Flow Activity?

You may want to see also

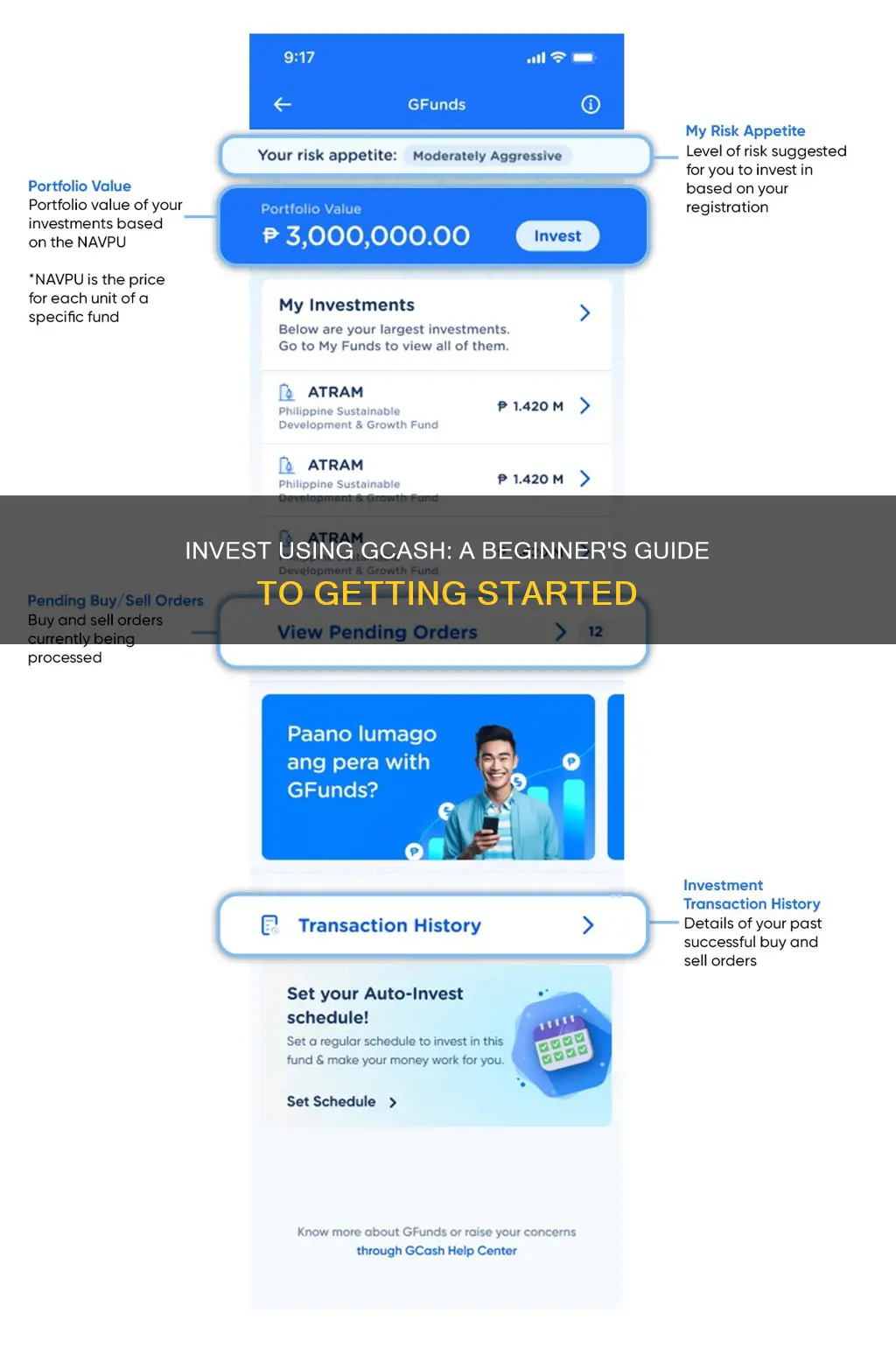

Tracking your investments

- On the GCash Menu or Dashboard, click on "Invest Money".

- Click on "View Investment Products".

- Select your desired Investment Product and click "View Details".

GInvest also shows the live market value of your investments in the app. This value generally changes every business day when the fund's Net Asset Value per Unit (NAVPU) is determined. You can also check the difference between the market value of your investments and your net buy and sell order amounts in your GInvest Transaction History.

Equity Investment's Impact on Cash Flow Statements

You may want to see also

Frequently asked questions

You can start investing with GCash for as little as PHP50.

First, you need to open a GCash account and get verified. Then, complete the Risk Profile Questionnaire to register your GInvest account. Once your account is approved, you can choose from a number of investment options and buy units from your chosen funds using your GCash balance.

Some of the investment options available with GCash include the ATRAM Peso Money Market Fund, the ATRAM Total Return Peso Bond Fund, and the ATRAM Philippine Equity Smart Index Fund.