A cash flow statement is a financial report that details the inflow and outflow of cash and cash equivalents entering and leaving a company. It is one of the three main financial statements, alongside the balance sheet and the income statement. The cash flow statement is divided into three sections: operating activities, investing activities, and financing activities. This text will focus on how to prepare the investing activities section of the cash flow statement.

The investing activities section of the cash flow statement details the cash inflows and outflows resulting from investment activities. These activities primarily involve the acquisition and disposal of long-term assets such as property, plant, equipment, and investments in marketable securities. It also includes loans made to and received from third parties.

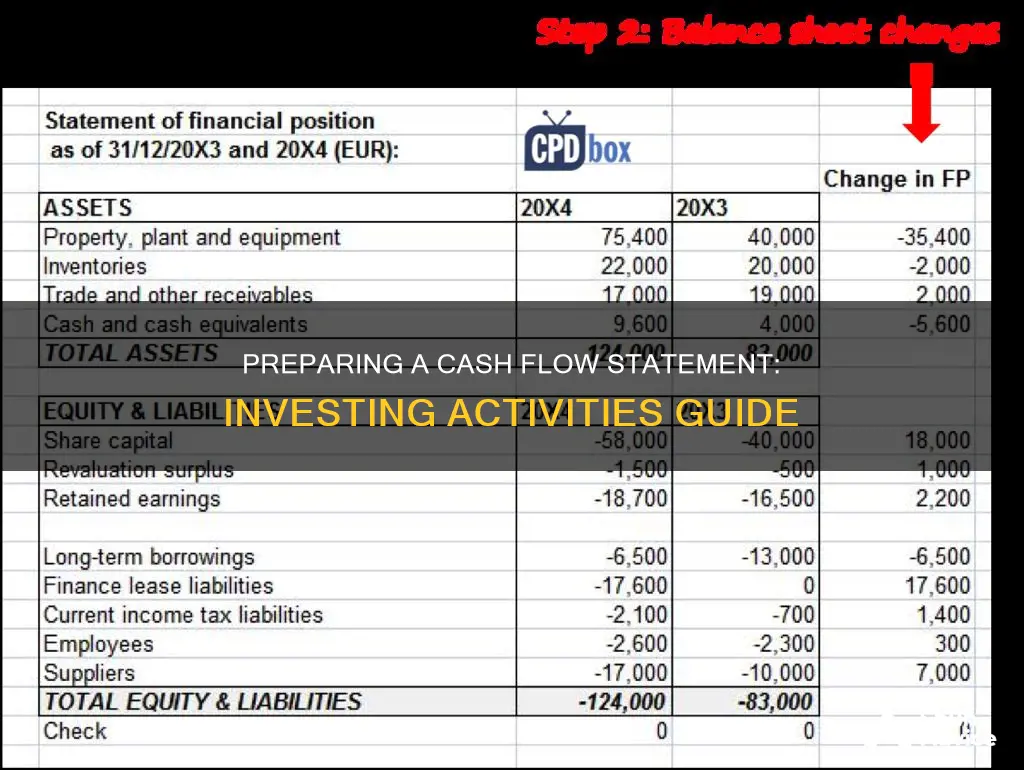

To prepare the investing activities section of the cash flow statement, you need to identify and summarise all cash inflows and outflows related to investments. Inflows include proceeds from asset sales, dividends received, and interest earned on investments. Outflows include purchases of property, plant, equipment, and investments.

The net cash flow from investing activities is calculated by subtracting total cash outflows from total inflows related to investing activities. A positive net cash flow indicates that a company is generating more cash from its investing activities than it is spending, suggesting effective management of investments.

| Characteristics | Values |

|---|---|

| Purpose | To provide a detailed picture of what happened to a business’s cash during a specified period |

| Data | All cash receipts and payments during the reporting period |

| Reporting Period | Monthly, quarterly, or annually |

| Methods | Direct or indirect |

| Cash Flow from Operating Activities | Cash flow from operations, calculated using either the direct or indirect method |

| Cash Flow from Investing Activities | Cash flow from investing activities, calculated by subtracting total cash outflows from total inflows |

| Cash Flow from Financing Activity | Cash flow from financing activities, including cash inflows and outflows from both debt and equity financing |

| Ending Balance | The ending balance of cash and cash equivalents at the close of the reporting period |

What You'll Learn

Identify cash transactions for investments

To prepare a cash flow statement, it is necessary to identify cash transactions for investments. This includes any cash spent on purchasing fixed assets, cash received from selling assets, and cash spent on or received from investing in securities.

Fixed assets are physical assets, such as property, facilities, and equipment. When a company buys fixed assets, it is investing in long-term assets that will deliver value in the future. This is an important aspect of growth and capital, and analysts will look at the investing section of the cash flow statement to monitor how much a company is spending in this area.

Securities are financial instruments that can be traded, such as stocks, bonds, and other investments. When a company buys or sells securities, it can impact the cash flow. For example, purchasing securities will typically result in a negative cash flow, while proceeds from selling securities will result in a positive cash flow.

It is also important to note that not all transactions related to investments are included in this section of the cash flow statement. Interest payments, dividends, debt, equity, and depreciation of capital assets are typically excluded and may be listed under other sections of the cash flow statement.

By identifying and analyzing cash transactions for investments, stakeholders can gain insights into the company's financial health, growth prospects, and capital allocation decisions.

Cashing Out Your GCash Investments: A Step-by-Step Guide

You may want to see also

Include cash spent on purchasing fixed assets

When preparing a cash flow statement, it is important to include cash spent on purchasing fixed assets. This is a crucial aspect of the "Investing Activities" section of the statement, which details cash flows related to the buying and selling of long-term assets.

The "Investing Activities" section of the cash flow statement provides valuable insights into the company's investment activities and their impact on cash flow. It includes both negative and positive cash flows. Negative cash flow in this context refers to cash spent on purchasing fixed assets, while positive cash flow indicates cash received from selling such assets.

Fixed assets are physical assets, such as property, facilities, equipment, or vehicles. These are long-term assets that a company intends to use for an extended period. When preparing the cash flow statement, it is essential to accurately record the cash spent on acquiring these fixed assets. This information is crucial for understanding the company's investment strategies and their impact on their cash position.

The "Investing Activities" section also encompasses investments in securities, which can include the purchase or sale of stocks, bonds, or other financial instruments. These activities can generate positive or negative cash flow, depending on whether the company is buying or selling these investments.

By including cash spent on purchasing fixed assets in the "Investing Activities" section, stakeholders can gain a comprehensive understanding of the company's investment strategies and their impact on cash flow. This information is vital for assessing the company's financial health, decision-making, and overall business value.

Free Cash Flow: Investment Costs and Their Inclusion

You may want to see also

Subtract cash payments for investments from cash receipts from sales of investments

When preparing a cash flow statement, it is important to calculate the net cash flow from investing activities. This is done by subtracting cash payments for investments from cash receipts from sales of investments. This section of the cash flow statement details the cash flow related to the buying and selling of long-term assets like property, facilities, and equipment. It is important to note that this section only includes investing activities involving free cash, not debt.

To identify cash transactions for investments, include cash spent on purchasing fixed assets, cash received from selling assets, and cash spent on or received from investing in securities. Positive net cash flow indicates that a company has more cash flowing into it than out of it, while negative net cash flow indicates the opposite.

For example, a company that purchases a new building for $10 million and sells an old piece of equipment for $1 million would have a net cash flow from investing activities of negative $9 million. This indicates that the company had a net outflow of cash from its investing activities.

It is crucial to accurately track and report cash transactions to ensure a clear understanding of a company's financial health and performance.

Strategies for Forecasting Cash Flow from Investing Activities

You may want to see also

Calculate net cash flow from investing activities

To prepare a cash flow statement, it is important to first understand what a cash flow statement is and what it is used for. A cash flow statement is a financial report that details how cash entered and left a business during a reporting period. It is one of the three fundamental financial statements that financial leaders use, the other two being income statements and balance sheets.

A typical cash flow statement is divided into three sections: cash flow from operating activities, cash flow from investing activities, and cash flow from financing activities. This answer will focus on the second section, cash flow from investing activities, and how to calculate net cash flow from such activities.

Investing activities include any sources and uses of cash from a company’s investments. This could include the purchase or sale of assets, loans made to vendors or received from customers, or any payments related to mergers and acquisitions. This section only includes investing activities involving free cash, not debt.

To calculate net cash flow from investing activities, simply subtract the cash payments for investments from the cash receipts from sales of investments. In other words, calculate the net cash flow from investing activities by adding up all the cash spent on purchasing fixed assets, all the cash received from selling assets, and all the cash spent on or received from investing in securities.

For example, imagine a company has a net cash flow from operating activities of £100,000 and a net cash flow from financial activities of £40,000. However, the company lost money from investments, resulting in a net cash flow from investing activities of -£60,000. To calculate the overall net cash flow, use the formula: Net Cash Flow = Net Cash Flow from Operating Activities + Net Cash Flow from Financial Activities + Net Cash Flow from Investing Activities. Therefore, the calculation would be: 100,000 + 40,000 – 60,000 = 80,000. This means the company’s net cash flow over the given period is £80,000, indicating that the business is relatively strong and may have enough capital to invest in new products or reduce debts.

Attracting Cash Investments: Strategies to Engage Shareholders

You may want to see also

Include cash received from selling assets

When preparing a cash flow statement, it is important to include cash received from selling assets. This is a crucial component of the cash flow statement, as it provides valuable insights into the company's financial health and investment activities.

The cash flow statement is divided into three main sections: operating activities, investing activities, and financing activities. The sale of assets falls under investing activities, which encompass the buying and selling of long-term assets such as property, facilities, and equipment. This section specifically focuses on transactions involving free cash, excluding debt.

When a company divests an asset, it is considered a cash-in transaction for the calculation of cash from investing activities. This means that the cash received from selling assets will be included as a positive cash flow item in the investing activities section of the cash flow statement.

It is important to accurately record and report the cash received from selling assets to ensure compliance with accounting principles and provide transparency to investors and stakeholders. This information helps assess the company's financial health and decision-making.

By including cash received from selling assets in the cash flow statement, investors and analysts can gain a comprehensive understanding of the company's investment strategies and the impact on its financial position. It provides insights into the company's ability to generate cash from its investments and its approach to capital allocation.

In summary, including cash received from selling assets in the cash flow statement is essential for providing a transparent and accurate representation of the company's financial activities, particularly in the context of its investment decisions and the resulting cash flows. This information is valuable for internal decision-making and external analysis by investors and creditors.

Cashing Out Putnam Investments: A Step-by-Step Guide

You may want to see also