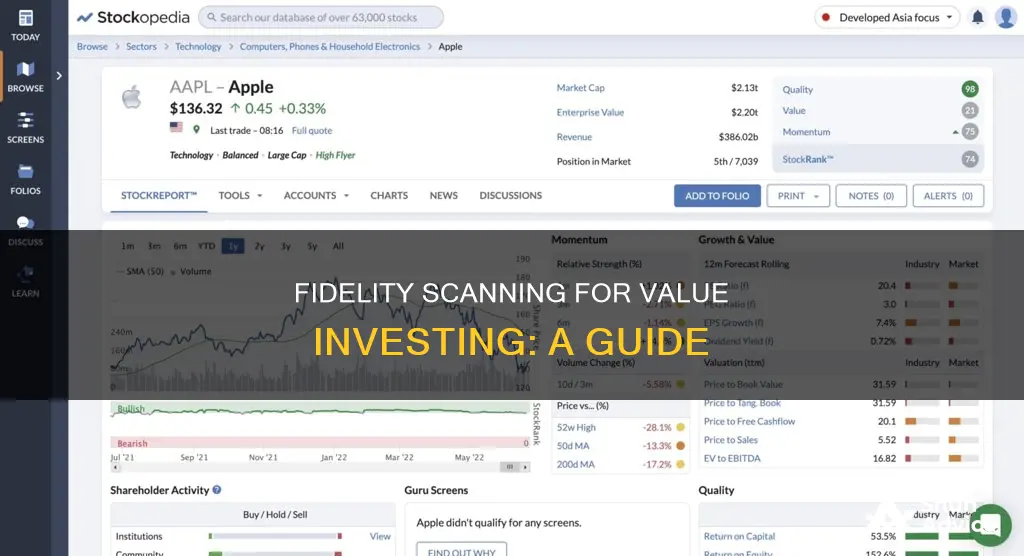

Value investing is an investment strategy that involves buying stocks that appear to be trading for less than their intrinsic value. This can be done by scanning the market for underlying securities with unique trading opportunities based on key variables such as price movement, volatility, and order flow. Fidelity's Market Scanner allows users to do just that. With over 140 customizable criteria, the Stock Screener can help investors find companies that align with their interests and values. The screener also provides a score for each security based on how well it meets the investor's criteria and allows for further customization through the Criteria Entry table. Additionally, Fidelity offers a range of other screeners, such as the Mutual Fund Screener and the Fixed Income Screener, to help investors make informed decisions.

| Characteristics | Values |

|---|---|

| Number of criteria | Over 140 |

| Customizable values | Yes |

| Predefined quick screens | Yes |

| Independent expert screens | Yes |

| Criteria categories | Basics, Performance, Trading Characteristics |

| Number of results | Less than 500 |

| Score weighting | Yes |

| Score weighting percentage | 100 |

| Number of digital coins for trading | 2 |

| Number of mutual funds | 9,330 |

| Number of screening criteria for mutual funds | 32 |

What You'll Learn

Using the Market Scanner to find underlying securities

The Market Scanner is a tool that allows you to find underlying securities that meet certain criteria and exhibit unique trading opportunities. You can use pre-built scans or create fully customizable market scans.

To create your own custom market scans, you can start by either typing in the Criteria entry box in the criteria entry area or by clicking on the "Select Criteria" menu drop-down. When you start typing in the Criteria entry box, a list of all possible matches will automatically appear, giving you quick access to various types of performance criteria.

If you are unfamiliar with the types of criteria or want another perspective on the security, clicking on the "Select Criteria" menu drop-down will open a window with all available screening criteria. Criteria are organized into categories like Basics, Performance, or Trading Characteristics. You can also select multiple criteria by holding down the "Control" key and making your selections with your mouse. Once you've made your selections, click "Ok" to proceed.

After selecting your criteria, you'll set the values by completing the selection fields shown. You can include or exclude values, enter a range, or choose a specific value based on the type of criteria selected. A benchmark for the universe median of the selected criteria is provided to help you select a value that will impact the number of results.

Once you've entered your values, the screener will search for your results, and you can change, add, or delete criteria and values as needed. The number of results matching your criteria will be displayed on the right of each criteria row, and the total number of results for all criteria will be shown at the bottom of the table. Adjust or add criteria until the total is less than 500, after which a full list of results will be displayed.

You can also use the Score and Score Weighting feature to focus on the criteria that matter most to you. A score is assigned to each security based on how well it meets your criteria, and you can change the score weighting to prioritize certain criteria.

A Beginner's Guide to Investing with Zerodha

You may want to see also

Using the Strategy Screener to find new trading strategies

The Strategy Screener is a tool that can be used to find new trading strategies. It allows users to search for underlying securities that meet certain criteria and exhibit unique trading opportunities.

To get started, make sure you have the most up-to-date browser version to take advantage of the rich interactive features of the screener. You can either load a predefined quick screen or independent expert screen using the appropriate drop-down menus at the top of the screener, or create your own screen.

If you choose to create your own screen, you can start by typing in the Criteria entry box or by clicking on the "Select Criteria" menu drop-down. The "Select Criteria" menu allows you to view all available screening criteria, organized into categories such as Basics, Performance, or Trading Characteristics. You can also select multiple criteria by holding down the "Control" key. Once you've selected your criteria, set the values by completing the selection fields.

The screener provides a benchmark for the universe median of the selected criteria, which can help you choose a value that will yield more or fewer results. You can change or add criteria and values until the total number of results is less than 500, at which point a full list of results matching your criteria will be displayed.

You can further focus your results by checking the action box in the action column of the results table and selecting the "Show Only Selected" feature. Additionally, you can sort any column by clicking on the column heading.

The screener also allows you to create and save your own custom views, which can be used with other screens. You can choose which criteria values you want to see and reorder your selected criteria into any column order you prefer.

Investing Wisely: Understanding Cash Flow & Depreciation

You may want to see also

Using the Strategy Evaluator to assess the appropriateness of a strategy

The Strategy Evaluator is a tool that can be used to assess the appropriateness of a particular strategy. It helps to determine the strategy that best meets your goals based on your outlook for a specific underlying. The tool can be used to evaluate and compare single-leg or multi-leg options strategies on an underlying symbol.

To get started, log in to your Fidelity account and access the Strategy Evaluator tool. You can then input your specific underlying symbol and evaluate single- or multi-leg opportunities based on your market sentiment. The tool allows you to search for Calls & Puts or multi-leg strategies, targeting your profit and investment. You can filter your searches by Expiration, Strike, Volatility, Underlying Move, and more.

The Strategy Evaluator provides valuable insights for each strategy returned, including Maximum Gain/Loss, Probability, and Intrinsic Value. This information empowers you to make informed decisions about the appropriateness of a particular strategy in alignment with your investment goals.

Additionally, the Strategy Evaluator is just one of the tools offered by Fidelity to assist in your investment journey. The Market Scanner and the Strategy Screener are also available to help identify underlying securities and explore new trading strategies, respectively.

Smart Ways to Invest 100K Cash for Maximum Returns

You may want to see also

Using the Stock Screener to find companies to research

Fidelity's Stock Screener is a comprehensive tool that can occasionally be overwhelming for new users. However, it is an excellent resource for investors to find companies to research. The screener has over 140 criteria with customizable values, allowing users to narrow down their search based on their specific requirements.

To get started, users can either load a predefined quick screen or an independent expert screen using the appropriate drop-downs at the top of the screener. This can be a great way to get ideas from others or to jump-start your own screen.

For those who want to create their own screen from scratch, there are two easy ways to access the list of criteria. One way is to start typing in the Criteria entry box, and a list of all possible matches will automatically appear, providing quick access to various types of performance criteria. The other way is to click on the "Select Criteria" menu drop-down, which will open a window with all available screening criteria organized into categories such as Basics, Performance, or Trading Characteristics.

Once the criteria are selected, users can set the values by completing the selection fields shown. This can include including or excluding specific values, entering a range, or choosing a particular value based on the criteria selected. A benchmark for the universe median of the selected criteria is provided to help users select a value that will impact the number of results they receive.

After entering the criteria and values, the screener will search for matching results, which can be viewed and sorted in various ways. Users can also change, add, or delete criteria or values and see the impact immediately. The total number of results for all criteria combined is shown at the bottom of the table, and users can adjust their selections until the total is less than 500, at which point a full list of matching results will be displayed.

Unique to Fidelity.com Screeners, a score is assigned to each security based on how well it meets the selected criteria. Users can also change the score weighting to focus on the criteria that matter most to them by assigning percentages to each criterion, with the total adding up to 100. The results will then be rescored and listed in descending order, with a score of 100 representing the best match.

Once users have their results, they can further explore and analyze individual securities by clicking on the company symbol in the results table or selecting other actions from the action drop-down menu. They can also act on multiple stocks simultaneously by checking the action boxes and choosing from various options such as Trade, Add to a Watchlist, Compare, or Hypothetical Trade.

Overall, the Stock Screener on Fidelity.com is a powerful tool for investors to find companies that match their specific criteria and research potential investment opportunities.

Understanding Cash Flow Investments: A Guide to Profitable Choices

You may want to see also

Using the Screener to identify ETFs and ETPs

Starting Your Screen:

You can start by loading a predefined quick screen or an independent expert screen to get ideas and understand the format. These screens are easily accessible through the appropriate drop-down menus at the top of the Screener. This can be a great way to get started and see how the Screener works.

Creating Your Own Screen:

If you want to create your own screen, there are two ways to access the list of criteria. You can either start typing in the Criteria entry box, or you can click on the "Select Criteria" menu. When you start typing, a list of possible matches will automatically appear, giving you quick access to various criteria, such as performance criteria.

The "Select Criteria" menu is particularly helpful if you are unfamiliar with the types of criteria or if you want another perspective on the security. It organizes the criteria into categories like Basic Facts, Portfolio Composition, Performance, or Trading Characteristics. You can select multiple criteria by holding down the "Control" key and making your selections with your mouse. Don't forget to click "Ok" once you've finished.

Entering Criteria Values:

After selecting your criteria, you'll need to set the values. You can include, exclude, or enter a range of values, depending on the criteria you've chosen. A benchmark for the universe median of the selected criteria may be provided to help guide your selection.

Understanding the Number of Results:

As you set your criteria and values, the Screener will display the number of results that match your criteria on the right of each criteria row. The total number of results for all criteria combined will be shown at the bottom of the table. You can adjust your criteria and values to get a manageable number of results (less than 500).

Score and Score Weighting:

Fidelity.com Screeners assign a score to each security based on how well it meets your criteria. You can change the score weighting to focus on the criteria that are most important to you. Simply click on the "Enable Score Weighting" link and assign percentages to each criterion, ensuring they total 100. The results will then be rescored and listed in descending order, with a score of 100 being the best match.

Viewing Your Results:

You can choose from preset views that focus on different aspects like Basic Facts, Performance, Analyst Ratings, or Technicals. Additionally, you have the option to create your own custom view, which can be saved and used with other screens.

Taking Action:

Once you've identified ETFs or ETPs that match your investment goals, you can get in-depth research by clicking on the symbol or selecting other actions from the symbol action menu. You can also act on multiple securities simultaneously by checking the action boxes and then choosing from options like Trade, Add to Watchlist, Compare, or Hypothetical Trade.

Remember, the Screener is a powerful tool for evaluating investment options, but it is for educational purposes only. The results and information provided should be supplemented with your own research and considerations, such as investment objectives, risk tolerance, and financial situation.

Cash App Investing: Legit or Scam?

You may want to see also

Frequently asked questions

You can use the Stock Screener on Fidelity.com to help you get started with scanning for value investing. The Stock Screener has over 140 criteria with customizable values. You can use the screener to find something you're familiar with or are interested in exploring more, and then with just a few clicks, you'll be provided with a list of companies to research further.

To take advantage of all the rich interactive features of the Stock Screener, make sure you have the most up-to-date browser version. You can load a predefined quick screen or independent expert screen using the appropriate drop-downs at the top of the screener to get ideas from others or to jump-start your own screen. You can also create your own screen by typing in the Criteria entry box or by clicking on the "Select Criteria" menu drop-down.

In addition to the Stock Screener, Fidelity offers a Market Scanner, a Strategy Screener, and a Strategy Evaluator. The Market Scanner allows you to find underlying securities whose options exhibit unique trading opportunities based on key variables including price movement, volatility, and order flow. The Strategy Screener can help you find new trading strategies, while the Strategy Evaluator can assist in assessing the appropriateness of a particular strategy.

Fidelity has excellent investment platforms for active traders and investors of all types, including mobile, desktop, and the downloadable Active Trader Pro. Fidelity's research and educational tools are also superior and suitable for nearly all investor levels. The platform offers a wide range of investment assets, including ETFs, mutual funds, options, cryptocurrency, and fixed-income products.