Probability theory is a powerful tool for investors to assess and manage expectations about risk and reward. While investing inherently involves uncertainty, understanding probabilities can help investors make more informed decisions and improve their long-term success. This involves analysing historical data and trends to determine the likelihood of different outcomes, such as stock returns or market movements. By applying probability theory, investors can determine the expected value of potential investments, weighing the probability of receiving a certain value against the value received. This allows investors to make more rational decisions, balancing risk and reward, and avoiding the pitfalls of following short-term market prognosticators.

| Characteristics | Values |

|---|---|

| Probability in investing | Can be used to determine the likelihood of an investment being profitable |

| Can be used to make better investment decisions | |

| Can be used to improve investing strategies | |

| Can be used to analyse mutual funds or hedge funds | |

| Can be used to determine if an investment strategy is successful | |

| Can inform an understanding of trends | |

| Can be used to determine if a string of profits or losses is due to skill or luck | |

| Can be used to determine the value of an investment | |

| Can be used to determine the risk of an investment | |

| Can be used to determine the expected value of an investment | |

| Can be used to assess the probability of different scenarios or catalysts |

What You'll Learn

Using probability to assess risk and reward

Probability theory is a powerful tool for investors to assess risk and reward. It involves analysing all relevant information and adjusting the probabilities and payouts assigned to various outcomes. While it's impossible to predict the stock market's short-term movements, probability can bring long-term trends into focus and inform our decision-making.

Understanding Probability Theory

Probability theory recognises that nothing in life is certain, and this is especially true in investing. We can't deal with certainties, so we use probabilities as our lens for viewing investment-related matters. A basic understanding of probabilities is important not just for investing but also for life in general.

How Probabilities Work

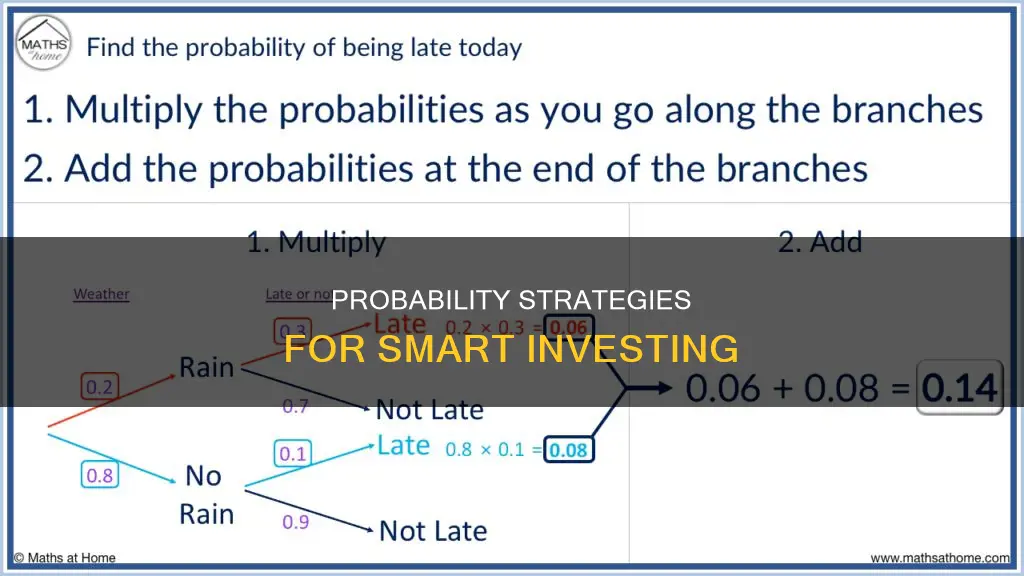

Probabilities are assigned values between 0 (impossible) and 1 (certain), or 0% and 100% in percentage terms. All possible outcomes must have probabilities that add up to 1 or 100%. For example, in a coin toss, the probability of landing heads-up is typically assumed to be 50%, and the probability of landing tails-up is also 50%. However, we could also consider the possibility of the coin landing on its edge, which is unlikely but not impossible.

Applying Probability to Investing

When investing, we implicitly bet that the probability of gain is greater than the probability of loss. To build confidence in these probabilities, we can examine how similar bets worked out in the past. While no two market bets are identical, we can identify past occasions that were similar to the opportunities we face today. By following definite decision criteria, we can know how things will turn out on average and not worry about individual instances.

The Role of Trends

Stock prices tend to run in a certain direction over time, creating trends. These trends skew the probability curve, moving it away from a normal distribution (a bell curve) and towards a "fat tail". This means that traders can be profitable over time if they use trends, even in extremely short time frames.

Subjective Probabilities in Investing

In investing, we rarely work with exact probabilities. Instead, we rely on subjective probabilities, which are based on our assigned probabilities for an event occurring. These subjective probabilities are unique to each person and depend on their knowledge and experience. The more we know, the more accurately we can forecast the likelihood of certain outcomes.

Using Historical Data and Probabilities

By examining historical investment returns, we can make reasonable guesses about how different asset classes will perform in the future. For example, we know that stock returns are hard to predict on a yearly basis, but over several decades, they tend to be positive. Similarly, owning bonds will likely reduce long-term investment returns but provide a smoother ride.

A Word of Caution

While probability can guide our investment decisions, it's important to remember that short-term predictions are often unreliable. Just as a string of profitable trades may be due to luck rather than skill, short-term predictions of market movements may be correct by chance. Thus, it's crucial to consider the long-term trends and focus on fundamental investing principles rather than following short-term prognosticators.

Jewelry Investment Strategies: Crafting Profitable, Beautiful Jewelry

You may want to see also

Understanding the concept of expected value

For example, consider an investment with a 60% chance of increasing in value by $10,000 and a 40% chance of decreasing in value by $5,000. By multiplying the probability of each outcome by its potential impact and then finding the difference, we can calculate the expected value. In this case, the EV would be $4,000 ($6,000 - $2,000).

The concept of expected value is particularly useful when comparing different investment opportunities. By calculating the expected value for each option, investors can make more informed decisions about which assets to include in their portfolio based on their desired level of return. Additionally, expected value can be used to adjust an existing portfolio by comparing the EVs of different assets and replacing underperforming investments with those that have higher expected values.

Expected value is also essential in portfolio construction. Investors need to understand various factors, such as how different assets function, their associated risks, and their financial situation, before employing EV to build a portfolio that maximises returns while minimising risks.

While expected value is a valuable tool, it should not be the sole factor in investment decision-making. Other factors, such as risk tolerance, age, income, and family status, also play a significant role in the investment decision-making process.

In summary, expected value is a powerful concept in investing that helps investors estimate future returns and make more informed decisions. By considering probabilities and potential outcomes, investors can use expected value to build robust portfolios that align with their financial goals and risk tolerance levels.

Cash or Invest: Where Should Your Money Go?

You may want to see also

Assigning probabilities to scenarios

When assigning probabilities to a range of scenarios, it is important to consider all possible outcomes and their likelihoods. For example, in a bull, base, and bear market scenario, assigning probabilities of 30%, 40%, and 30% respectively is generally considered more reasonable than assigning probabilities of 5%, 15%, and 80%, as the latter may be questioned for failing to appreciate the downside and overemphasizing the upside. Providing sources or links to support the assigned probabilities can also enhance the credibility of the analysis.

Additionally, it is worth noting that in the world of investing, we often deal with subjective probabilities rather than exact probabilities. Subjective probabilities are based on the individual's assessment of the likelihood of an event occurring and are influenced by their knowledge and experience. As such, it is important to continuously educate oneself and improve one's understanding of the market to make more accurate forecasts.

By assigning probabilities to different scenarios, investors can create a more robust and realistic analysis, considering a wider range of possible outcomes. This approach allows for a more comprehensive evaluation of investment opportunities and helps to manage expectations about risk and reward.

Investing Cash: How Much and When?

You may want to see also

Using probability to time the market

Timing the market is a difficult task, and the short-term movements are often impossible to predict. However, by understanding probability theory, investors can make more informed decisions and avoid common pitfalls.

Firstly, it is important to recognise that the stock market operates on probabilities, not certainties. While we can never know for sure whether a stock will go up or down, we can assign probabilities to different outcomes based on our knowledge and experience. These subjective probabilities form the basis of our investment decisions.

When considering market timing, investors should think like actuaries. Actuaries apply criteria to estimate probabilities and rely on the law of large numbers for the outcome. For example, an actuary can determine the likelihood of a house burning down by considering factors such as the presence of alarms and proximity to fire services. Investors can use a similar approach by creating reliable decision criteria based on historical data and market trends.

By analysing past performance and identifying similar market conditions, investors can estimate the probability of future outcomes. This approach helps to remove emotions from decision-making and focuses on the process rather than individual trades. It is crucial to remember that no two market bets are identical, but by establishing definite decision criteria, investors can identify occasions that closely resemble the opportunities they are currently facing.

Additionally, investors should be cautious of short-term predictions made by investment advisors or gurus. While some may correctly predict short-term movements, it is often due to chance rather than skill. Following such predictions can lead to larger bets and increased confidence, which can result in significant losses when the odds eventually catch up.

To make successful investments, it is essential to focus on the long-term and implement a disciplined, patient approach. By understanding probability theory, investors can improve their decision-making, manage expectations, and increase the likelihood of positive outcomes.

In conclusion, probability theory provides a valuable framework for market timing. By analysing historical data, establishing decision criteria, and recognising the inherent uncertainty of the stock market, investors can make more informed choices and improve their long-term investment performance.

Maximizing Returns: IRR for Multiple Investments

You may want to see also

Applying probability to long-term investing

Probability is a useful tool for investors to make decisions, especially for long-term investing. While it is impossible to predict the stock market in the short term, probabilities can be used to make predictions about the market over longer periods.

Understanding probability

Probability is a measure of the likelihood of an event occurring, with outcomes ranging from 0% (impossible) to 100% (certain). In the context of investing, probabilities can be used to assess the likelihood of gains or losses when making trades or investments.

How to use probability in investing

When investing, it is important to recognise that you are implicitly betting that the probability of gain is greater than the probability of loss. To build confidence in these probabilities, it is helpful to look at historical data and consider how similar bets have worked out in the past. While no two market bets are identical, you can identify prior occasions that were similar to the opportunities you are facing today. By following definite decision criteria, you can identify patterns and have a better understanding of how things will turn out on average.

Long-term investing is based on the idea that, over time, the odds will even out and you will come out on top. This is similar to the concept of a casino, where the house doesn't win every time, but over thousands of players and games, the casino will maintain its edge and come out on top.

When applying probability to long-term investing, it is important to focus on the process and not get too caught up in individual trades. Think of investing as a game of probabilities, where you are trying to make decisions that give you the best odds of success. Just like in a casino, you won't win every time, but if you make disciplined decisions based on rational probability theory, you can increase your chances of long-term success.

Additionally, when considering long-term investing, it is important to recognise the impact of time on your investments. The longer you invest, the more opportunities you give probability theory to work in your favour. This is because, over time, the number of instances or trades increases, and you can more accurately determine whether your strategy is successful or if you have simply been lucky.

In conclusion, applying probability to long-term investing involves understanding the underlying probabilities of the market, making informed decisions based on historical data and patterns, and focusing on the long-term process rather than short-term gains or losses. By doing so, investors can increase their chances of success and achieve their financial goals.

KraftHeinz's Strategic Debt Investments: A Risky Gamble?

You may want to see also

Frequently asked questions

Probability theory is a framework for assessing and managing expectations about risk and reward. It involves analysing all relevant information and adjusting the probabilities and payouts assigned to various outcomes. Understanding probability theory can help investors make better decisions and improve their long-term financial success.

By understanding probability theory, investors can look at historical investment returns and make more informed guesses about how different asset classes will perform in the future. For example, by analysing historical data, investors can identify trends and patterns that can guide their investment choices.

It's important to remember that probability in investing is not an exact science. We are dealing with subjective probabilities, which are based on our own knowledge and experience. Additionally, short-term market predictions are often inaccurate, and it's challenging to predict daily, weekly, monthly, or even yearly movements.

Probability theory can help investors manage risk by considering a range of possible outcomes and their potential impact. By assigning probabilities to different scenarios, investors can make more informed decisions and avoid putting all their eggs in one basket. Diversification and asset allocation are also essential tools for managing investment risk.