When discussing long-term assets, it's important to understand which expenditures are considered major investments. These investments are typically significant financial outlays that are expected to provide benefits over an extended period, often several years. Major investments in long-term assets can include the purchase of property, plant, and equipment (PPE), such as land, buildings, machinery, and vehicles, which are essential for a company's operations and have a useful life extending beyond one year. Additionally, intangible assets like trademarks, patents, and goodwill, which have a finite useful life but are not physical in nature, can also be considered major investments. These assets are crucial for a company's competitive advantage and brand value, and their acquisition often involves substantial costs. Understanding these major investments is vital for businesses to accurately assess their financial health and make informed decisions regarding their long-term asset management.

What You'll Learn

- Tangible Assets: Physical items like property, machinery, and vehicles

- Intangible Assets: Non-physical assets like patents, trademarks, and goodwill

- Financial Investments: Stocks, bonds, and other securities with long-term value

- Natural Resources: Oil, gas, minerals, and forests with future revenue potential

- Research & Development: Spending on innovation and product development for future growth

Tangible Assets: Physical items like property, machinery, and vehicles

Tangible assets are physical items that hold significant value and are considered long-term investments for businesses and individuals alike. These assets are often referred to as "hard assets" due to their physical nature and the substantial amount of money invested in them. When it comes to major investments, tangible assets play a crucial role in various industries and personal financial strategies.

Property, machinery, and vehicles are prime examples of tangible assets. Property, in the context of investments, refers to real estate, including land, buildings, and any permanent structures attached to it. This can range from residential homes to commercial offices, retail spaces, or industrial warehouses. Investing in property is a long-term strategy as it provides a tangible asset that can appreciate in value over time. For businesses, purchasing or leasing property can be a significant investment, especially for those in the retail, hospitality, or manufacturing sectors, where physical locations are essential for operations.

Machinery, on the other hand, encompasses a wide range of equipment and tools used in various industries. This includes manufacturing equipment, agricultural machinery, construction vehicles, and even computer hardware and software. When a business invests in machinery, it is acquiring assets that will contribute to its production processes and overall efficiency. For instance, a factory might purchase advanced machinery to increase output and reduce production costs, which can lead to higher profits in the long run. Similarly, farmers investing in modern agricultural machinery can improve crop yields and productivity, ensuring a more sustainable and profitable venture.

Vehicles, such as cars, trucks, and other transportation equipment, are also considered tangible assets. While they may be more commonly associated with personal transportation, they can also be significant investments for businesses. For example, a delivery company might invest in a fleet of vehicles to optimize its logistics and reduce transportation costs. Over time, these vehicles can depreciate, but they also provide a tangible asset that can be sold or traded, offering a degree of liquidity to investors.

The acquisition of tangible assets, such as property, machinery, and vehicles, is a strategic decision that requires careful consideration. These investments often involve substantial financial outlays and can impact a business's or individual's cash flow. However, they offer long-term benefits, including potential appreciation in value, increased productivity, and a tangible asset that can be used for various purposes. It is essential to research and analyze the specific needs and goals before making such investments to ensure they align with the overall financial strategy.

Prepaid Insurance: A Long-Term Strategy or Short-Term Gain?

You may want to see also

Intangible Assets: Non-physical assets like patents, trademarks, and goodwill

Intangible assets are a unique category of long-term investments that play a crucial role in a company's financial health and future prospects. These assets are non-physical in nature, meaning they cannot be seen or touched, but they possess significant value and have a substantial impact on a company's operations and success. The concept of intangible assets is essential to understanding what expenditures are considered major investments in long-term assets.

One of the most well-known intangible assets is intellectual property, which includes patents, trademarks, and copyrights. Patents protect innovative ideas and inventions, giving companies exclusive rights to their products or processes for a limited period. This exclusivity allows businesses to capitalize on their creativity and gain a competitive edge in the market. For example, a pharmaceutical company might invest in research and development to create a new drug, and the patent for this invention becomes a valuable intangible asset, protecting their investment and generating potential revenue. Trademarks, on the other hand, protect brand names, logos, and other distinctive signs that identify a company's products or services. These trademarks become powerful tools for marketing and customer recognition, contributing to a company's long-term success.

In addition to intellectual property, goodwill is another critical intangible asset. Goodwill represents the portion of a company's purchase price that exceeds the fair value of its tangible and identifiable intangible assets. It is often associated with the acquisition of another business and reflects the value of the company's reputation, customer relationships, and favorable location. When a company acquires another, the purchase price is allocated to various assets, and the amount that exceeds the fair value of tangible and identifiable intangibles is recorded as goodwill. This goodwill can be a significant indicator of a company's potential for future growth and profitability.

These intangible assets are considered major investments in long-term assets because they provide long-lasting benefits and contribute to a company's value over an extended period. Unlike tangible assets, which may depreciate over time, intangible assets often have an indefinite useful life. For instance, a patent can protect a company's invention for years, providing a competitive advantage and generating revenue. Similarly, a strong trademark can become a valuable asset, enhancing brand recognition and customer loyalty.

In financial statements, intangible assets are typically reported at historical cost, which is the amount paid to acquire the asset. This cost may include legal and professional fees associated with obtaining patents or trademarks. Over time, companies may revalue these assets, and any impairment losses can be recognized if the asset's value decreases. Intangible assets are subject to amortization, which is the process of allocating the cost of the asset over its useful life. This ensures that the asset's value is recognized over time, providing a more accurate representation of the company's financial position.

Understanding and effectively managing intangible assets is crucial for businesses to make informed decisions about their long-term investments. These non-physical assets contribute significantly to a company's success and should be treated as valuable resources that require careful consideration and strategic planning.

Understanding Short-Term Investments: A Balance Sheet Guide

You may want to see also

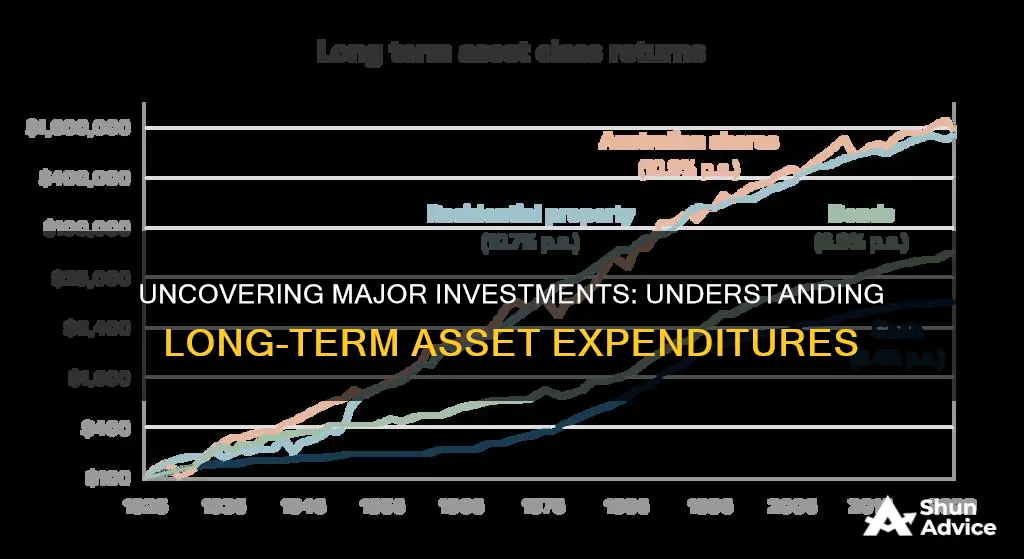

Financial Investments: Stocks, bonds, and other securities with long-term value

When discussing long-term assets and major investments, it's essential to understand the nature of financial investments that fall into this category. These investments are typically characterized by their potential to generate returns over an extended period, often spanning several years or even decades. The focus here is on assets that are not consumed or converted into cash within a short timeframe but rather held with the expectation of future growth and income generation.

Stocks, also known as equities, are a prime example of long-term investments. When you purchase a stock, you are essentially buying a small ownership stake in a company. This investment allows you to benefit from the company's success and growth over time. Stocks are considered long-term assets because they are not meant to be sold quickly for profit but rather held for an extended period to accumulate wealth. The value of stocks can fluctuate in the short term due to market conditions and company performance, but over the long haul, they have historically shown the potential for significant appreciation.

Bonds are another crucial component of long-term investments. A bond is essentially a loan made by an investor to a borrower, typically a government or corporation. When you buy a bond, you are lending money to the borrower, and in return, they pay you interest at regular intervals. Bonds are considered long-term investments because they have a maturity date, after which the borrower repays the principal amount. This makes bonds a more stable and predictable investment compared to some other asset classes. Over the long term, bonds can provide a steady income stream and act as a hedge against inflation.

Other securities with long-term value include mutual funds, exchange-traded funds (ETFs), and real estate investment trusts (REITs). Mutual funds and ETFs pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. This diversification reduces risk and provides long-term growth potential. REITs, on the other hand, allow investors to invest in real estate without directly purchasing property. These securities are considered long-term investments as they offer the potential for capital appreciation and regular income distributions.

In summary, financial investments such as stocks, bonds, mutual funds, ETFs, and REITs are considered major long-term assets due to their ability to generate returns over extended periods. These investments are typically held with a long-term perspective, allowing investors to benefit from the growth and potential of companies, governments, and real estate markets. While short-term market fluctuations can impact the value of these investments, a long-term investment strategy often leads to more stable and substantial returns.

Understanding Short-Term Investments: Key Traits and Strategies

You may want to see also

Natural Resources: Oil, gas, minerals, and forests with future revenue potential

Natural resources, such as oil, gas, minerals, and forests, are indeed significant long-term assets for any economy or business. These resources are considered major investments because they possess the potential to generate substantial revenue over an extended period. The value of these assets lies in their ability to provide a continuous stream of income and contribute to the overall financial health of an organization.

When it comes to oil, gas, and minerals, the expenditure on exploration and extraction is a crucial investment. Drilling for oil and gas requires significant capital outlay, and the process can be costly and risky. However, successful exploration can lead to the discovery of valuable reserves, ensuring a steady supply of these finite resources. For instance, investing in offshore drilling technology and acquiring drilling rights can be considered a major investment, as it enables access to potentially lucrative oil and gas fields. Similarly, mining operations for minerals like iron ore, copper, or precious metals involve substantial costs, but they can result in long-term revenue generation.

Forests, on the other hand, offer a different kind of investment opportunity. While the initial expenditure on acquiring land and planting trees might be high, forests provide a sustainable resource with future revenue potential. Timber harvesting, for example, can generate income over multiple decades, especially if the forest is managed sustainably. Additionally, forests can have other economic benefits, such as providing raw materials for paper production, furniture manufacturing, or even eco-tourism opportunities. Investing in reforestation and sustainable forest management practices is essential to ensure the long-term viability of this resource.

The key to successful investment in natural resources is proper management and a long-term perspective. These assets require careful planning, monitoring, and adaptation to changing market conditions. For instance, oil and gas companies must invest in advanced drilling techniques to maximize resource extraction while minimizing environmental impact. Similarly, forest management companies need to implement sustainable practices to preserve the resource and ensure its longevity.

In summary, natural resources like oil, gas, minerals, and forests are major investments due to their potential to generate substantial revenue over the long term. The initial expenditures on exploration, extraction, and sustainable management are crucial to unlocking the value of these resources. By recognizing the importance of these investments, businesses and economies can secure a stable and prosperous future, relying on the finite yet valuable assets that nature provides.

Unleash Your Wealth: Exploring India's Long-Term Investment Strategies

You may want to see also

Research & Development: Spending on innovation and product development for future growth

Research and Development (R&D) is a critical component of long-term asset investment for any business aiming to stay competitive and drive future growth. This expenditure is a strategic investment in the company's ability to innovate, create new products, and improve existing ones, ultimately leading to increased market share and profitability. R&D spending is a key differentiator, allowing companies to stay ahead of the curve and adapt to changing market dynamics.

The primary focus of R&D is to identify and address customer needs, often by developing new products or enhancing existing ones. This process involves extensive market research, prototyping, testing, and refining to ensure the final product meets or exceeds customer expectations. For instance, a software company might invest in R&D to create a new app feature, while a pharmaceutical firm could be working on a novel drug treatment. These efforts are not just about creating something new but also about ensuring it is market-ready and provides a competitive edge.

In the long term, R&D spending can lead to significant returns. It can result in the development of groundbreaking products that capture new markets, expand customer bases, and drive revenue growth. For example, a tech company's investment in R&D to create a revolutionary smartphone feature could lead to increased sales and a stronger market position. Similarly, a pharmaceutical company's R&D efforts might lead to a breakthrough drug, potentially saving lives and generating substantial revenue.

Moreover, R&D is an essential tool for businesses to stay agile and responsive to market changes. It allows companies to quickly adapt to new trends, technologies, and consumer behaviors, ensuring they remain relevant and competitive. For instance, during the pandemic, many companies had to rapidly shift their R&D focus to address new customer needs, such as developing online services or enhancing remote work tools. This agility is a direct result of their long-term investment in R&D.

In summary, R&D spending is a major investment in long-term assets, as it directly contributes to a company's ability to innovate, create market-leading products, and adapt to changing conditions. This strategic expenditure is a key driver of future growth and a critical factor in a company's long-term success and sustainability. By allocating resources to R&D, businesses can ensure they are not just keeping up with the market but are also setting the pace for future innovation.

Understanding the Nature of Investment Sales: Operating or Not?

You may want to see also

Frequently asked questions

Major investments in long-term assets typically refer to significant expenditures made by a business to acquire or enhance assets that will provide benefits over an extended period, usually beyond one accounting year. These investments are often substantial and have a substantial impact on a company's financial statements.

To determine if an expenditure is a major investment, consider the following criteria: the asset's useful life is generally more than one year, the acquisition or development cost is significant (often a threshold set by the company or industry standards), and the asset is expected to generate future economic benefits. For example, purchasing a new piece of machinery with a useful life of 10 years and a cost of $500,000 would likely be considered a major investment.

Yes, some common examples include:

- Acquiring property, plant, and equipment (PPE), such as land, buildings, machinery, and vehicles.

- Investing in intangible assets like trademarks, patents, and goodwill.

- Developing or acquiring natural resources, such as mineral deposits or oil and gas reserves.

- Spending on research and development (R&D) to create new products or improve existing ones.

- Major renovations or expansions of existing facilities.

Major investments are typically capitalized and depreciated or amortized over their useful lives. This means the cost is not expensed immediately but is spread out over the years the asset is expected to benefit the company. Regular expenses, on the other hand, are expensed in the period they are incurred, reducing the company's profit or loss for that period. Proper accounting treatment ensures a more accurate representation of a company's financial position and performance.