Before engaging in foreign portfolio investments, it's crucial to understand the complexities and risks involved. This includes a thorough analysis of the target country's economic stability, political climate, and regulatory environment. Investors should also consider the potential impact of currency fluctuations and the specific tax implications of their investments. Additionally, assessing the liquidity and accessibility of the investment is essential, as well as the potential for diversification and the alignment with one's investment goals and risk tolerance. Understanding these factors can help investors make informed decisions and navigate the challenges of international investing.

What You'll Learn

- Regulatory Environment: Understand the legal and tax implications of foreign investments in your home country

- Market Dynamics: Research economic trends, political stability, and industry-specific risks in the target country

- Currency Fluctuations: Assess the impact of exchange rate changes on investment returns and potential risks

- Political and Economic Risks: Evaluate the stability of the target country's government and economy

- Tax Considerations: Be aware of tax treaties and double taxation agreements to optimize returns

Regulatory Environment: Understand the legal and tax implications of foreign investments in your home country

Before engaging in foreign portfolio investments, it is crucial to thoroughly understand the regulatory environment and legal implications in your home country. This knowledge is essential to ensure compliance with local laws and to avoid any potential legal pitfalls. Here are some key points to consider:

Legal Considerations:

- Investment Treaties and Agreements: Many countries have signed bilateral or multilateral treaties to facilitate cross-border investments. These agreements often provide protections and benefits for investors, such as dispute resolution mechanisms and guarantees against expropriation. Understanding these treaties can help investors navigate potential legal challenges.

- Local Laws and Regulations: Each country has its own set of laws governing foreign investments. These may include restrictions on ownership percentages, sector-specific regulations, and requirements for registration or licensing. For example, some countries may impose restrictions on foreign ownership of land or specific industries, which could impact investment strategies.

- Corporate Governance and Disclosure: Familiarize yourself with the corporate governance standards and disclosure requirements in the target country. These rules dictate how companies must operate, the information they need to disclose to investors, and the responsibilities of board members and management. Adhering to these standards is essential for maintaining investor confidence and compliance.

Tax Implications:

- Tax Treaties: Tax treaties between countries aim to prevent double taxation and provide clear guidelines for taxing cross-border investments. These treaties can significantly impact the tax treatment of dividends, interest, and capital gains. Investors should carefully review these treaties to understand the tax obligations in both the home and host countries.

- Transfer Pricing: When investing in foreign entities, transfer pricing rules become relevant. These rules determine the prices at which companies can transfer goods, services, or intellectual property between related parties. Proper transfer pricing documentation and compliance are essential to avoid tax disputes and penalties.

- Tax Residency and Tax Incentives: Understanding the tax residency rules of your home country is vital. Tax residency determines the tax obligations of an investor and can impact the tax treatment of foreign-source income. Additionally, some countries offer tax incentives for foreign investors, such as tax credits or reduced rates, which can significantly affect the overall investment attractiveness.

By thoroughly researching and understanding the regulatory environment and tax implications, investors can make informed decisions, ensure compliance, and potentially mitigate risks associated with foreign portfolio investments. It is advisable to consult legal and tax professionals who specialize in international investments to obtain tailored advice for your specific circumstances.

Finding Investment Balance: Principal as the Key

You may want to see also

Market Dynamics: Research economic trends, political stability, and industry-specific risks in the target country

Before embarking on foreign portfolio investments, it is crucial to conduct a comprehensive analysis of the target country's market dynamics, which encompass economic trends, political stability, and industry-specific risks. This research will provide valuable insights to make informed investment decisions and mitigate potential pitfalls.

Economic Trends: Understanding the economic landscape of the target country is essential. Research historical economic data, including GDP growth rates, inflation rates, interest rates, and exchange rate fluctuations. Analyze the country's economic policies, such as taxation, trade regulations, and investment incentives. Assess the overall economic health by examining key indicators like unemployment rates, income distribution, and poverty levels. For instance, a country with a rapidly growing GDP and a stable currency might indicate a promising investment opportunity. Conversely, a country facing high inflation and economic recession could present significant risks.

Political Stability: Political factors significantly influence investment decisions. Evaluate the political stability of the target country by studying its governance structure, legal framework, and historical political events. Assess the risk of political unrest, changes in government policies, and their potential impact on businesses and investors. Countries with consistent and transparent legal systems often attract more foreign investments. Additionally, consider the geopolitical environment, including international relations, trade agreements, and any potential sanctions or restrictions that could affect your investment.

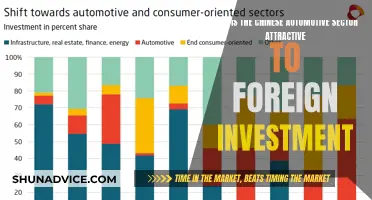

Industry-Specific Risks: Different industries carry varying levels of risk in each country. Research and identify the key industries you are interested in investing in. Analyze industry-specific risks such as market competition, regulatory changes, labor laws, and environmental standards. For example, if you are considering investments in the technology sector, study the country's data privacy laws and intellectual property rights protection. In the energy sector, assess the regulatory environment for renewable energy projects and the potential impact of government policies on traditional energy industries. Understanding these industry-specific risks will help you make more targeted and strategic investment choices.

By thoroughly examining economic trends, political stability, and industry-specific risks, investors can make well-informed decisions. This research enables investors to identify potential opportunities and pitfalls, allowing for better risk management and the potential for successful foreign portfolio investments. It is a critical step to ensure that investments are aligned with the country's economic and political climate, ultimately leading to more sustainable and profitable outcomes.

WTO's Role in Regulating Foreign Direct Investment

You may want to see also

Currency Fluctuations: Assess the impact of exchange rate changes on investment returns and potential risks

Currency fluctuations can significantly impact the returns and risks associated with foreign portfolio investments. When investing in international markets, it's crucial to understand how exchange rate movements can affect your investment's value and overall performance. Here's a detailed breakdown of this critical aspect:

Understanding Exchange Rates: Exchange rates represent the value of one country's currency in relation to another. They fluctuate constantly due to various economic factors, including interest rates, inflation, trade balances, and geopolitical events. For investors, these fluctuations directly impact the value of their investments. When the value of the currency in which your investment is denominated strengthens against your home currency, it means your investment's value has increased in your local currency terms. Conversely, a weakening currency can lead to a decrease in investment value.

Impact on Investment Returns: Currency fluctuations can either enhance or diminish the returns on your foreign investments. If an investor holds a portfolio of international stocks or bonds, the earnings generated by these investments are typically paid in the local currency of the country where the company operates. When these earnings are converted back into the investor's home currency, the exchange rate plays a pivotal role. A favorable exchange rate can boost the overall return, while an unfavorable rate may reduce it. For instance, if an investor from the Eurozone invests in a US company, a stronger Euro could result in higher returns when the company's profits are converted back into Euros.

Risk Assessment: Currency volatility introduces an additional layer of risk to foreign investments. Unpredictable exchange rate movements can lead to unexpected losses or gains. Investors should carefully consider the following:

- Translation Risk: This refers to the potential loss or gain that can occur when converting the investment's local currency value back to the home currency. It's especially relevant for long-term investments, where the cumulative effect of exchange rate changes can be significant.

- Transaction Risk: For investors who frequently buy or sell foreign assets, transaction costs and exchange rate variations can impact their overall returns.

- Country-Specific Risks: Different countries have varying levels of currency stability and economic policies, which can influence exchange rates. Investors should research and understand the specific risks associated with the countries they are investing in.

Mitigating Currency Risk: To navigate currency fluctuations effectively, investors can employ several strategies:

- Diversification: Diversifying your portfolio across multiple countries and currencies can help reduce the impact of any single currency movement.

- Hedging: Using financial derivatives like currency swaps or forward contracts can allow investors to lock in exchange rates, protecting their investments from adverse movements.

- Active Currency Management: Regularly monitoring and adjusting the currency composition of your portfolio can help optimize returns and manage risk.

In summary, currency fluctuations are an integral part of the investment landscape in foreign markets. Investors must stay informed about exchange rate trends and be prepared to adapt their strategies accordingly. By understanding the potential impact on investment returns and carefully assessing the risks, investors can make more informed decisions when building a foreign portfolio.

Dams: Unlocking Foreign Investment Potential through Infrastructure Development

You may want to see also

Political and Economic Risks: Evaluate the stability of the target country's government and economy

When considering foreign portfolio investments, understanding the political and economic landscape of the target country is crucial. This involves a comprehensive evaluation of the stability and predictability of the government and its policies, as well as the overall health and outlook of the economy. Here's a breakdown of the key considerations:

Government Stability and Predictability:

- Political System and Leadership: Research the political system of the target country. Is it a democracy, a monarchy, or another form of governance? What is the track record of the current government? Are there any signs of political instability, such as frequent changes in leadership or rising tensions between political factions?

- Policy Consistency and Predictability: Look for consistent and predictable policies that support foreign investment. This includes clear regulations, transparent procedures, and a history of honoring commitments made to investors. Avoid countries with frequent policy changes or sudden nationalizations that could disrupt investment plans.

- Rule of Law and Corruption: Assess the strength of the legal system and its enforcement. A robust legal framework that protects property rights and enforces contracts is essential for investor confidence. Additionally, low levels of corruption are crucial, as it can create an unpredictable and unfair business environment.

Economic Stability and Outlook:

- Macroeconomic Indicators: Analyze key economic indicators such as GDP growth rate, inflation, unemployment rate, and fiscal deficit. These metrics provide a snapshot of the economy's overall health and its ability to sustain investments.

- Economic Policies and Reforms: Evaluate the government's economic policies and reforms. Are they conducive to attracting foreign investment? Do they address inflation, unemployment, and other economic challenges? Look for policies that promote economic diversification, technological advancement, and a competitive business environment.

- Foreign Investment Environment: Research the government's attitude towards foreign investment. Does it actively encourage and facilitate foreign direct investment (FDI)? Are there any incentives or tax breaks offered to foreign investors? A welcoming investment climate can significantly reduce risks and enhance returns.

Risk Mitigation Strategies:

- Diversification: Diversifying your portfolio across multiple countries can help mitigate political and economic risks. Don't put all your eggs in one basket.

- Local Expertise: Consider engaging local advisors or consultants who understand the political and economic landscape of the target country. Their insights can be invaluable in identifying potential risks and opportunities.

- Risk Assessment Tools: Utilize risk assessment tools and resources provided by international organizations, financial institutions, and investment firms. These tools can help you quantify and manage the political and economic risks associated with a particular country.

Business Cycle Investing: Strategies for Success

You may want to see also

Tax Considerations: Be aware of tax treaties and double taxation agreements to optimize returns

When engaging in foreign portfolio investments, understanding the tax implications is crucial to ensure compliance and optimize your returns. Tax treaties and double taxation agreements play a significant role in this process, offering a framework to manage tax obligations effectively. These agreements are designed to prevent double taxation, which occurs when the same income is taxed in two or more countries. By being aware of these treaties, investors can take advantage of the benefits they provide.

Tax treaties establish clear guidelines for taxing income derived from investments, such as dividends, interest, and capital gains. They define the tax residency of the investor and the income source, ensuring that taxes are levied fairly and efficiently. For instance, if an investor is a resident of Country A and invests in a company located in Country B, the tax treaty between these countries will determine the tax obligations. It may specify that certain types of income should be taxed in the country of source, while others are subject to tax in the investor's country of residence. This clarity helps investors plan their investments and manage their tax liabilities accordingly.

Double taxation agreements are another essential aspect to consider. These agreements aim to eliminate the double tax burden by providing a mechanism for tax relief. When an investor's income is subject to tax in both the source country and their country of residence, double taxation agreements come into play. These agreements often include provisions for tax credits, deductions, or refunds to ensure that investors are not unfairly penalized. By understanding these agreements, investors can structure their investments to minimize tax impacts and potentially increase their overall returns.

To optimize returns, investors should carefully review the tax treaties and double taxation agreements relevant to their specific investments. This involves identifying the tax laws and regulations applicable to the countries involved. Consulting with tax professionals who specialize in international investments can provide valuable insights and guidance. They can help navigate the complexities of tax treaties, ensure compliance, and identify strategies to minimize tax obligations. Additionally, staying updated on any changes or amendments to these agreements is essential, as tax laws can evolve over time.

In summary, tax considerations are vital when undertaking foreign portfolio investments. Tax treaties and double taxation agreements provide a structured approach to managing tax obligations, preventing double taxation, and optimizing returns. By understanding these agreements and seeking professional advice, investors can make informed decisions, ensure compliance, and potentially enhance their overall investment outcomes. Being proactive in this regard is essential for successful international investment ventures.

Investing Activity: Largest Source of Cash Flows?

You may want to see also

Frequently asked questions

Foreign portfolio investments involve investing in financial assets of other countries, and there are several important factors to keep in mind. Firstly, understand the regulatory environment of the target country, including tax laws, accounting standards, and any restrictions on foreign ownership. Research the political and economic stability of the country, as well as the potential risks associated with currency fluctuations, inflation, and geopolitical events. It's crucial to assess the liquidity of the investment, the availability of information, and the potential impact of local market dynamics.

Risk mitigation is a critical aspect of foreign portfolio investments. Diversification is key; consider investing in multiple countries and asset classes to spread risk. Conduct thorough due diligence on the investment opportunities, including financial analysis, market research, and understanding the local business environment. Consider using hedging strategies to protect against currency risks, and ensure you have adequate insurance coverage for your investments. Regularly monitor and review your investments, and be prepared to adapt your strategy based on changing market conditions.

Tax regulations can vary significantly across countries, so it's essential to understand the tax treatment of foreign investments. Each country has its own tax laws, and some may impose taxes on foreign-source income, dividends, or capital gains. Be aware of double taxation agreements that may exist between your home country and the investment destination. Consult with tax professionals to ensure compliance with tax obligations and to take advantage of any available tax incentives or deductions. Proper tax planning can help optimize the after-tax returns from your foreign portfolio investments.