An investment portfolio is a powerful tool for individuals seeking to grow their wealth over time. It involves carefully selecting and combining different types of investments, such as stocks, bonds, and real estate, to create a diversified and balanced approach. By spreading investments across various assets, investors can potentially reduce risk and increase the chances of achieving their financial goals. This strategy allows individuals to manage their risk exposure and optimize returns by tailoring the portfolio to their specific needs and risk tolerance. Understanding how investment portfolios work is essential for anyone looking to build a secure financial future.

What You'll Learn

- Asset Allocation: Diversifying investments across asset classes to manage risk

- Risk Management: Strategies to mitigate potential losses in the portfolio

- Performance Tracking: Regularly monitoring and evaluating investment returns

- Rebalancing: Adjusting asset weights to maintain desired risk exposure

- Tax Efficiency: Optimizing portfolio to minimize tax implications

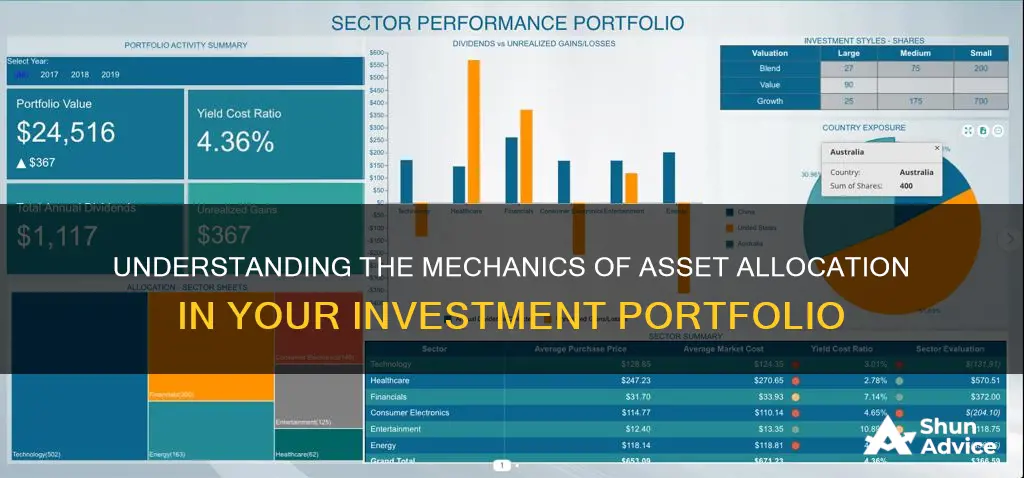

Asset Allocation: Diversifying investments across asset classes to manage risk

Asset allocation is a fundamental concept in investment management, and it involves strategically distributing your investment portfolio across various asset classes to achieve specific financial goals while managing risk effectively. This process is crucial for investors as it determines how their money is divided among different types of investments, such as stocks, bonds, real estate, commodities, and cash equivalents. The primary objective of asset allocation is to create a well-balanced portfolio that aligns with an investor's risk tolerance, time horizon, and financial objectives.

Diversification is at the heart of asset allocation. By diversifying investments across multiple asset classes, investors can reduce the overall risk of their portfolio. Each asset class has its own unique characteristics, risks, and potential rewards. For example, stocks are generally associated with higher risk and potential for higher returns over the long term, while bonds are considered less risky but offer lower potential returns. Real estate and commodities, on the other hand, provide diversification benefits and can serve as a hedge against market volatility.

The idea behind diversification is to spread risk. When you invest in a wide range of asset classes, the impact of any single investment's poor performance is minimized. For instance, if a stock in your portfolio underperforms, the overall impact on your portfolio's value will be less significant if you have a well-diversified portfolio with investments in bonds, real estate, and other asset classes. This approach helps to smooth out the volatility of returns and provides a more stable investment experience.

Asset allocation strategies can vary depending on the investor's profile and goals. A common approach is to use a target allocation model, where the portfolio is divided into specific percentages of different asset classes. For instance, a 60/40 portfolio might allocate 60% of the investment to stocks and 40% to bonds. This allocation can be tailored to an investor's risk tolerance, with more conservative investors favoring a higher bond allocation and more aggressive investors opting for a larger stock component. Over time, as the investor's financial situation changes, the asset allocation may be adjusted to reflect new goals and risk preferences.

Regular review and rebalancing of the investment portfolio are essential to maintain the desired asset allocation. Market movements can cause the actual allocation to deviate from the target allocation. For example, if stocks outperform bonds over a period, the portfolio's stock allocation may become higher than intended. Rebalancing involves buying or selling assets to restore the original allocation, ensuring that the portfolio remains aligned with the investor's strategy and risk tolerance. This process helps investors stay on track and adapt to changing market conditions.

Equity Trust: Collaborating with Investment Advisors for Optimal Wealth Management

You may want to see also

Risk Management: Strategies to mitigate potential losses in the portfolio

Risk management is a critical component of investment portfolio management, as it aims to minimize potential losses and protect the value of the portfolio. Effective risk management strategies can help investors navigate market volatility and ensure their investments remain aligned with their financial goals. Here are some key strategies to consider:

Diversification: One of the most fundamental risk management techniques is diversification. This involves spreading your investments across various asset classes, sectors, and geographic regions. By diversifying, you reduce the impact of any single investment's performance on the overall portfolio. For example, if you invest in a mix of stocks, bonds, real estate, and commodities, a decline in one area may be offset by gains in another. Diversification helps to smooth out returns and reduce the volatility of the portfolio.

Asset Allocation: Asset allocation refers to the process of dividing your portfolio among different asset classes based on your risk tolerance, investment goals, and time horizon. A well-defined asset allocation strategy ensures that your portfolio is appropriately balanced and aligned with your risk profile. For instance, a conservative investor might allocate a larger portion of their portfolio to bonds and fixed-income securities, while a more aggressive investor may focus on stocks and alternative investments. Regularly reviewing and rebalancing your asset allocation can help maintain the desired risk exposure.

Risk Assessment and Monitoring: Conducting a comprehensive risk assessment is essential to identify potential risks associated with your investments. This includes analyzing market risks, credit risks, liquidity risks, and operational risks. Market risks relate to fluctuations in asset prices, credit risks are associated with the possibility of borrowers defaulting, and liquidity risks pertain to the ease of converting assets into cash. Regularly monitoring these risks allows investors to make informed decisions and take proactive measures to mitigate potential losses.

Risk Mitigation Techniques: Several strategies can be employed to manage and mitigate risks:

- Stop-Loss Orders: These are instructions to sell an asset if it reaches a certain price, limiting potential losses.

- Hedging: Investors can use derivatives or other financial instruments to hedge against potential losses. For instance, buying put options can protect against declines in stock prices.

- Regular Portfolio Review: Periodically reviewing your portfolio's performance and risk exposure is crucial. This enables you to make necessary adjustments to your investment strategy.

- Risk Transfer: Consider insurance products like investment protection policies that can safeguard your portfolio against market downturns.

By implementing these risk management strategies, investors can make more informed decisions, protect their capital, and potentially enhance their long-term investment success. It is important to remember that risk management is an ongoing process, and investors should stay vigilant and adapt their strategies as market conditions evolve.

Retirement Investments: Safe Options for the Elderly

You may want to see also

Performance Tracking: Regularly monitoring and evaluating investment returns

Performance tracking is an essential component of managing an investment portfolio, as it allows investors to gauge the success of their investment strategies over time. Regular monitoring and evaluation of investment returns provide valuable insights into the performance of individual assets and the overall portfolio. This process is crucial for making informed decisions and adjusting strategies to meet financial goals.

When tracking performance, investors should establish a baseline by comparing current returns against historical data. This baseline helps in understanding the performance of the portfolio relative to its past performance and market benchmarks. For instance, if an investor's portfolio has consistently outperformed the market over the past year, it indicates a successful strategy. Conversely, if returns are consistently lower, it may prompt a review of the investment approach.

The frequency of performance tracking is a critical aspect. Investors should set a regular schedule, such as monthly or quarterly reviews, to ensure consistent evaluation. More frequent monitoring, especially for short-term investments, can provide early warnings of potential issues. For long-term investments, less frequent reviews might be sufficient, but still, it's important to stay updated on market trends and economic factors that could impact performance.

During performance tracking, investors should analyze various metrics. Return on investment (ROI) is a fundamental measure, indicating the profit or loss generated relative to the initial investment. Investors can also track the Sharpe ratio, which assesses risk-adjusted returns, and the Sortino ratio, which focuses on returns excluding volatility. These metrics provide a more comprehensive understanding of the portfolio's performance and risk exposure.

Additionally, investors should pay attention to the composition of their portfolio. Regularly reviewing asset allocation ensures that the portfolio remains aligned with the investor's risk tolerance and financial objectives. If certain asset classes or individual securities significantly underperform, investors may consider rebalancing the portfolio to maintain the desired risk-return profile. Performance tracking also enables investors to identify underperforming assets early on, allowing for timely adjustments to optimize returns.

AI-Assisted Investing: The Future of Finance

You may want to see also

Rebalancing: Adjusting asset weights to maintain desired risk exposure

Rebalancing is a crucial strategy in asset management (AM) that involves periodically adjusting the allocation of assets within an investment portfolio to ensure it aligns with the investor's risk tolerance and financial goals. This process is essential for maintaining the desired risk exposure and optimizing the potential returns while managing risk effectively. Here's a detailed explanation of rebalancing and its significance:

Understanding Risk Exposure: Risk exposure refers to the potential for loss or gain in an investment. It is influenced by various factors, including market volatility, interest rates, and economic conditions. Investors often have a specific risk tolerance, which is their capacity to withstand fluctuations in their portfolio's value. Rebalancing helps investors stay within their comfort zone by managing the allocation of assets. For instance, if an investor has a high-risk tolerance, they might allocate a larger portion of their portfolio to stocks, which are generally more volatile but offer higher potential returns. Conversely, a low-risk investor might prefer a mix of bonds and stable investments.

The Rebalancing Process: When an investor's portfolio deviates from the initially set asset allocation, rebalancing becomes necessary. This can happen due to market movements, where certain asset classes perform better or worse than expected. For example, if stocks outperform bonds over a short period, the stock portion of the portfolio will grow disproportionately. A rebalancing strategy would involve selling a portion of the overperforming asset and buying underperforming assets to restore the original allocation. This process ensures that the portfolio's risk and return characteristics remain in line with the investor's objectives.

Benefits of Rebalancing: Regular rebalancing offers several advantages. Firstly, it helps investors avoid the trap of 'buy-and-hold' investing, where they might become overly exposed to risk due to market fluctuations. By actively managing the portfolio, investors can maintain their desired risk level and potentially avoid significant losses during market downturns. Secondly, rebalancing encourages a long-term investment approach. It prevents investors from making impulsive decisions based on short-term market movements, promoting a more disciplined and strategic investment mindset.

Frequency and Timing: The frequency of rebalancing depends on the investor's risk profile, investment strategy, and market conditions. Some investors prefer monthly or quarterly rebalancing, while others may opt for a more flexible approach, rebalancing only when the portfolio deviates significantly from its target allocation. Market volatility and economic cycles also play a role in determining the timing of rebalancing. During periods of high market volatility, more frequent rebalancing might be necessary to quickly adjust asset weights and protect capital.

In summary, rebalancing is a vital aspect of AM, allowing investors to actively manage their risk exposure and stay aligned with their investment goals. It involves regularly monitoring and adjusting the portfolio's asset allocation to ensure a balanced and well-diversified approach, ultimately contributing to a more stable and potentially rewarding investment journey.

Investments: Where People Put Their Money

You may want to see also

Tax Efficiency: Optimizing portfolio to minimize tax implications

When it comes to investment portfolios, tax efficiency is a crucial aspect that investors should consider to maximize their returns and minimize the impact of taxes on their investments. Tax implications can significantly affect the overall performance of a portfolio, and understanding how to optimize it for tax efficiency is essential for long-term success. Here are some strategies to consider:

Tax-Efficient Asset Allocation: One of the primary ways to optimize your portfolio for tax efficiency is by carefully allocating your assets. Different types of investments may have varying tax treatments. For example, stocks and bonds are taxed differently, and certain investments, like real estate or collectibles, may have unique tax considerations. By diversifying your portfolio across various asset classes, you can take advantage of tax-efficient strategies. Long-term capital gains taxes are generally lower than ordinary income taxes, so holding investments for the long term can be advantageous. Additionally, consider the tax efficiency of different investment vehicles, such as index funds or exchange-traded funds (ETFs), which often have lower tax-related expenses compared to actively managed funds.

Tax-Loss Harvesting: This strategy involves selling investments that have decreased in value to offset capital gains and reduce taxable income. By strategically realizing losses, investors can use them to their advantage. For instance, if you have a stock that has declined in value, you can sell it to generate a loss, which can then be used to offset gains from other investments. This technique helps in minimizing the tax burden on overall portfolio gains. Tax-loss harvesting is particularly useful for investors with a mix of winning and losing positions, allowing them to balance their tax liability.

Tax-Advantaged Accounts: Utilizing tax-advantaged accounts, such as retirement accounts (e.g., 401(k)s, IRAs), can significantly impact tax efficiency. Contributions to these accounts are often tax-deductible, and the investments grow tax-free until withdrawal. This allows your portfolio to grow without the immediate impact of taxes. Additionally, qualified distributions from retirement accounts are typically taxed at a lower rate compared to ordinary income. By strategically allocating investments within these accounts, you can defer taxes and potentially benefit from tax-free growth.

Regular Portfolio Review: Tax efficiency requires ongoing maintenance and review. Market conditions and personal financial circumstances change over time, which may impact the tax efficiency of your portfolio. It is essential to periodically assess your investments and make adjustments as needed. Stay informed about tax laws and regulations that may affect your investments, and consider consulting a financial advisor who can provide tailored advice based on your specific situation. Regular reviews ensure that your portfolio remains aligned with your tax efficiency goals.

By implementing these strategies, investors can take control of their tax obligations and potentially enhance their overall investment returns. Tax efficiency is a critical component of successful portfolio management, allowing investors to keep more of their hard-earned money and achieve their financial objectives.

Two Harbors Investment Corp: Dividend Payment Date and Expectations

You may want to see also

Frequently asked questions

An investment portfolio is a collection of financial assets, such as stocks, bonds, cash, and other securities, owned by an individual or institution. It is a way to diversify investments and manage risk by holding a variety of assets.

Diversification is a key strategy in portfolio management. By investing in a range of assets, investors can reduce the impact of any single investment's performance on the overall portfolio. This approach helps to manage risk and potentially increase returns over the long term.

Asset allocation refers to the process of dividing your portfolio among different asset classes like stocks, bonds, cash, and alternatives (such as real estate or commodities). The allocation is based on an investor's risk tolerance, investment goals, and time horizon. A well-diversified portfolio typically has a mix of asset classes to balance risk and potential returns.

Rebalancing is the process of adjusting your portfolio to maintain your desired asset allocation. It is generally recommended to rebalance periodically, such as once a year or when significant market movements occur. Regular rebalancing helps to ensure that your portfolio stays aligned with your investment strategy and risk tolerance.

Investment portfolios can have tax considerations, depending on the type of assets held and the jurisdiction. For example, capital gains taxes may apply when selling profitable investments. Additionally, dividends and interest earned from certain investments may be taxable. It's important to understand the tax rules in your region and consider consulting a financial advisor to optimize your portfolio's tax efficiency.