Direct investment and portfolio investment are two different approaches to investing. Direct investment, also known as foreign direct investment (FDI), involves investing in a foreign business with the aim of acquiring a controlling interest or exerting significant influence over its management. On the other hand, portfolio investment refers to investing in a diverse range of financial instruments, such as stocks, bonds, mutual funds, and derivatives, to balance risk and maximise returns. While direct investment seeks control and active participation in business operations, portfolio investment is passive and focuses on financial gain without involvement in the company's internal decision-making.

| Characteristics | Direct Investment | Portfolio Investment |

|---|---|---|

| Type of Investment | Long-term | Short-term |

| Investor Involvement | Hands-on | Hands-off |

| Investor Objective | Control/Significant Influence Over Management | Quick Return |

| Investor Stake | At least 10% | Any Amount |

| Investor Type | MNCs, Large Institutions, Venture Capital Firms | Individual Investors |

| Investment Type | Physical Assets | Financial Assets |

| Examples | Manufacturing Business, Warehouses, Buildings | Stocks, Bonds |

What You'll Learn

Foreign direct investment (FDI)

FDI can take several forms. One common approach is to establish a subsidiary in the foreign country, allowing the investor to expand their operations within that country. Another method is through mergers and acquisitions (M&As), where the investor acquires an existing enterprise in the foreign country, either by merging with another company or taking it over. FDI can also involve starting a joint venture partnership with a foreign company, giving the investor a degree of control and influence over the business's operations.

Greenfield investment is another form of FDI, where a new company or facility is established in the foreign country. This approach is often chosen when the investor seeks a high degree of control over their foreign activities. Greenfield investment can be particularly attractive in emerging markets, as it allows the investor to build operations from the ground up, tailoring them to their specific needs and strategies.

FDI is typically considered a long-term investment, requiring a substantial commitment of resources and capital. Due to the significant investment required, FDI is usually undertaken by multinational companies, large institutions, or venture capital firms. It is viewed more favourably than portfolio investment because it represents a long-term commitment to the host country's economy and is less susceptible to quick profit-taking or speculative behaviour.

FDI offers both benefits and considerations. On the one hand, it can bring capital, technology, and knowledge transfer, increased employment, improved productivity, and overall economic growth to the host country. On the other hand, it may lead to increased competition, potentially forcing less productive local companies out of business. The potential influence and control exerted by foreign investors over the host country's economy and policies is also a factor that requires careful management.

Strategies for Efficiently Monitoring Your Investment Portfolio

You may want to see also

Foreign portfolio investment (FPI)

FPI is often compared with foreign direct investment (FDI), which refers to investments made by an individual or firm in one country in a business located in another country. FDI usually involves establishing a subsidiary, acquiring or merging with a foreign company, or forming a joint venture partnership. In contrast, FPI does not provide direct ownership of a company's assets and investors generally do not have control over the management of the business they invest in.

FPI is becoming an increasingly common way to invest, as it provides investors with an opportunity to diversify their portfolios and access different markets. It also increases the liquidity of domestic capital markets and promotes the development of equity markets. However, FPI is subject to higher risks due to volatile asset pricing and jurisdictional risk.

Examples of countries that have attracted significant FPI include India and Brazil. Factors such as economic stability, growth prospects, favourable regulatory environments, and attractive returns draw FPI into a country.

Savings and Investments: Economy's Growth Engine

You may want to see also

Short-term vs long-term investment

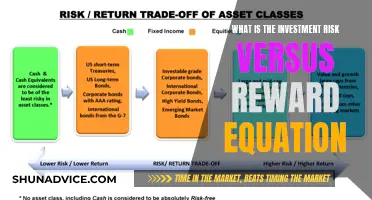

When it comes to investing, there are two main categories: short-term and long-term investments. Each has its own unique characteristics, risks, and potential rewards. So, what's the difference between the two, and how do they fit into the broader context of direct and portfolio investment?

Short-term investments are typically held for one year or less. These types of investments are often characterised by high volatility and high liquidity. Traders holding assets for the short term aim to profit from rapid price movements and usually look for repeatable near-term gains. Common short-term investments include stocks, options, and ETFs, which are bought and sold quickly to take advantage of short-term price fluctuations.

On the other hand, long-term investments are held for more than a year, with investors expecting slow but steady gains over time. These investments are common in retirement accounts and college funds, where the focus is on long-term growth rather than short-term profits. Real estate is a prime example of a long-term investment, as properties typically gain value over time. Other examples include mutual funds and bonds.

Direct Investment vs Portfolio Investment

Now, let's bring this back to direct and portfolio investment. Direct investment, also known as foreign direct investment (FDI), is when a company, multinational corporation, or individual invests directly in a foreign country's economy. This could involve establishing a subsidiary, acquiring a local company, or building new facilities from scratch. Direct investment is considered a long-term commitment, as it often involves substantial resources and a hands-on approach to managing the foreign enterprise.

Portfolio investment, on the other hand, is when investors purchase financial assets such as stocks or bonds in a foreign market. This type of investment is often short-term in nature, as investors can quickly buy and sell these assets to take advantage of favourable exchange rates or interest rate differences. Portfolio investment, also known as foreign portfolio investment (FPI), does not usually involve the same level of control or influence over the foreign enterprise as direct investment.

In summary, short-term and long-term investments differ in terms of their holding periods, risk profiles, and expected returns. Meanwhile, direct and portfolio investment are distinguished by their level of involvement in a foreign market, with direct investment being more hands-on and long-term, and portfolio investment being more passive and short-term.

Savings-Investment Equilibrium: What's the Balancing Act?

You may want to see also

Liquidity and volatility

Liquidity

Direct investment is often a long-term investment, requiring a substantial amount of capital and a commitment to the business's operations. It involves building or purchasing businesses and their associated infrastructure in a foreign country. This makes it much harder to liquidate or pull out of the investment.

On the other hand, portfolio investment is the purchase of securities of foreign countries, such as stocks and bonds, on an exchange. These are easily traded and provide much easier liquidity compared to direct investments. Portfolio investments can be sold off quickly, and due to the lower investment capital required, are more accessible to the average investor.

Volatility

Direct investment is generally viewed as a stable contributor to a country's financial structure. As investors have a long-term interest and control over the business, they are less likely to take actions that could undermine the value of their investments.

Portfolio investments, on the other hand, can be more volatile. As they are often short-term and can be sold off quickly, a country's financial circumstances could be negatively impacted if investors suddenly withdrew their funds.

In summary, direct investments offer more stability and a long-term commitment, while portfolio investments provide easier liquidity but come with the risk of higher volatility.

Invest Wisely to Secure Your Dream Home

You may want to see also

Control and influence

Direct investment and portfolio investment differ significantly in terms of control and influence. Direct investment is often viewed as a long-term investment in a country's economy, while portfolio investment is typically seen as a short-term move aimed at quick financial gains.

Direct investment involves establishing a direct business interest in a foreign country, such as building or acquiring businesses and their associated infrastructure. This type of investment usually requires a substantial amount of capital and is often undertaken by large corporations, institutions, or private equity investors. Due to the significant investment, direct investors often seek to gain control or exert significant influence over the management of the business. In some cases, investors may build new facilities from scratch, maintaining full control over operations.

On the other hand, portfolio investment refers to the purchase of securities, such as stocks or bonds, on a foreign stock exchange. This type of investment is typically made without the intention of acquiring a controlling interest in the issuing company. Portfolio investments are generally considered short-term and are often sold off quickly to realize financial gains or avoid losses. They are more accessible to average investors due to lower capital requirements and less extensive research.

While direct investment offers control and influence over the business entity, portfolio investment does not provide investors with control over the operation of the enterprise. Direct investors have a long-term interest in the business and are committed to making it profitable and continuing its operation indefinitely. They are willing to take on more risk, work, and commitment compared to portfolio investors.

The level of control and influence in direct investment can vary depending on the specific context. In foreign direct investment (FDI), investors may establish a subsidiary, acquire an existing foreign company, or form a joint venture partnership. The degree of control depends on the percentage of ownership and the structure of the investment. In greenfield FDI, investors have a higher degree of control as they build new operations from scratch. In contrast, brownfield FDI involves investing in or taking over an existing local company, which may result in a lower degree of control.

In summary, direct investment provides investors with a higher degree of control and influence over the business entity, while portfolio investment offers less control and is more focused on short-term financial gains. Direct investment is often associated with long-term strategic goals, while portfolio investment is typically a tactical approach to investing.

Blockchain Investment: Diversifying Your Portfolio with Crypto

You may want to see also

Frequently asked questions

Direct investment is when an individual or entity establishes a new business or acquires a stake in a business in a foreign country, with the intention of gaining control or exerting influence over its management. It is considered a long-term investment.

Portfolio investment refers to the purchase of securities, such as stocks or bonds, on a foreign stock exchange. Portfolio investments are typically short-term and do not offer the investor control over the business they are investing in.

Direct investment can bring increased employment, improved productivity, technology and knowledge transfer, and overall economic growth to the host country. It is also seen as a more stable contributor to a country's financial structure as it is harder to liquidate or pull out of the investment.

Portfolio investment can help strengthen domestic capital markets, enhance liquidity, and contribute to improved functioning, leading to optimal allocation of capital and resources in the domestic economy. It also provides investors with an opportunity to diversify their portfolios and better manage risk.