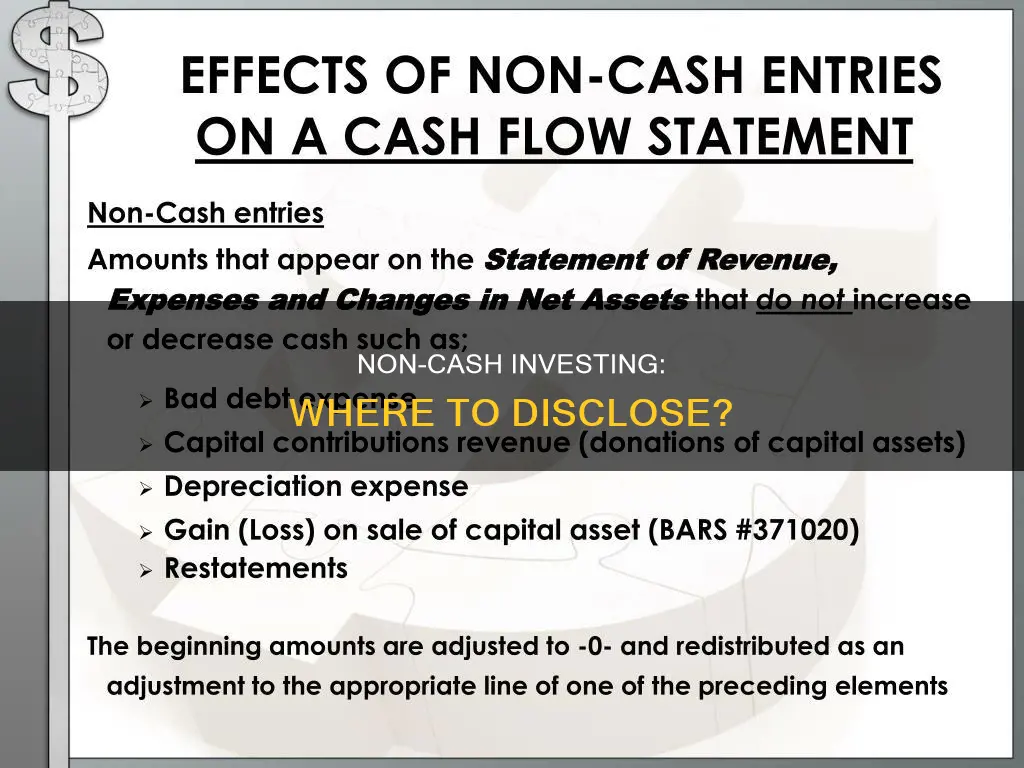

Non-cash investing activities are those that do not generate any cash inflows or outflows for a company, but can still significantly impact its financial position. While these activities are not reported on the cash flow statement, they must be disclosed when they are significant. This is typically done as a footnote or attachment to the standard cash flow statement, or in a separate note or supplementary schedule. This is required by both IFRS and US GAAP. Examples of non-cash investing activities include the issuance of stock to retire debt, the purchase of an asset by issuing stock, and the exchange of non-cash assets.

| Characteristics | Values |

|---|---|

| Where to disclose non-cash investing | At the bottom of the statement of cash flows as a footnote or in the notes to the financial statements |

| In a separate note or schedule attached to the cash flow statement | |

| In the agency's annual financial statement | |

| Whether to disclose non-cash investing | Required if the transaction is non-cash, affects assets or liabilities, and is an investing, capital or financing activity |

| Required if the non-cash transaction could have a material effect on the company's financial position |

What You'll Learn

Non-cash investing and financing activities

Non-cash activities can include the issuance of common shares for dividends or the conversion of convertible bonds or preferred shares, as well as the exchange of non-monetary assets. For example, a company may engage in the issuance of stock to retire debt, the purchase of an asset by issuing stock or bonds, or the conversion of debt to common stock. These activities can have a material impact on a company's financial performance and ability to generate cash flows in the future.

GASB Statement No. 9, paragraph 37, requires governmental enterprises to disclose information about investing, capital, and financing activities that affect recognised assets or liabilities but do not result in cash transactions. A non-cash transaction should be disclosed when it meets the following three criteria: it is non-cash, it affects assets or liabilities, and it would be categorised as an investing, capital, or financing activity if it were a cash transaction.

To ensure compliance with IFRS and US GAAP, companies must disclose all significant non-cash investing and financing activities. This can be done in a footnote at the bottom of the statement of cash flows or in a separate note or schedule in the financial statements. Both approaches provide acceptable disclosure of these activities and allow users of financial statements to understand the potential impact on the entity's performance.

Understanding Cash Flows: Notes Receivable and Operating Cash

You may want to see also

Disclosure of non-cash activities

Non-cash investing and financing activities are transactions that do not generate any cash inflows or outflows for a company but can still significantly impact its financial position and performance. These activities are not reported on the cash flow statement; however, they must be disclosed as they can affect a company's capital composition and overall financial health.

Criteria for Non-Cash Transactions

A transaction is considered a non-cash transaction if it meets all three of the following criteria:

- The transaction is non-cash or part cash and part non-cash.

- The transaction affects assets or liabilities, resulting in changes in the balances of non-cash assets and liabilities.

- The transaction is an investing, capital, or financing activity, meaning it would be categorized as such if it were a cash transaction.

Examples of Non-Cash Activities

Non-cash activities can include:

- Issuing stock to retire debt or pay for services.

- Converting debt, preferred stock, or convertible bonds to common stock.

- Acquiring assets by issuing stock, bonds, or a note payable.

- Exchanging non-cash assets or liabilities, such as obtaining a right-of-use asset in exchange for a lease liability.

- Obtaining assets as gifts or through a lease-purchase agreement.

Disclosure Requirements

Both IFRS and US GAAP require companies to disclose all significant non-cash investing and financing activities. These disclosures can be made in the following ways:

- As a footnote at the bottom of the statement of cash flows.

- In a separate note or schedule attached to the cash flow statement.

- In the notes to the financial statements.

These disclosures typically include a brief description of each non-cash transaction and its monetary value.

Cash Allocation Strategies: Investing Basics Explained

You may want to see also

Non-cash transactions

The disclosure of non-cash transactions is essential to provide a comprehensive overview of a company's current activity and to present an accurate picture of its financial position.

Creating Cash Flow: Investment Strategies for Success

You may want to see also

Impact on financial statements

Non-cash investing activities can have a material impact on a company's financial position and performance, and thus, must be disclosed in financial statements. These activities do not generate any cash inflows or outflows but can significantly affect a company's capital composition. Examples of non-cash investing activities include the issuance of common shares for dividend purposes, the conversion of convertible bonds or preferred shares, and the exchange of non-monetary assets.

Non-cash investing activities are typically disclosed as footnotes or attachments to the standard cash flow statement. This is because they are not included in the body of the statement, as no cash was involved. However, these activities must still be reported to provide a comprehensive overview of the company's financial position. The disclosure of non-cash investing activities is required by both IFRS and US GAAP.

The general approach to disclosing non-cash investing activities is to include a schedule of these activities at the bottom of the statement of cash flows. This schedule can be presented as a footnote or in a separate note. Alternatively, these activities can be disclosed in a separate document attached to the cash flow statement, such as "Schedule A". Both methods meet International Financial Reporting Standards and are in accordance with IFRS and US-GAAP.

Non-cash investing activities can also be disclosed in a supplementary schedule or as a separate note to the financial statements. This approach is acceptable under IFRS and US-GAAP and allows for a more detailed disclosure of these activities. The disclosure of non-cash investing activities is crucial for investors, potential investors, and creditors, as it provides a more accurate representation of the company's financial health and helps them evaluate the company's profitability and strength.

Understanding the Cash Flows Statement: Investing Activities

You may want to see also

Examples of non-cash investing and financing activities

While investing and financing activities that generate cash flows are reported on a company's cash flow statement, non-cash investing and financing activities are not. However, these non-cash activities can still have a significant impact on a company's financial position and performance. As such, companies are required to disclose all significant non-cash investing and financing activities in their financial statements. This can be done either at the bottom of the statement of cash flows as a footnote or in the notes to the financial statements.

- Issuance of stock to retire a debt

- Purchase of an asset by issuing stock, bonds, or a note payable

- Exchange of non-cash assets, such as acquiring property by exchanging another piece of property

- Conversion of debt to common stock

- Conversion of preferred stock to common stock

- Payment for services availed by issuing stock instead of cash

- Acquiring property, plant, or equipment by assuming directly related liabilities, such as a mortgage or loan

- Net unrealized increase or decrease in the fair market value of investments

- Obtaining an asset by entering into a capital lease

- Retiring debt by issuing additional debt or giving non-cash assets to a debtor

- Issuance of common shares for dividend purposes

- Exchange of one non-monetary asset for another

Understanding Capex and Cash Flow: Are They Synonymous?

You may want to see also

Frequently asked questions

Non-cash investing should be disclosed in a company's cash flow statement. This can be done either in a separate note or in a supplementary schedule.

Non-cash investing activities are those that do not generate any cash inflows or outflows but can still significantly impact a company's financial position and future performance. Examples include issuing stock to retire debt and exchanging non-cash assets.

Disclosing non-cash investing activities is essential for providing a comprehensive overview of a company's current activity and future potential. It allows investors, potential investors, and creditors to understand how well cash is being managed and what actions are being taken to generate more cash.